Azdor Gov Forms Property Tax FormsProperty Tax Forms Arizona Department of Revenue

Understanding Form 82514

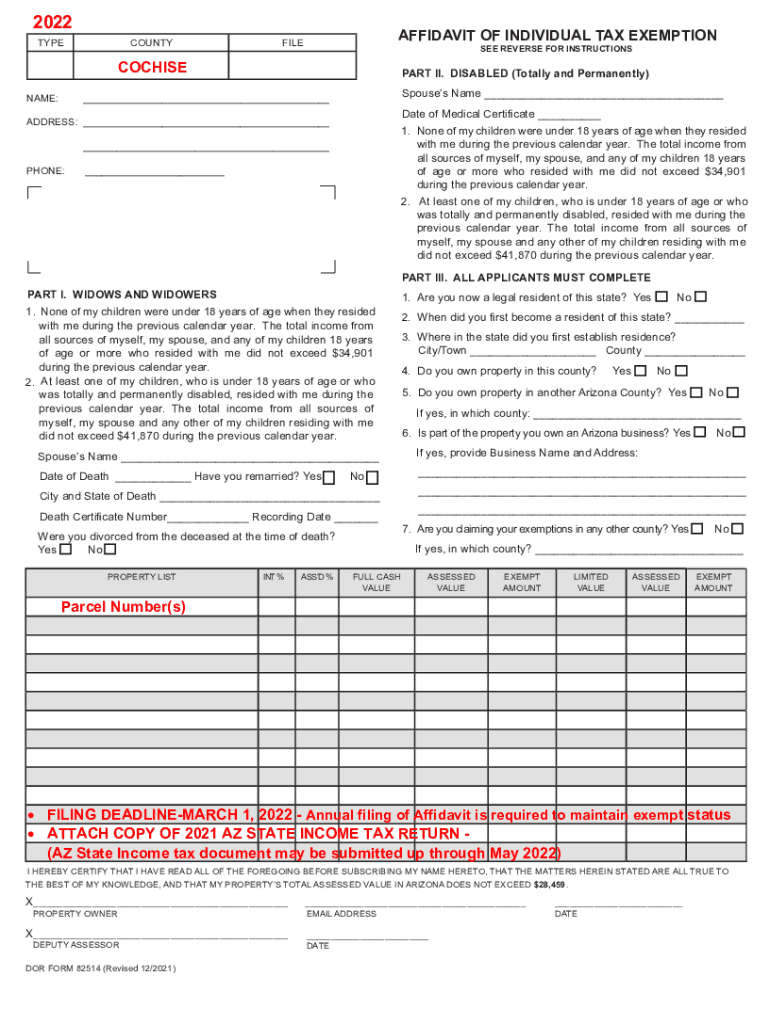

Form 82514, also known as the Arizona Property Tax Exemption Form, is a crucial document for individuals seeking property tax exemptions in Arizona. This form is specifically designed to assist eligible homeowners in claiming exemptions that can significantly reduce their property tax burden. The form requires detailed information about the property and the applicant's eligibility, ensuring that only qualified individuals benefit from these exemptions.

Steps to Complete Form 82514

Completing Form 82514 involves several key steps to ensure accuracy and compliance with Arizona's property tax regulations. Begin by gathering necessary information, including your property address, ownership details, and any relevant financial documentation. Next, fill out the form with precise details, ensuring that all sections are completed. After filling out the form, review it for any errors or omissions before submitting it to the appropriate county assessor’s office. This careful approach helps prevent delays in processing your exemption request.

Eligibility Criteria for Form 82514

To qualify for the exemptions available through Form 82514, applicants must meet specific eligibility criteria set by the Arizona Department of Revenue. Generally, these criteria include being the owner of the property, residing in the home as your primary residence, and meeting certain income thresholds. Additionally, certain groups, such as senior citizens, disabled individuals, and veterans, may have additional considerations that enhance their eligibility for property tax exemptions.

Legal Use of Form 82514

Form 82514 is legally recognized as a binding document when filled out and submitted according to Arizona state laws. To ensure its legal standing, it is essential to comply with all requirements outlined by the Arizona Department of Revenue. This includes providing accurate information and submitting the form within the designated time frames. Utilizing a reliable eSignature solution, such as signNow, can further enhance the legal validity of your submission by ensuring secure and compliant electronic signatures.

Required Documents for Form 82514

When submitting Form 82514, applicants must provide supporting documentation to verify their eligibility for property tax exemptions. Commonly required documents include proof of ownership, such as a deed, and identification that confirms residency, like a driver’s license or utility bill. Additionally, income documentation may be necessary to demonstrate compliance with income limits. Ensuring that all required documents are included with your application will help facilitate a smoother processing experience.

Form Submission Methods for Form 82514

Form 82514 can be submitted through various methods, providing flexibility for applicants. The primary submission methods include online submission via the Arizona Department of Revenue's website, mailing a hard copy to the appropriate county assessor’s office, or delivering it in person. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline for receiving the exemption.

Quick guide on how to complete azdorgov forms property tax formsproperty tax forms arizona department of revenue

Complete Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents rapidly without delays. Manage Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue effortlessly

- Obtain Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of form delivery, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Adjust and eSign Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the azdorgov forms property tax formsproperty tax forms arizona department of revenue

The best way to generate an e-signature for your PDF document in the online mode

The best way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is form 82514 and how can airSlate SignNow help my business with it?

Form 82514 is an important document that businesses may need to send and eSign for various purposes. With airSlate SignNow, you can easily manage form 82514 by sending it securely and ensuring it is signed promptly. Our platform streamlines the signing process, making it simpler for both senders and recipients.

-

How does pricing for airSlate SignNow compare for businesses needing form 82514?

airSlate SignNow offers flexible pricing plans that cater specifically to businesses that frequently use form 82514. We provide cost-effective solutions that ensure you get the best value while managing your eSigning needs. Whether you're a small startup or a large enterprise, our plans scale according to your usage.

-

What features does airSlate SignNow offer for processing form 82514?

airSlate SignNow provides a range of features tailored for processing form 82514, including customizable templates, real-time tracking, and secure cloud storage. These features enhance documentation accuracy and compliance, allowing users to manage their forms with ease. Plus, our user-friendly interface makes it straightforward to navigate.

-

Can I integrate airSlate SignNow with other tools for better handling of form 82514?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow when dealing with form 82514. Integrations with tools like Google Drive, Salesforce, and Zapier allow you to automate processes and keep your documents organized. This ensures that all your essential resources work harmoniously together.

-

What are the benefits of using airSlate SignNow for form 82514?

Using airSlate SignNow for form 82514 provides numerous benefits including increased efficiency, enhanced security, and improved compliance. By digitalizing your documentation process, you can save time, reduce errors, and ensure that your form is signed and processed without delays. This ultimately leads to a more streamlined operation for your business.

-

Is airSlate SignNow user-friendly for signing form 82514?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to sign form 82514 without any technical difficulties. Our intuitive interface allows users to sign documents swiftly and efficiently, so your team can focus on what matters most. Training resources are also available to assist users in getting started.

-

How does airSlate SignNow ensure the security of form 82514?

airSlate SignNow prioritizes security when handling form 82514 by employing advanced encryption techniques and secure servers. Every transaction is protected to ensure the confidentiality and integrity of your documents. Additionally, our platform complies with industry standards and regulations, providing you peace of mind.

Get more for Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue

Find out other Azdor gov Forms Property tax formsProperty Tax Forms Arizona Department Of Revenue

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer