Form 8796 a Rev 9 Request for ReturnInformation FederalState Tax Exchange Program State and Local Government Use Only

What is the 8796A return form?

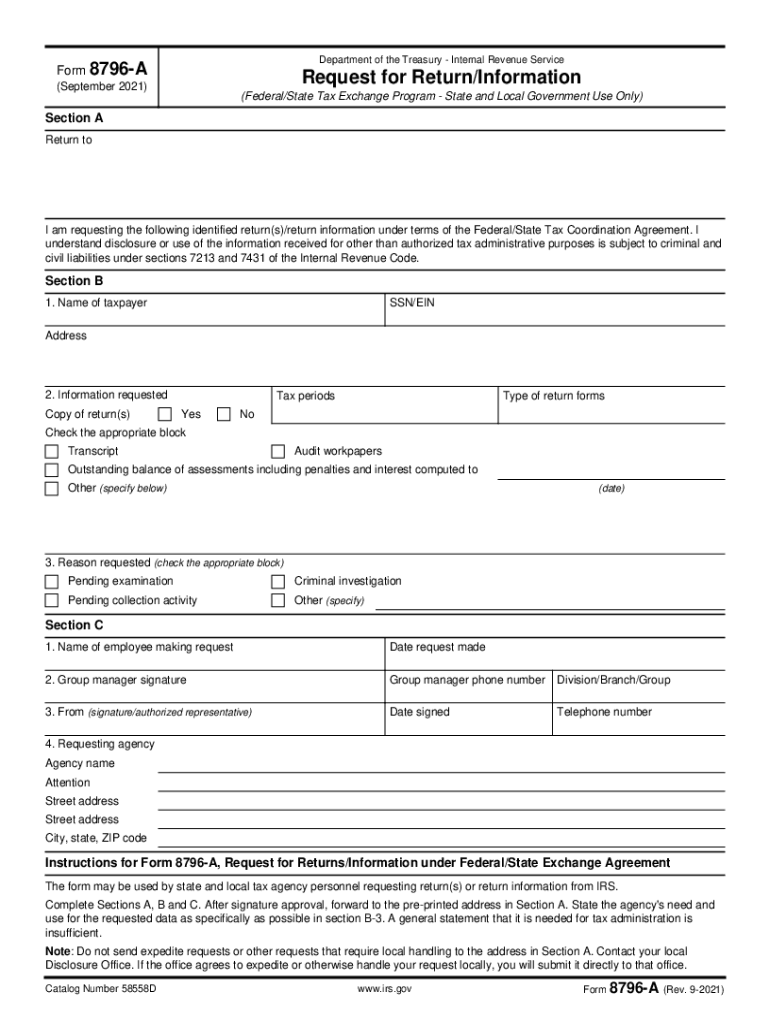

The 8796A return form, officially known as the Request for Return Information Federal-State Tax Exchange Program, is a document used primarily by state and local governments in the United States. This form facilitates the exchange of tax information between federal and state agencies, ensuring compliance with tax regulations. It serves as a vital tool for government entities to obtain necessary tax data to enforce tax laws effectively and maintain accurate records.

How to use the 8796A return form

Using the 8796A return form involves several straightforward steps. First, ensure that you are authorized to request tax information under the Federal-State Tax Exchange Program. Next, complete the form accurately, providing all required details such as the taxpayer's identification information and the specific data requested. After filling out the form, submit it to the appropriate federal agency, following any specific submission guidelines outlined by that agency. It is crucial to keep a copy for your records and ensure compliance with any applicable deadlines.

Steps to complete the 8796A return form

Completing the 8796A return form requires careful attention to detail. Follow these steps for successful completion:

- Begin by downloading the latest version of the 8796A form from the IRS website or your state tax authority.

- Fill in the taxpayer's name, address, and identification number accurately.

- Specify the type of information being requested and the tax years involved.

- Review the form for completeness and accuracy, ensuring all required fields are filled.

- Sign and date the form, indicating your authority to request this information.

- Submit the completed form according to the instructions provided, whether online, by mail, or in person.

Legal use of the 8796A return form

The legal use of the 8796A return form is governed by federal and state regulations that outline its purpose and the entities authorized to utilize it. Only designated state and local government officials may request information using this form, ensuring that it is used for legitimate tax enforcement purposes. Compliance with these legal requirements is essential to avoid any potential penalties or legal issues associated with improper use of the form.

Key elements of the 8796A return form

Understanding the key elements of the 8796A return form is vital for effective use. Important components include:

- Taxpayer Information: Details such as name, address, and identification numbers.

- Request Details: Specific information being requested and the relevant tax years.

- Signature: The authorized signature of the requester, affirming the legitimacy of the request.

- Submission Instructions: Guidelines on how and where to submit the form for processing.

Filing deadlines for the 8796A return form

Filing deadlines for the 8796A return form can vary based on the specific requirements of the requesting agency. Generally, it is advisable to submit the form as early as possible to ensure timely processing of the requested tax information. Be aware of any specific deadlines communicated by the federal or state agency to avoid delays in obtaining the necessary data.

Quick guide on how to complete form 8796 a rev 9 2021 request for returninformation federalstate tax exchange program state and local government use only

Effortlessly Prepare Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without any holdups. Manage Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only on any device using the airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

How to Alter and Electronically Sign Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only with Ease

- Acquire Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only and then click Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with features specifically designed by airSlate SignNow for that purpose.

- Generate your signature utilizing the Sign tool, which takes just seconds and carries the same legal validity as a customary wet ink signature.

- Review the information thoroughly and then click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new document copies. airSlate SignNow satisfies your document management requirements in a few clicks from any device of your preference. Modify and electronically sign Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8796 a rev 9 2021 request for returninformation federalstate tax exchange program state and local government use only

The best way to make an e-signature for a PDF file online

The best way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

The best way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the 8796a return form and who needs it?

The 8796a return form is a tax form that individuals and businesses use to report specific income types to the IRS. It is essential for those who need to accurately file their taxes and ensure compliance. Using airSlate SignNow, you can easily create and fill out the 8796a return form electronically for seamless submission.

-

How can airSlate SignNow help with completing the 8796a return form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the 8796a return form. With features such as templates and electronic signatures, you can save time and reduce errors in your submissions. Additionally, you can securely send and store your completed forms, making the whole process efficient.

-

Is there a cost associated with using airSlate SignNow for the 8796a return form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs, including options for individuals. These plans allow you to access features needed to manage the 8796a return form efficiently. You can choose a plan that suits your budget while ensuring optimal functionality.

-

Can I integrate airSlate SignNow with other platforms for the 8796a return form?

Absolutely! airSlate SignNow offers integrations with popular tools like Google Drive, Dropbox, and Zapier, enhancing your workflow for managing the 8796a return form. This allows for smooth document sharing and collaboration across various applications, ensuring you can efficiently handle all your tax documentation.

-

What are the benefits of using airSlate SignNow for the 8796a return form?

Using airSlate SignNow to manage your 8796a return form comes with multiple benefits, including improved efficiency, reduced turnaround time, and enhanced document security. You can also track the status of your returns and receive notifications, ensuring that you never miss a deadline, making tax time less stressful.

-

Is the 8796a return form compatible with mobile devices through airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to complete and sign the 8796a return form on the go. With mobile access, you can manage your tax forms from anywhere, ensuring flexibility and convenience in your tax preparation process. This feature is especially useful for busy professionals.

-

How secure is my information when using airSlate SignNow for the 8796a return form?

Security is a top priority for airSlate SignNow. When using the platform for your 8796a return form, all data is encrypted and stored securely, protecting it from unauthorized access. Additionally, electronic signatures are compliant with legal standards, ensuring your documents are both secure and valid.

Get more for Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only

- Concrete mason contract for contractor georgia form

- Demolition contract for contractor georgia form

- Framing contract for contractor georgia form

- Security contract for contractor georgia form

- Insulation contract for contractor georgia form

- Paving contract for contractor georgia form

- Site work contract for contractor georgia form

- Siding contract for contractor georgia form

Find out other Form 8796 A Rev 9 Request For ReturnInformation FederalState Tax Exchange Program State And Local Government Use Only

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy