Schedule K 1 Form 568 2011

What is the Schedule K-1 Form 568

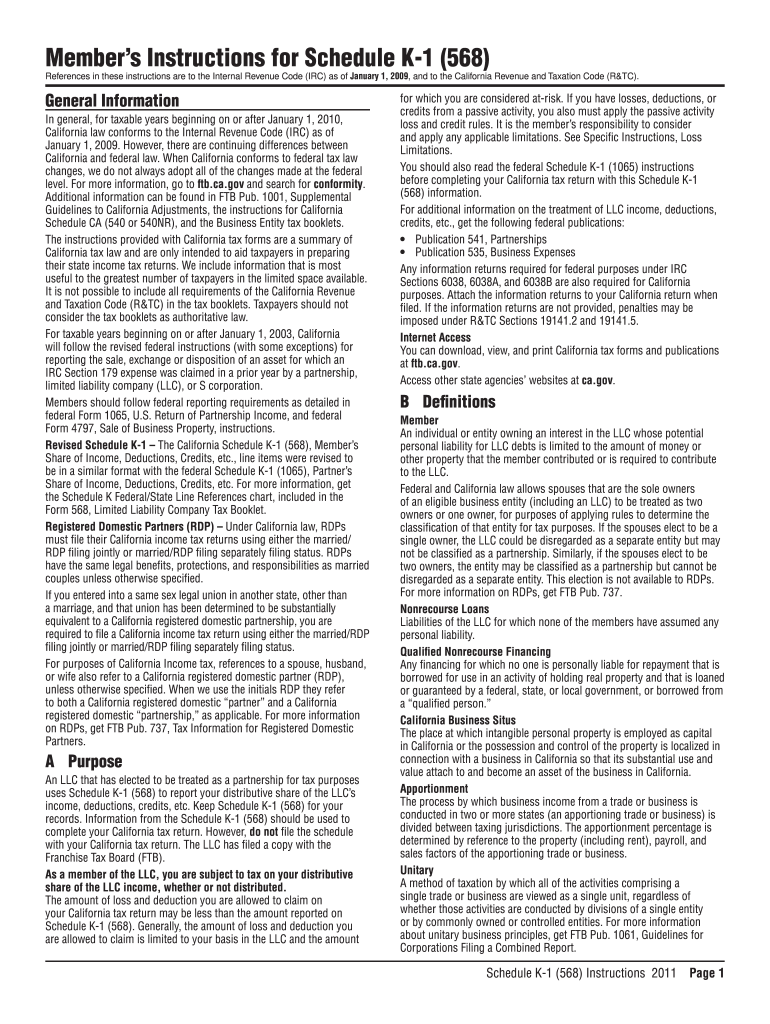

The Schedule K-1 Form 568 is a tax document used by partnerships and limited liability companies (LLCs) operating in California. It reports each partner's or member's share of income, deductions, credits, and other tax-related items. This form is essential for individuals who are part of a pass-through entity, as it allows them to report their share of the entity's income on their personal tax returns. The information provided on the K-1 is crucial for accurate tax reporting and compliance with state tax laws.

Steps to Complete the Schedule K-1 Form 568

Completing the Schedule K-1 Form 568 involves several key steps:

- Gather necessary information, including the entity's name, address, and tax identification number.

- Input the partner's or member's details, such as name, address, and ownership percentage.

- Report the income, deductions, and credits allocated to the partner or member, ensuring accuracy in calculations.

- Review the completed form for any errors or omissions before finalizing it.

- Distribute copies of the K-1 to all partners or members and retain a copy for the entity's records.

How to Obtain the Schedule K-1 Form 568

The Schedule K-1 Form 568 can be obtained through the California Franchise Tax Board's website or directly from the entity that is filing the form. Entities are required to provide K-1 forms to their partners or members by the tax filing deadline, which is typically the fifteenth day of the fourth month following the close of the tax year. It is important to ensure that the form is the most current version to comply with state regulations.

Legal Use of the Schedule K-1 Form 568

The Schedule K-1 Form 568 is legally required for partnerships and LLCs in California to report their income and distributions to the IRS and state tax authorities. Each partner or member must use the information provided on the K-1 to accurately report their share of the entity's income on their individual tax returns. Failure to provide accurate K-1 forms can result in penalties for both the entity and the partners or members.

Filing Deadlines / Important Dates

For partnerships and LLCs, the Schedule K-1 Form 568 must be filed by the entity by the fifteenth day of the fourth month after the end of the tax year. For most entities operating on a calendar year, this means the deadline is April 15. Partners or members should receive their K-1 forms by this date to ensure they can accurately report their income on their personal tax returns. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with tax regulations.

Form Submission Methods

The Schedule K-1 Form 568 can be submitted through various methods. Entities may choose to file the form electronically or via mail. Electronic filing is often preferred for its speed and efficiency, allowing for quicker processing by the California Franchise Tax Board. When filing by mail, it is important to ensure that the form is sent to the correct address and that it is postmarked by the filing deadline.

Quick guide on how to complete schedule k 1 form 568 2011

Your assistance manual on how to prepare your Schedule K 1 Form 568

If you’re interested in learning how to complete and submit your Schedule K 1 Form 568, below are a few brief instructions on how to simplify tax processing considerably.

To begin, you only need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to amend information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Schedule K 1 Form 568 in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Schedule K 1 Form 568 in our editor.

- Enter the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally binding eSignature (if applicable).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can increase return mistakes and postpone refunds. Naturally, before electronically filing your taxes, verify the IRS website for declaration rules in your area.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 568 2011

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 568 2011

How to create an eSignature for the Schedule K 1 Form 568 2011 online

How to generate an eSignature for your Schedule K 1 Form 568 2011 in Google Chrome

How to generate an eSignature for signing the Schedule K 1 Form 568 2011 in Gmail

How to generate an eSignature for the Schedule K 1 Form 568 2011 from your mobile device

How to create an eSignature for the Schedule K 1 Form 568 2011 on iOS

How to create an electronic signature for the Schedule K 1 Form 568 2011 on Android devices

People also ask

-

What is the Schedule K 1 Form 568 and why is it important?

The Schedule K 1 Form 568 is a tax document used by partnerships and LLCs in California to report income, deductions, and credits to their partners or members. It's essential for ensuring accurate tax reporting and compliance with California state tax laws. Understanding how to correctly fill out this form can save you from potential penalties and help maximize your tax benefits.

-

How can airSlate SignNow help with filing the Schedule K 1 Form 568?

airSlate SignNow simplifies the process of preparing and signing the Schedule K 1 Form 568 by providing an intuitive platform for document management and electronic signatures. Users can easily upload their completed forms, send them for eSignature, and track the signing process in real time. This streamlines your workflow, saving you valuable time during tax season.

-

What features does airSlate SignNow offer for managing the Schedule K 1 Form 568?

With airSlate SignNow, you can create templates for the Schedule K 1 Form 568, enabling fast and efficient completion for multiple partners. The platform also offers secure storage, advanced security features, and integration with popular accounting software, making it easier to manage your tax documents. Plus, you can access your forms from anywhere, ensuring flexibility and convenience.

-

Is airSlate SignNow affordable for small businesses needing the Schedule K 1 Form 568?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage the Schedule K 1 Form 568. With competitive pricing plans, you can choose an option that fits your budget while still accessing powerful features that enhance your document workflow. Additionally, the time saved can lead to cost reductions in your overall tax preparation process.

-

Can I integrate airSlate SignNow with my existing accounting software for the Schedule K 1 Form 568?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to import and export data related to the Schedule K 1 Form 568 effortlessly. This integration ensures that your financial records are up-to-date and accurate, simplifying your tax reporting and compliance processes.

-

How secure is my information when using airSlate SignNow for the Schedule K 1 Form 568?

Security is a top priority for airSlate SignNow. When using the platform to manage the Schedule K 1 Form 568, your data is protected through advanced encryption and secure cloud storage. This means your sensitive tax information remains confidential and safe from unauthorized access.

-

What support options are available if I have questions about the Schedule K 1 Form 568?

airSlate SignNow provides comprehensive customer support to assist you with any questions regarding the Schedule K 1 Form 568. You can access a detailed knowledge base, video tutorials, and signNow out to our support team via chat or email for personalized assistance. We are here to ensure you have all the help you need during tax season.

Get more for Schedule K 1 Form 568

Find out other Schedule K 1 Form 568

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement