Oreogn Form or 65 2018

What is the Oregon Form OR 65?

The Oregon Form OR 65 is a tax form used by partnerships to report income, deductions, and credits to the Oregon Department of Revenue. This form is essential for partnerships operating within the state, as it ensures compliance with state tax regulations. It captures critical financial information, allowing the state to assess the tax liability of the partnership. The form must be filed annually, reflecting the partnership's financial activities for the previous year.

Steps to Complete the Oregon Form OR 65

Completing the Oregon Form OR 65 involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Next, accurately fill out the form, ensuring that all income and deductions are reported correctly. Pay special attention to the sections that require detailed information about each partner's share of income and losses. After completing the form, review it for accuracy and completeness before submission.

Legal Use of the Oregon Form OR 65

The Oregon Form OR 65 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, partnerships must adhere to the guidelines set forth by the Oregon Department of Revenue. This includes providing accurate information and submitting the form by the established deadlines. Utilizing electronic signature solutions, like signNow, can enhance the legal standing of the form by ensuring secure and compliant document execution.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for the Oregon Form OR 65 to avoid penalties. Typically, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It is important to check for any changes in deadlines or extensions that may apply, especially in light of special circumstances or state announcements.

Required Documents

When preparing to file the Oregon Form OR 65, partnerships should gather several key documents. These include profit and loss statements, balance sheets, and any supporting documentation for deductions claimed. Additionally, information regarding each partner's contributions and distributions is necessary to accurately complete the form. Having these documents organized and readily available can streamline the filing process and ensure compliance with state requirements.

Form Submission Methods

The Oregon Form OR 65 can be submitted through various methods, providing flexibility for partnerships. It can be filed electronically using approved e-filing software, which is often the fastest and most efficient method. Alternatively, partnerships may choose to mail a paper copy of the form to the Oregon Department of Revenue. In-person submissions are also an option, though they may be less common. Each method has its own advantages, so partnerships should select the one that best suits their needs.

Examples of Using the Oregon Form OR 65

The Oregon Form OR 65 is utilized in various scenarios involving partnerships. For instance, a partnership formed by several businesses to provide a shared service would use this form to report their combined income and expenses. Additionally, partnerships that engage in real estate investments must file the OR 65 to report rental income and related deductions. Understanding how the form applies to different partnership structures can help ensure accurate reporting and compliance with state tax laws.

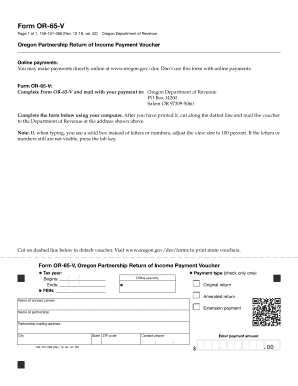

Quick guide on how to complete form or 65 v oregon partnership return of income oregongov

Prepare Oreogn Form Or 65 effortlessly on any device

Digital document management has become common among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documentation, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Oreogn Form Or 65 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Oreogn Form Or 65 with ease

- Find Oreogn Form Or 65 and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Choose how you wish to deliver your form, whether through email, SMS, an invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Oreogn Form Or 65 and guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 65 v oregon partnership return of income oregongov

Create this form in 5 minutes!

How to create an eSignature for the form or 65 v oregon partnership return of income oregongov

How to make an electronic signature for the Form Or 65 V Oregon Partnership Return Of Income Oregongov in the online mode

How to make an eSignature for the Form Or 65 V Oregon Partnership Return Of Income Oregongov in Google Chrome

How to make an electronic signature for putting it on the Form Or 65 V Oregon Partnership Return Of Income Oregongov in Gmail

How to make an electronic signature for the Form Or 65 V Oregon Partnership Return Of Income Oregongov from your smartphone

How to make an eSignature for the Form Or 65 V Oregon Partnership Return Of Income Oregongov on iOS

How to generate an eSignature for the Form Or 65 V Oregon Partnership Return Of Income Oregongov on Android

People also ask

-

What is the OR Dept of Revenue Form 65 V and why is it important?

The OR Dept of Revenue Form 65 V is a payment voucher used for submitting estimated tax payments in Oregon. This form is essential for businesses and individuals to ensure compliance with state tax regulations. Using airSlate SignNow to eSign and send this form streamlines the tax process, making it easier to manage deadlines and payments.

-

How can airSlate SignNow help me with the OR Dept of Revenue Form 65 V?

airSlate SignNow provides a user-friendly platform that allows you to eSign and submit the OR Dept of Revenue Form 65 V electronically. This solution improves efficiency and reduces the chances of errors. Plus, it allows you to track the status of your submissions, giving you peace of mind during the tax filing process.

-

What are the pricing options for using airSlate SignNow for the OR Dept of Revenue Form 65 V?

airSlate SignNow offers several pricing plans to cater to various business needs, starting with basic options for individual users and scaling to comprehensive solutions for enterprises. Each plan ensures you can manage essential documents like the OR Dept of Revenue Form 65 V without breaking the bank. Make sure to check our website for the most current pricing and promotional offers.

-

Are there any integrations available with airSlate SignNow for tax preparation software related to the OR Dept of Revenue Form 65 V?

Yes, airSlate SignNow integrates seamlessly with various tax preparation and financial software. This feature allows users to streamline their workflow when working with the OR Dept of Revenue Form 65 V. These integrations simplify the process of incorporating signed documents directly into your tax software, enhancing efficiency and accuracy.

-

Can I use airSlate SignNow to store my OR Dept of Revenue Form 65 V submissions securely?

Absolutely! airSlate SignNow provides secure cloud storage options for all your documents, including the OR Dept of Revenue Form 65 V submissions. You can access your documents anytime while ensuring that sensitive information is protected with top-notch security features.

-

What features should I look for in an eSigning solution for the OR Dept of Revenue Form 65 V?

When choosing an eSigning solution for the OR Dept of Revenue Form 65 V, look for features like user-friendly document management, robust security measures, and tracking capabilities. airSlate SignNow offers all these features, making it simple to manage your tax documents effectively and securely.

-

Is airSlate SignNow easy to use for beginners unfamiliar with the OR Dept of Revenue Form 65 V?

Yes, airSlate SignNow is designed with beginners in mind, offering an intuitive interface that simplifies the eSigning process. Even if you are unfamiliar with the OR Dept of Revenue Form 65 V, our platform provides guided steps and support resources to help you through every stage of document handling.

Get more for Oreogn Form Or 65

- Application for show approval american quarter horse association western info form

- Manufactured home purchase order and federal disclosure statement form

- Printable self employment forms

- Application for employment cactus club cafe form

- Tbssct 5946 form

- Paratransit application greater cleveland regional transit authority form

- 5107 form

- 1 786 form

Find out other Oreogn Form Or 65

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple