PT 300 a the South Carolina Department of Revenue Sctax 2015

What is the PT 300 A The South Carolina Department Of Revenue Sctax

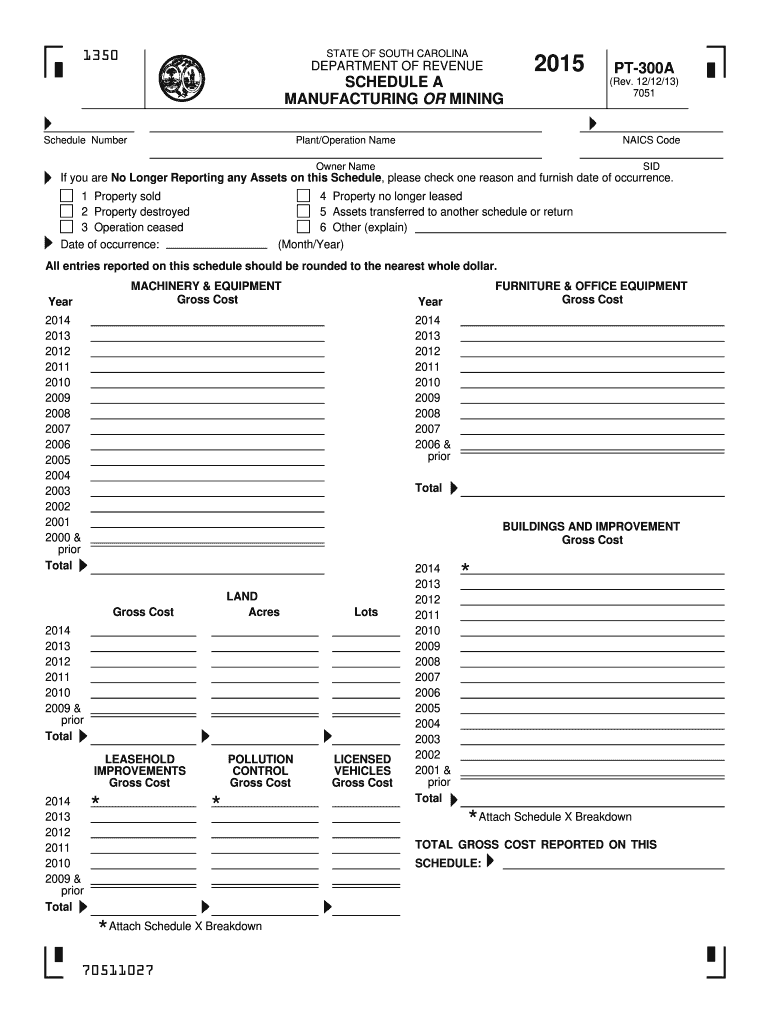

The PT 300 A is a tax form issued by the South Carolina Department of Revenue, specifically designed for reporting property tax information. This form is essential for taxpayers who need to declare their property holdings and assess their tax obligations accurately. It serves as a formal declaration to the state, ensuring compliance with local tax laws and regulations.

Steps to complete the PT 300 A The South Carolina Department Of Revenue Sctax

Completing the PT 300 A involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your property, including purchase agreements and previous tax statements. Next, fill out the form by providing detailed information about the property, such as its location, value, and any improvements made. After completing the form, review all entries for accuracy before signing. Finally, submit the form to the South Carolina Department of Revenue by the specified deadline, either electronically or by mail.

Legal use of the PT 300 A The South Carolina Department Of Revenue Sctax

The PT 300 A must be used in accordance with South Carolina tax laws. This form is legally binding and should be filled out truthfully to avoid penalties. Misrepresentation of property information can lead to legal consequences, including fines or increased tax assessments. Therefore, it is crucial to ensure that all information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the PT 300 A are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, often aligned with the property tax assessment cycle. Taxpayers should be aware of these deadlines and plan accordingly to ensure timely submission. Failure to file by the deadline may result in late fees or other penalties imposed by the South Carolina Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the PT 300 A. The form can be filed online through the South Carolina Department of Revenue's website, which offers a convenient and efficient method. Alternatively, taxpayers may choose to mail the completed form to the appropriate address or submit it in person at designated offices. Each submission method has its own processing times, so it is advisable to consider these factors when choosing how to file.

Key elements of the PT 300 A The South Carolina Department Of Revenue Sctax

The PT 300 A includes several key elements that are essential for proper completion. These elements typically consist of property identification details, owner information, and specific assessments related to the property's value. Additionally, the form may require disclosures about any exemptions or deductions applicable to the property. Understanding these components is crucial for accurate reporting and compliance with state tax regulations.

Quick guide on how to complete 2015 pt 300 a the south carolina department of revenue sctax

Your instructional manual on how to prepare your PT 300 A The South Carolina Department Of Revenue Sctax

If you are looking to understand how to create and dispatch your PT 300 A The South Carolina Department Of Revenue Sctax, here are some straightforward instructions to simplify tax submission.

To start, you simply need to set up your airSlate SignNow account to transform how you handle documentation online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your tax files effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to modify responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your PT 300 A The South Carolina Department Of Revenue Sctax in a few minutes:

- Establish your account and begin working on PDFs shortly.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to load your PT 300 A The South Carolina Department Of Revenue Sctax in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if applicable).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that paper submissions may lead to increased errors and delayed reimbursements. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 pt 300 a the south carolina department of revenue sctax

FAQs

-

How many marks out of 100 should I get to get a 100 rank in the GATE 2015 civil department?

Thnx for a2aIt depends on the competition.But it will be between 70-85 as i think.

-

How long does it take to receive a South Carolina driver's license after submitting the appropriate paper work with the DMV when moving from out of state into SC?

I can’t speak for SC, but when I moved from NY to PA, it took 6 weeks. I understand that most DMV’s have similar delays.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

How can we track our visitors conversion/drop off when the visitor actually fills out fields on a form page outside of our site domain (Visitor finds listing in SERPS, hits our site, jumps to client site to complete form)?

The short answer: You can't unless the client site allows you to do so. A typical way to accomplish measuring external conversions is to use a postback pixels. You can easily google how they work - in short you would require your client to send a http request to your tracking software on the form submit. A good way to do this in practice is to provide an embedable form to your clients that already includes this feature and sends along a clientID with the request, so that you can easily see which client generates how many filled out forms.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

I am a repeater. I will be appearing for the JEE Mains 2016. I will also appear for the Maharashtra HSC improvement exam in October of 2015. Will my October board exam result be accepted for the Mains rankings? If so, then how would I have to fill the form?

If you are reappearing for all the subjects then JEE will consider your new results. However if you're reappearing for selected subjects then your pervious results will be considered by JEE.

Create this form in 5 minutes!

How to create an eSignature for the 2015 pt 300 a the south carolina department of revenue sctax

How to create an eSignature for the 2015 Pt 300 A The South Carolina Department Of Revenue Sctax in the online mode

How to create an electronic signature for the 2015 Pt 300 A The South Carolina Department Of Revenue Sctax in Chrome

How to create an eSignature for putting it on the 2015 Pt 300 A The South Carolina Department Of Revenue Sctax in Gmail

How to make an electronic signature for the 2015 Pt 300 A The South Carolina Department Of Revenue Sctax right from your smartphone

How to make an eSignature for the 2015 Pt 300 A The South Carolina Department Of Revenue Sctax on iOS

How to create an eSignature for the 2015 Pt 300 A The South Carolina Department Of Revenue Sctax on Android devices

People also ask

-

What is the PT 300 A form for the South Carolina Department of Revenue?

The PT 300 A form, required by the South Carolina Department of Revenue, is used to report property tax returns for businesses. It provides critical information about the personal property owned by a business, allowing the Department to assess taxes accurately. Completing this form correctly is essential for compliance.

-

How can airSlate SignNow help with completing the PT 300 A form?

airSlate SignNow simplifies the process of completing the PT 300 A form for the South Carolina Department of Revenue. With its easy-to-use electronic signature capabilities, you can fill out, sign, and send your PT 300 A form efficiently. This reduces paperwork and streamlines your tax reporting process.

-

What features does airSlate SignNow offer for managing documents like the PT 300 A?

airSlate SignNow provides a suite of features for managing documents such as the PT 300 A form. This includes customizable templates, secure storage, and workflow automation, ensuring that you can easily create, manage, and sign your tax documents. These features enhance productivity and facilitate compliance with the South Carolina Department of Revenue requirements.

-

Is airSlate SignNow cost-effective for businesses needing to file the PT 300 A form?

Yes, airSlate SignNow is a cost-effective solution for businesses required to file the PT 300 A form. With affordable pricing plans, you can access powerful tools that save time and reduce administrative overhead. This financial efficiency makes managing tax documents more feasible for companies of all sizes.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow integrates effortlessly with popular tax preparation software. This integration can help streamline your workflow when submitting the PT 300 A form to the South Carolina Department of Revenue, ensuring that all your documents and data are synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for eSigning the PT 300 A form?

Using airSlate SignNow for eSigning the PT 300 A form offers several benefits, including enhanced security and faster turnaround times. Your documents are safely encrypted and accessible from any device, allowing for a seamless signing experience. This means you can focus on your business without delays related to paperwork.

-

Are there any limitations or restrictions when using airSlate SignNow for the PT 300 A?

There are no signNow limitations when using airSlate SignNow for the PT 300 A form, as the platform supports a wide range of document types and workflows. However, ensure that you comply with the specifications set by the South Carolina Department of Revenue regarding eSigned documents. For optimal compliance, familiarize yourself with the applicable rules and regulations.

Get more for PT 300 A The South Carolina Department Of Revenue Sctax

- Scientific notation multiplication and division independent practice worksheet answers form

- Dc homestead application form

- Maersk deposit slip 90440728 form

- Dwaynes photo form

- Tenant welcome packet pdf form

- Fillable contact form

- 1040 forms 8915 a 8915 b 8915 c 8915 d and 8915 e

- Non confidential public sutter county home co sutter ca form

Find out other PT 300 A The South Carolina Department Of Revenue Sctax

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer