Instructions for Form 8824 Internal Revenue ServiceInstructions for Form 8275 01 IRS Tax FormsInstructions for Form 8824 Interna

Understanding IRS Form 8824

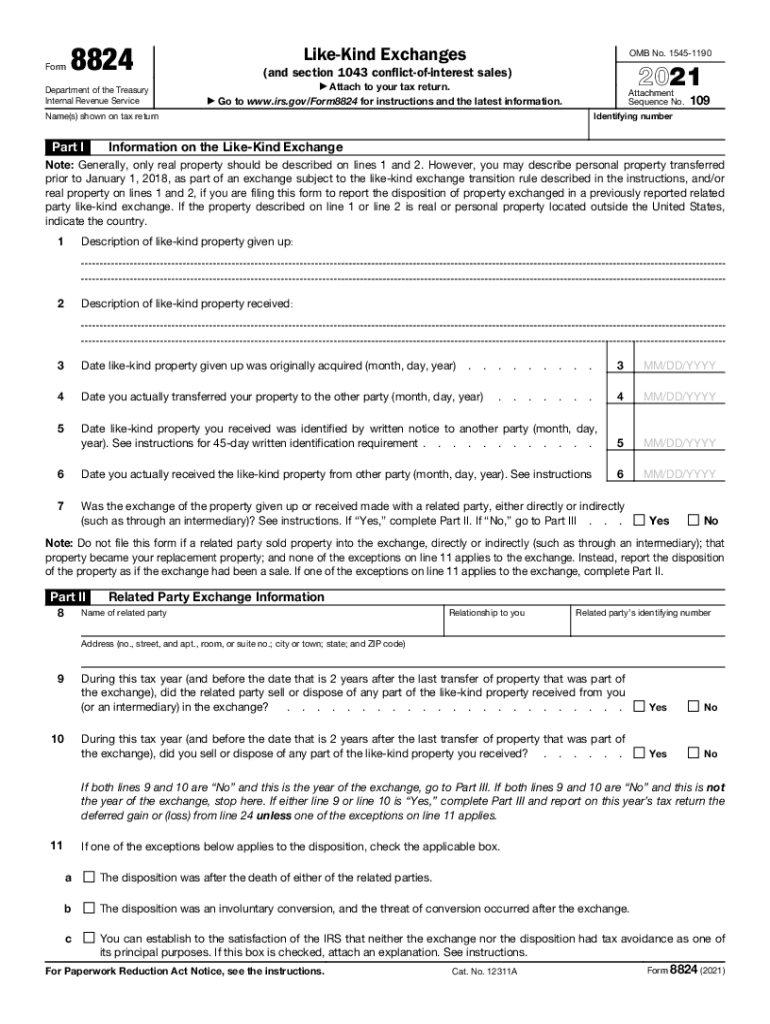

IRS Form 8824 is used for reporting like-kind exchanges of real property under Section 1031 of the Internal Revenue Code. This form allows taxpayers to defer capital gains taxes when they exchange one investment property for another. Understanding the purpose of this form is crucial for anyone considering a like-kind exchange, as it helps ensure compliance with IRS regulations and maximizes tax benefits.

Steps to Complete IRS Form 8824

Completing IRS Form 8824 involves several key steps:

- Gather necessary documentation, including details about the properties involved in the exchange.

- Complete Part I of the form, which requires information about the relinquished and replacement properties.

- Fill out Part II, where you report the gain or loss from the exchange.

- Ensure all required signatures are included before submission.

Following these steps carefully helps ensure that the form is filled out accurately and submitted in compliance with IRS guidelines.

Legal Use of IRS Form 8824

IRS Form 8824 is legally binding when completed correctly and submitted on time. It is essential to adhere to the guidelines set forth by the IRS to avoid any legal issues. The form must be filed with your federal income tax return for the year in which the exchange occurred. Failure to file or inaccuracies can result in penalties or disqualification from tax deferral benefits.

Key Elements of IRS Form 8824

Several key elements must be included when completing IRS Form 8824:

- Identification of the properties exchanged, including their fair market values.

- Details regarding the time frame of the exchange, including identification and acquisition periods.

- Any cash or other property received in the exchange, known as "boot."

These elements are critical for accurately reporting the exchange and ensuring compliance with IRS regulations.

Filing Deadlines for IRS Form 8824

IRS Form 8824 must be filed with your tax return for the year in which the like-kind exchange occurs. The typical deadline for individual taxpayers is April 15 of the following year, unless an extension is granted. It is important to keep track of these deadlines to avoid late filing penalties and ensure that you receive any tax benefits associated with the exchange.

Examples of Using IRS Form 8824

Consider a scenario where a taxpayer exchanges a rental property for another rental property. In this case, IRS Form 8824 would be utilized to report the exchange, allowing the taxpayer to defer capital gains taxes on the appreciated value of the relinquished property. Another example could involve a business owner exchanging commercial real estate for another commercial property, which would also be reported using this form. These examples illustrate the practical application of Form 8824 in real estate transactions.

Quick guide on how to complete instructions for form 8824 2020internal revenue serviceinstructions for form 8275 012021 irs tax formsinstructions for form

Complete Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed documentation, as you can obtain the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna with ease

- Locate Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8824 2020internal revenue serviceinstructions for form 8275 012021 irs tax formsinstructions for form

The best way to make an e-signature for your PDF file online

The best way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2021 8824 kind, and how does it relate to airSlate SignNow?

The 2021 8824 kind refers to the IRS form used for reporting specific tax information. Using airSlate SignNow, you can easily sign and send this document, facilitating efficient document management and compliance with tax regulations.

-

How much does airSlate SignNow cost for handling the 2021 8824 kind?

airSlate SignNow offers competitive pricing plans that accommodate various business sizes. Depending on your needs, pricing starts at a low monthly fee, making it a cost-effective solution for managing important documents, including the 2021 8824 kind.

-

What features does airSlate SignNow offer for the 2021 8824 kind?

airSlate SignNow provides various features such as effortless e-signing, document templates, and in-built storage solutions tailored for forms like the 2021 8824 kind. These features enhance efficiency and ensure that your documents are handled securely.

-

Can I integrate airSlate SignNow with other software for the 2021 8824 kind?

Yes, airSlate SignNow supports multiple integrations with popular platforms like Google Drive and Salesforce. This allows for seamless management of the 2021 8824 kind along with your existing workflows, improving overall productivity.

-

What are the benefits of using airSlate SignNow for the 2021 8824 kind?

Using airSlate SignNow for the 2021 8824 kind streamlines your document handling process. This solution enhances accessibility, boosts productivity, and ensures that your important documents are always signed and ready to go.

-

Is airSlate SignNow secure for handling sensitive documents like the 2021 8824 kind?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, including the 2021 8824 kind. Your data is encrypted and stored securely, ensuring that it remains confidential and protected at all times.

-

How user-friendly is airSlate SignNow for the 2021 8824 kind?

airSlate SignNow is designed with user experience in mind, making it incredibly easy to navigate and use, even for beginners. Whether dealing with the 2021 8824 kind or other documents, users can quickly adapt and start managing their paperwork efficiently.

Get more for Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna

Find out other Instructions For Form 8824 Internal Revenue ServiceInstructions For Form 8275 01 IRS Tax FormsInstructions For Form 8824 Interna

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple