TAX COMPLIANCE UNIT NOTICE of BULK Cook County, Illinois Form

Understanding the Tax Compliance Unit Notice of Bulk in Cook County

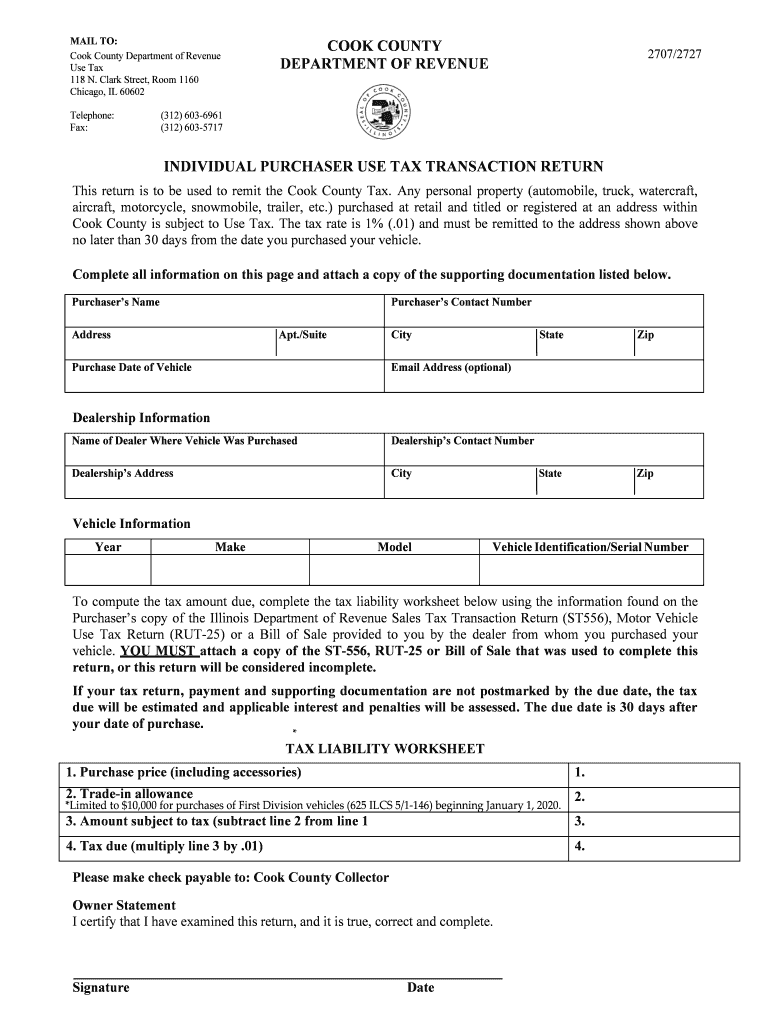

The Tax Compliance Unit Notice of Bulk in Cook County, Illinois, is a formal document that serves to inform individuals and businesses about their tax obligations related to bulk sales. This notice is particularly relevant for those engaged in transactions involving substantial quantities of goods, as it outlines the necessary compliance requirements. Understanding this notice is crucial for ensuring that all tax liabilities are met appropriately, thereby avoiding potential penalties.

Steps to Complete the Tax Compliance Unit Notice of Bulk

Completing the Tax Compliance Unit Notice of Bulk involves several key steps:

- Gather necessary information about the bulk sale, including the nature of the goods and the parties involved.

- Fill out the notice form accurately, ensuring all required fields are completed.

- Attach any supporting documentation that may be required, such as proof of purchase or sale agreements.

- Review the completed notice for accuracy before submission.

- Submit the notice through the appropriate channels, which may include online submission, mailing, or in-person delivery.

Required Documents for the Tax Compliance Unit Notice of Bulk

When filing the Tax Compliance Unit Notice of Bulk, several documents may be required to support your submission. These typically include:

- Proof of identity for the individual or business submitting the notice.

- Documentation related to the bulk sale, such as invoices, contracts, or receipts.

- Any prior correspondence with the Tax Compliance Unit that may be relevant to the current filing.

Penalties for Non-Compliance with Tax Regulations

Failure to comply with the requirements outlined in the Tax Compliance Unit Notice of Bulk can result in significant penalties. These may include:

- Fines that vary based on the severity of the non-compliance.

- Interest charges on unpaid taxes that accumulate over time.

- Potential legal action if the non-compliance is deemed egregious.

Filing Deadlines for the Tax Compliance Unit Notice of Bulk

It is important to be aware of the filing deadlines associated with the Tax Compliance Unit Notice of Bulk. Generally, these deadlines are set by the Cook County tax authority and can vary based on the specific circumstances of the bulk sale. Missing these deadlines may lead to penalties, so it is advisable to stay informed about the relevant dates.

Legal Use of the Tax Compliance Unit Notice of Bulk

The legal use of the Tax Compliance Unit Notice of Bulk is essential for ensuring that all transactions comply with local tax laws. This notice serves as an official record of the bulk sale, which can be referenced in case of audits or disputes. Properly filing this notice not only aids in tax compliance but also protects the rights of the parties involved in the transaction.

Quick guide on how to complete tax compliance unit notice of bulk cook county illinois

Effortlessly Prepare TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the right form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Edit and Electronically Sign TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois with Ease

- Locate TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools available specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a standard handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method for sending your form — via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax compliance unit notice of bulk cook county illinois

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is use tax in Cook County?

Use tax in Cook County refers to the tax imposed on the storage, use, or consumption of tangible personal property that is purchased from outside the county. Businesses must be aware of use tax requirements to ensure compliance and avoid penalties. Understanding use tax Cook County is crucial for maintaining financial integrity.

-

How can airSlate SignNow help with managing use tax in Cook County?

airSlate SignNow streamlines document management, allowing users to eSign and send vital tax-related documents efficiently. With automated workflows, it helps ensure that all tax filings, including use tax Cook County submissions, are completed accurately and on time. This can signNowly reduce the administrative burden associated with tax compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers affordable pricing plans tailored to different business needs. These include a free trial period, letting users explore the platform before committing. No matter the size of your operation, airSlate SignNow aims to provide a cost-effective solution for managing essential documents like those related to use tax Cook County.

-

Can airSlate SignNow integrate with my existing software?

Yes, airSlate SignNow can seamlessly integrate with numerous popular software applications. Whether you're using accounting software or other document management systems, it can enhance your workflow. This means staying updated on use tax Cook County without the need for double data entry or reconciliation.

-

What features does airSlate SignNow offer for use tax documentation?

With airSlate SignNow, users can easily create, edit, and eSign documents required for use tax Cook County compliance. The platform boasts features like customizable templates and automated reminders for filing deadlines, ensuring that all tax obligations are met without hassle. This can save time and reduce errors in your tax documentation.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption protocols to protect sensitive tax information. When managing documents related to use tax Cook County, users can have peace of mind knowing that their data is safe and compliant with industry standards.

-

How does airSlate SignNow improve efficiency in tax-related processes?

By using airSlate SignNow, businesses can enhance their operational efficiency through streamlined document workflows. Automated processes help reduce manual errors, ensuring that documents related to use tax Cook County are processed correctly and timely. This allows teams to focus on more strategic tasks rather than administrative overhead.

Get more for TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois

- Florida form package

- Power of attorney for sale of motor vehicle florida form

- Wedding planning or consultant package florida form

- Hunting forms package florida

- Fl theft form

- Aging parent package florida form

- Sale of a business package florida form

- Legal documents for the guardian of a minor package florida form

Find out other TAX COMPLIANCE UNIT NOTICE OF BULK Cook County, Illinois

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed