Form 8594 Rev November Asset Acquisition Statement under Section 1060

What is the Form 8594 Asset Acquisition Statement Under Section 1060

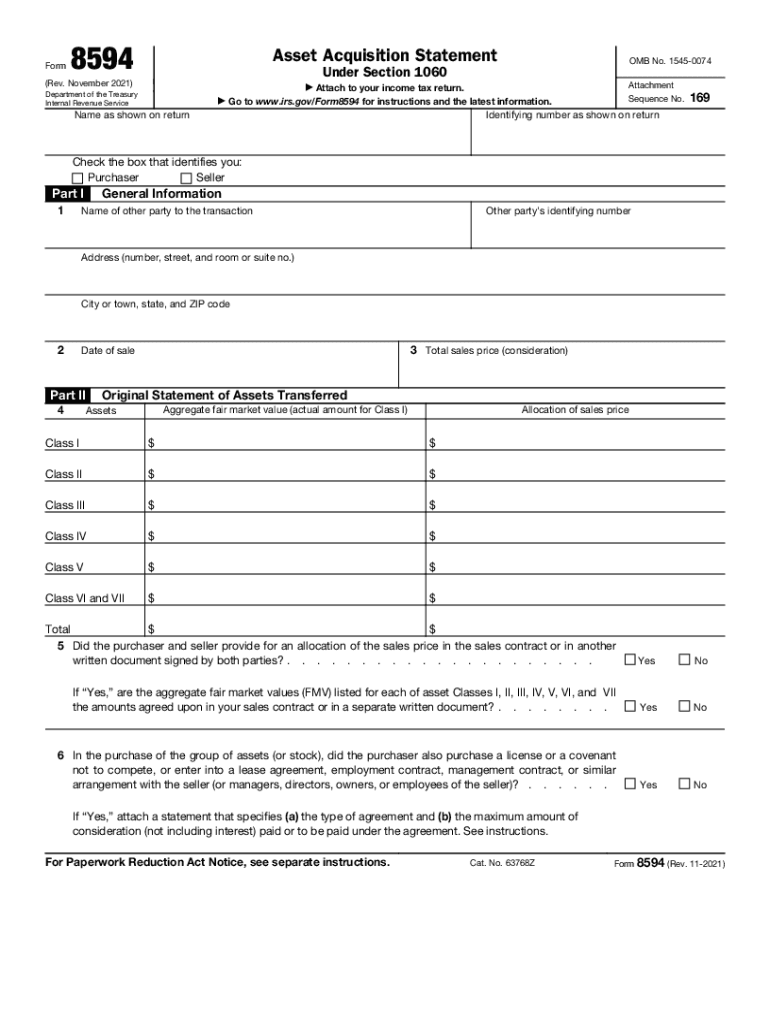

The IRS Form 8594, known as the Asset Acquisition Statement under Section 1060, is a crucial document used in the context of asset acquisitions. This form is primarily utilized when a business acquires a group of assets that constitutes a trade or business. The purpose of the form is to provide the IRS with information regarding the allocation of the purchase price among the acquired assets. This allocation is significant for tax purposes, as it affects the depreciation and gain or loss calculations for the assets involved in the transaction.

Steps to Complete the Form 8594 Asset Acquisition Statement Under Section 1060

Completing the IRS Form 8594 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the transaction, including the purchase price and details of the assets acquired. Next, identify the categories of assets, such as tangible and intangible assets, and determine their fair market values. Once you have this information, fill out the form by listing the assets and their respective values in the designated sections. Finally, ensure that all parties involved in the transaction sign the form, as their signatures are required for validation. Consider using digital tools to streamline this process, as they can enhance accuracy and provide a secure method for signing.

Legal Use of the Form 8594 Asset Acquisition Statement Under Section 1060

The legal use of IRS Form 8594 is essential for ensuring compliance with tax regulations. This form must be filed when a business acquires assets in a manner that meets the criteria outlined by the IRS. Properly completing and submitting this form helps avoid potential disputes with the IRS regarding asset valuations and tax liabilities. It is also important to keep a copy of the completed form for your records, as it may be required for future tax filings or audits. Utilizing a reliable digital platform for signing and storing this document can enhance its legal standing and accessibility.

IRS Guidelines for Form 8594

The IRS provides specific guidelines for the completion and submission of Form 8594. These guidelines outline the necessary information that must be included, such as the names and addresses of the parties involved, the date of the acquisition, and the details of the assets being transferred. Additionally, the IRS emphasizes the importance of accurate asset valuation and proper allocation of the purchase price. Familiarizing yourself with these guidelines can help ensure that your form is completed correctly, reducing the risk of errors that could lead to penalties or audits.

Filing Deadlines for Form 8594

Filing deadlines for IRS Form 8594 are typically aligned with the tax return deadlines for the parties involved in the transaction. Generally, the form must be filed with the tax return for the year in which the asset acquisition occurs. It is important to be aware of these deadlines to avoid late filing penalties. Keeping track of any changes in tax regulations or deadlines is crucial, as these can impact your filing requirements. Utilizing a digital document management system can help you stay organized and ensure timely submissions.

Required Documents for Form 8594

When preparing to complete IRS Form 8594, several supporting documents are necessary. These may include purchase agreements, asset appraisals, and any other relevant documentation that provides evidence of the transaction and asset values. Having these documents readily available can facilitate the completion of the form and ensure that all necessary information is included. Additionally, maintaining a well-organized file of these documents can be beneficial for future reference and compliance purposes.

Quick guide on how to complete form 8594 rev november 2021 asset acquisition statement under section 1060

Effortlessly Prepare Form 8594 Rev November Asset Acquisition Statement Under Section 1060 on Any Device

The management of online documents has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly and without delays. Handle Form 8594 Rev November Asset Acquisition Statement Under Section 1060 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 8594 Rev November Asset Acquisition Statement Under Section 1060 with Ease

- Obtain Form 8594 Rev November Asset Acquisition Statement Under Section 1060 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8594 Rev November Asset Acquisition Statement Under Section 1060 and ensure excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8594 rev november 2021 asset acquisition statement under section 1060

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is IRS Form 8594 and why is it important?

IRS Form 8594 is a tax form used for asset acquisitions and business sales. It is crucial because it helps determine the allocation of purchase price among various assets, affecting both the buyer and seller's tax obligations. Understanding how to properly complete this form is essential for a smooth transaction.

-

How can airSlate SignNow assist with completing IRS Form 8594?

airSlate SignNow provides a user-friendly platform for electronically signing and sending IRS Form 8594 among parties involved in the transaction. The software streamlines the process, ensuring all stakeholders can review and eSign the form securely and efficiently. This helps avoid delays and complications in submitting the form.

-

What features does airSlate SignNow offer for IRS Form 8594?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for IRS Form 8594. These tools simplify the document management process, making it easier for businesses to handle their legal and tax paperwork. Additionally, users can ensure compliance with electronic signature laws.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8594?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Depending on your usage, you can choose a plan that fits your budget while enjoying the benefits of electronic signing for documents like IRS Form 8594. Free trials may also be available for new users to explore the features.

-

Can I integrate airSlate SignNow with other software I use for IRS Form 8594?

Absolutely! airSlate SignNow integrates easily with various software solutions such as CRM systems, email platforms, and cloud storage services. This flexibility allows you to streamline your workflow while preparing IRS Form 8594 and other documents. Integration enhances productivity and keeps all necessary data in sync.

-

What types of businesses can benefit from using airSlate SignNow for IRS Form 8594?

Any business involved in asset acquisitions or sales can benefit from using airSlate SignNow for IRS Form 8594. This includes small businesses, corporations, and advisors who regularly handle such transactions. The platform simplifies eSigning processes, making it accessible for companies of all sizes.

-

What are the security features of airSlate SignNow for managing IRS Form 8594?

airSlate SignNow prioritizes security with features such as two-factor authentication, document encryption, and secure storage. This ensures that your sensitive documents, including IRS Form 8594, are protected throughout the signing and storage process. You can trust that your data is safe with airSlate SignNow.

Get more for Form 8594 Rev November Asset Acquisition Statement Under Section 1060

- Quitclaim deed timeshare from two individuals to one individual florida form

- Husband wife corporation form

- Warranty deed from husband and wife to corporation florida form

- Florida enhanced life estate deed form

- Florida life estate deed 497302934 form

- Deed timeshare 497302935 form

- Fl divorce 497302936 form

- Florida husband llc form

Find out other Form 8594 Rev November Asset Acquisition Statement Under Section 1060

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself