10 1065 X Form to Edit, Download & PrintCocoDoc

Understanding the 1065X Form

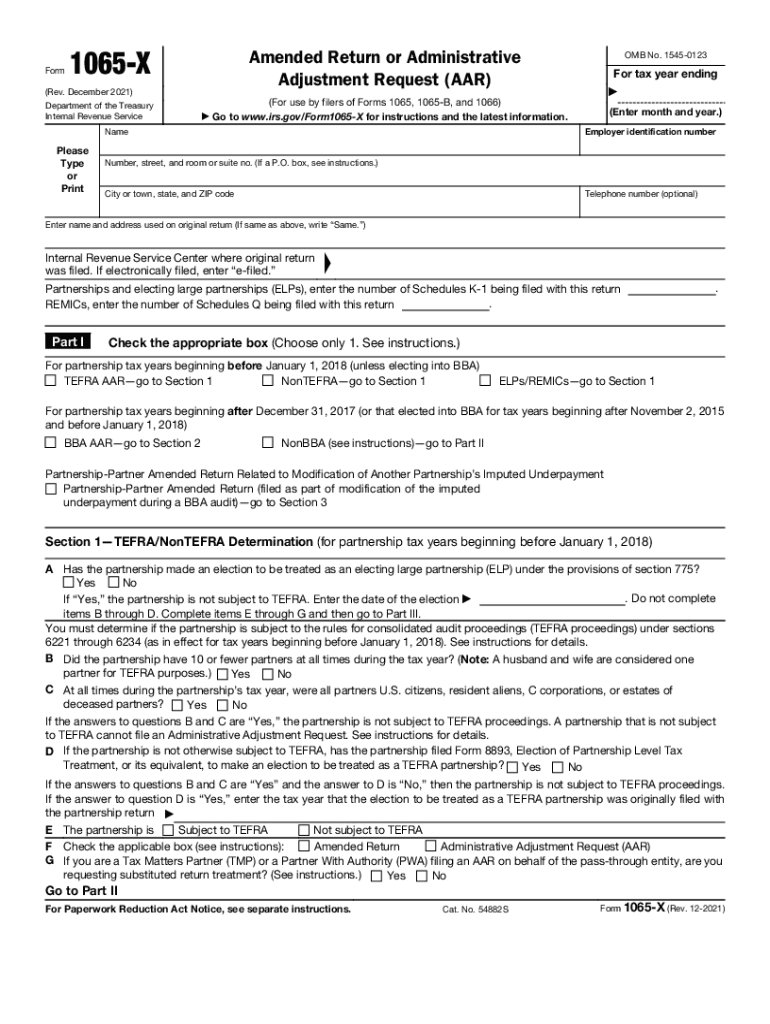

The 1065X form, known as the Amended Return or Administrative Adjustment Request, is used by partnerships to amend previously filed Form 1065. This form allows partnerships to correct errors or make adjustments to their income, deductions, or credits. It is essential for ensuring that the partnership's tax obligations are accurate and up to date. The 1065X form is particularly important for partnerships that need to report changes to their income or expenses that could affect their tax liability.

Steps to Complete the 1065X Form

Completing the 1065X form involves several key steps to ensure accuracy and compliance with IRS regulations. Start by gathering all relevant financial documents and the original Form 1065 that needs to be amended. Follow these steps:

- Enter the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

- Indicate the tax year for which you are filing the amendment.

- Complete the sections that require adjustments, providing detailed explanations for each change made.

- Ensure all calculations are accurate and reflect the changes made to the original return.

- Sign and date the form, ensuring that all partners are aware of the amendments made.

IRS Guidelines for the 1065X Form

The IRS provides specific guidelines for filing the 1065X form. It is crucial to adhere to these guidelines to avoid penalties or delays in processing. Key points include:

- File the 1065X form within three years of the original filing date to ensure eligibility for refunds.

- Clearly indicate the reasons for the amendments in the designated section of the form.

- Attach any supporting documentation that justifies the changes made to the original return.

Filing Deadlines for the 1065X Form

Timeliness is essential when submitting the 1065X form. The IRS requires that amended returns be filed within a specific timeframe to ensure compliance. The general deadline for filing the 1065X is three years from the original due date of the Form 1065 or within two years from the date the tax was paid, whichever is later. Missing these deadlines can result in the inability to claim a refund or make necessary adjustments.

Form Submission Methods

The 1065X form can be submitted through various methods, depending on the preference of the partnership. The available submission methods include:

- Electronically through IRS-approved e-file software, which can expedite processing times.

- By mail, sending the completed form to the appropriate IRS address based on the partnership's location.

- In-person submission at local IRS offices, although this option may vary by location.

Penalties for Non-Compliance

Failure to file the 1065X form correctly or on time can lead to significant penalties for partnerships. The IRS may impose fines for late filings, and incorrect information can result in additional taxes owed. It is essential for partnerships to ensure that all amendments are accurate and submitted within the required timeframe to avoid these penalties.

Quick guide on how to complete 10 1065 x form free to edit download ampamp printcocodoc

Effortlessly Prepare 10 1065 X Form To Edit, Download & PrintCocoDoc on Any Device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage 10 1065 X Form To Edit, Download & PrintCocoDoc across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Method to Modify and eSign 10 1065 X Form To Edit, Download & PrintCocoDoc with Ease

- Find 10 1065 X Form To Edit, Download & PrintCocoDoc and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require new document printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 10 1065 X Form To Edit, Download & PrintCocoDoc and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 10 1065 x form free to edit download ampamp printcocodoc

The best way to make an e-signature for your PDF document online

The best way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1065x internal functionality in airSlate SignNow?

The 1065x internal functionality in airSlate SignNow enables businesses to streamline their document management processes. It enhances the efficiency of eSigning documents, ensuring that internal team collaborations are seamless and secure.

-

How can the 1065x internal feature benefit my business?

By utilizing the 1065x internal feature of airSlate SignNow, your business can reduce turnaround time for document approvals. It simplifies workflows, allowing teams to focus on core tasks rather than getting bogged down by paperwork.

-

Is there a cost associated with the 1065x internal feature?

The costs associated with the 1065x internal feature depend on the pricing plan you choose with airSlate SignNow. However, it offers a cost-effective solution for businesses looking to optimize their document signing processes.

-

What are the key features of the 1065x internal option?

Key features of the 1065x internal option include customizable workflows, secure document storage, and integration with other tools. These features make it easier for teams to manage and sign documents all within one platform.

-

Can I integrate the 1065x internal feature with other software?

Yes, the 1065x internal feature is designed to integrate seamlessly with other software applications. This allows for enhanced functionality and better collaboration across different platforms that your team uses.

-

How does the 1065x internal feature enhance document security?

The 1065x internal feature enhances document security through encryption and authentication measures. With airSlate SignNow, your business can ensure that only authorized personnel have access to sensitive documents.

-

What types of documents can be managed using the 1065x internal feature?

The 1065x internal feature allows you to manage a wide range of documents, including contracts, agreements, and internal memos. This flexibility makes it an ideal solution for various business needs.

Get more for 10 1065 X Form To Edit, Download & PrintCocoDoc

- Divorce maiden name form

- Georgia decree divorce form

- Quitclaim deed from corporation to two individuals georgia form

- Warranty deed from corporation to two individuals georgia form

- Ga trust 497303623 form

- Deed husband wife 497303624 form

- Warranty deed from husband to himself and wife georgia form

- Georgia husband wife form

Find out other 10 1065 X Form To Edit, Download & PrintCocoDoc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors