Form 1041 Es

What is the Form 1041 ES

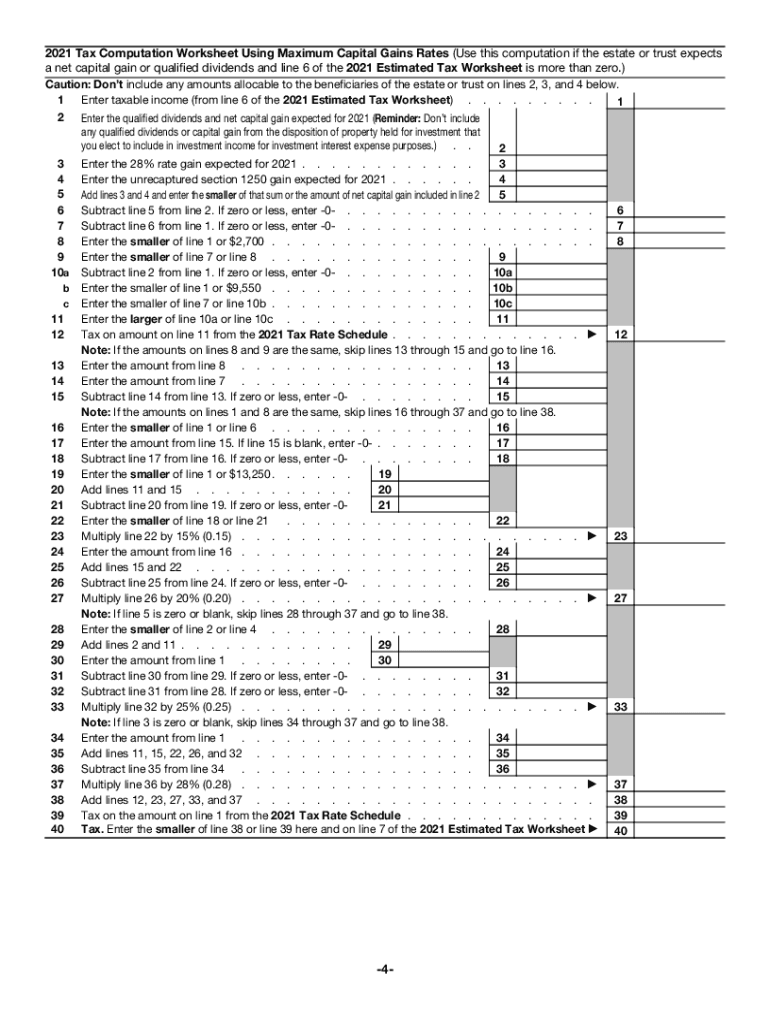

The Form 1041 ES is an estimated tax payment voucher specifically designed for estates and trusts. This form allows fiduciaries to make estimated tax payments on behalf of the estate or trust, ensuring compliance with federal tax obligations. It is essential for managing tax liabilities effectively, particularly for entities that generate income during the tax year.

How to use the Form 1041 ES

Using the Form 1041 ES involves calculating the estimated tax liability for the estate or trust and submitting the appropriate payment vouchers. Taxpayers should determine the expected income for the year, considering any deductions and credits applicable to the estate or trust. Each payment voucher must be filled out accurately and submitted by the required deadlines to avoid penalties.

Steps to complete the Form 1041 ES

Completing the Form 1041 ES requires several steps:

- Gather financial information regarding the estate or trust's income and expenses.

- Calculate the estimated tax liability based on the projected income.

- Fill out the Form 1041 ES with the calculated amounts, ensuring all information is accurate.

- Submit the completed form along with the payment by the due date.

Legal use of the Form 1041 ES

The legal use of the Form 1041 ES is governed by IRS regulations. To ensure its validity, the form must be completed accurately and submitted on time. Failure to comply with IRS guidelines can result in penalties. It is essential to maintain records of all submitted forms and payments for future reference and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 ES are crucial for compliance. Typically, the estimated payments are due on specific dates throughout the year, often in April, June, September, and January of the following year. Taxpayers should be aware of these dates to avoid late fees and interest charges on unpaid taxes.

Required Documents

To complete the Form 1041 ES, several documents may be required, including:

- Financial statements of the estate or trust.

- Previous tax returns for reference.

- Documentation of any deductions or credits applicable.

Form Submission Methods (Online / Mail / In-Person)

The Form 1041 ES can be submitted through various methods. Taxpayers may choose to file online through the IRS e-file system or send the completed form via mail to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic or postal methods the primary options for compliance.

Quick guide on how to complete 2021 form 1041 es

Complete Form 1041 Es seamlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 1041 Es on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 1041 Es with ease

- Obtain Form 1041 Es and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 1041 Es and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1041 es

How to generate an e-signature for your PDF in the online mode

How to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an e-signature for a PDF document on Android OS

People also ask

-

What are 2021 1041es, and why are they important for tax filing?

The 2021 1041es are estimated tax payments that must be filed by estates and trusts. They are essential for ensuring that these entities meet their tax obligations throughout the year. Properly managing your 2021 1041es can help avoid penalties and maintain compliance with IRS regulations.

-

How does airSlate SignNow simplify the process of signing 2021 1041es?

airSlate SignNow streamlines the process of signing 2021 1041es by providing an intuitive platform for electronic signatures. Users can easily upload, sign, and send their tax documents securely. This saves time and reduces the hassle of traditional paper signing methods.

-

What features does airSlate SignNow offer for managing 2021 1041es?

airSlate SignNow offers features such as customizable templates, real-time status tracking, and secure cloud storage for your 2021 1041es. These tools enhance document management and ensure that you can easily access and manage your important tax files whenever needed.

-

Is airSlate SignNow a cost-effective solution for filing 2021 1041es?

Yes, airSlate SignNow is a cost-effective solution for managing and filing your 2021 1041es. With various pricing plans available, you can choose an option that fits your budget while accessing valuable features that streamline your tax processes.

-

Can I collaborate with my accountant on 2021 1041es using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration with your accountant on 2021 1041es. You can share documents, obtain electronic signatures, and communicate in real-time, ensuring that all parties are aligned throughout the tax filing process.

-

Are there any integrations available with airSlate SignNow for processing 2021 1041es?

Yes, airSlate SignNow integrates with various accounting and tax software to help streamline the processing of your 2021 1041es. These integrations facilitate seamless data transfer and enhance your overall productivity, allowing for a more efficient tax preparation experience.

-

What are the benefits of using airSlate SignNow for 2021 1041es?

Using airSlate SignNow for your 2021 1041es offers numerous benefits, including faster processing times, reduced paperwork, and improved organization. The platform's user-friendly design enhances both usability and security throughout the signing process, making it an optimal choice for tax filing.

Get more for Form 1041 Es

- Guaranty or guarantee of payment of rent alaska form

- Letter from landlord to tenant as notice of default on commercial lease alaska form

- Residential or rental lease extension agreement alaska form

- Commercial rental lease application questionnaire alaska form

- Apartment lease rental application questionnaire alaska form

- Residential rental lease application alaska form

- Salary verification form for potential lease alaska

- Landlord agreement to allow tenant alterations to premises alaska form

Find out other Form 1041 Es

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form