Form 8718 Rev November User Fee for Exempt Organization Determination Letter Request

Understanding the Form 8718 User Fee for Exempt Organization Determination Letter Request

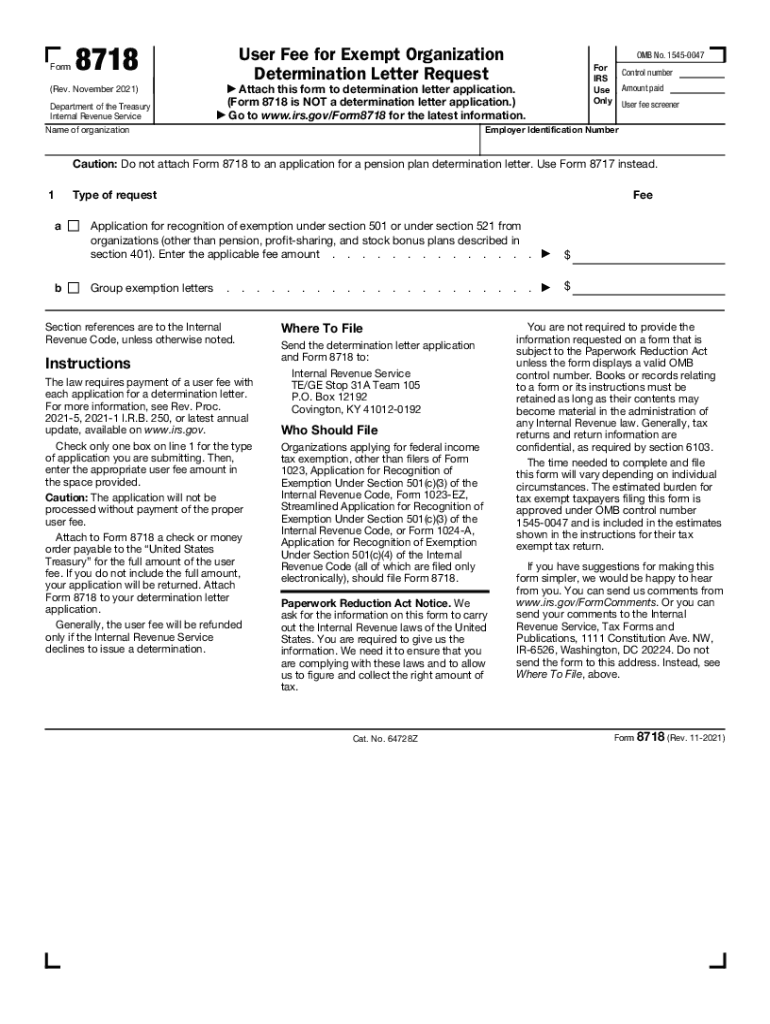

The Form 8718 is essential for organizations seeking a determination letter from the IRS regarding their tax-exempt status. This form serves as a request for a user fee that is necessary for processing the application. The IRS requires this fee to cover the costs associated with reviewing applications for tax-exempt status. Organizations must submit this form alongside their application to ensure that their request is considered. The fee structure is outlined in the IRS guidelines, and it is crucial for applicants to be aware of the current fee amount to avoid delays in processing.

Steps to Complete the Form 8718

Completing the Form 8718 involves several key steps to ensure accuracy and compliance with IRS requirements. Start by gathering all necessary information about your organization, including its legal name, address, and Employer Identification Number (EIN). Next, accurately fill out the form, ensuring that all sections are completed. It is important to double-check the fee amount and include payment information as required. After completing the form, review it for any errors before submission. This thorough approach helps prevent processing delays and ensures that your request for a determination letter is handled efficiently.

How to Obtain the Form 8718

The Form 8718 can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, organizations can complete the form electronically if they prefer a digital submission process. Ensure that you are using the most current version of the form, as outdated versions may not be accepted by the IRS. Familiarizing yourself with the form layout and instructions will facilitate a smoother completion process.

Legal Use of the Form 8718

The legal use of the Form 8718 is defined by IRS regulations concerning tax-exempt organizations. This form must be submitted to request the user fee for a determination letter, which is a crucial step in establishing tax-exempt status. Organizations must adhere to the guidelines set forth by the IRS to ensure that their application is valid. Failure to comply with these legal requirements may result in delays or denials of the tax-exempt status request. Understanding the legal implications of this form is essential for organizations seeking compliance with federal tax laws.

Filing Deadlines and Important Dates

Filing deadlines for the Form 8718 are critical for organizations to keep in mind. The IRS has specific timelines for submitting this form in conjunction with the application for tax-exempt status. It is advisable to review the IRS guidelines for any updates on deadlines, as they can vary based on the type of organization and the fiscal year. Missing a deadline can result in additional fees or complications in the application process, so organizations should plan accordingly to ensure timely submission.

Eligibility Criteria for Using the Form 8718

Eligibility to use the Form 8718 is primarily determined by the type of organization seeking tax-exempt status. Generally, nonprofit organizations, charities, and other entities that meet the IRS criteria for tax exemption can file this form. It is important for applicants to review the specific eligibility requirements outlined by the IRS to confirm that they qualify for the exemption. Understanding these criteria helps organizations prepare their applications accurately and increases the likelihood of a successful determination.

Quick guide on how to complete form 8718 rev november 2021 user fee for exempt organization determination letter request

Effortlessly Prepare Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed materials, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request

- Obtain Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and electronically sign Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8718 rev november 2021 user fee for exempt organization determination letter request

The best way to make an e-signature for your PDF document in the online mode

The best way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 8718?

airSlate SignNow is a powerful platform that simplifies the process of sending and eSigning documents. It relates to 8718 as this is our special code for users who want to access exclusive features designed to enhance document management efficiency.

-

What features does airSlate SignNow offer under the 8718 plan?

The 8718 plan offers numerous features, including advanced eSigning capabilities, document templates, and real-time tracking. These features are designed to improve the workflow for businesses of all sizes, ensuring compliant and secure document handling.

-

How much does airSlate SignNow cost for the 8718 offerings?

The pricing for airSlate SignNow under the 8718 offering is designed to be cost-effective for businesses. It's best to visit our pricing page for detailed options, but rest assured, we offer various plans to suit every budget.

-

What are the key benefits of using airSlate SignNow with the 8718 features?

The key benefits of using airSlate SignNow with the 8718 features include increased productivity, reduced turnaround times for document approvals, and enhanced security for sensitive information. With our intuitive interface, users can streamline their document workflows efficiently.

-

Is it easy to integrate airSlate SignNow into existing systems using the 8718 features?

Yes, airSlate SignNow is designed to integrate seamlessly with a variety of existing systems and applications. The 8718 features enhance these integrations, allowing your team to continue using familiar tools while benefiting from our eSigning capabilities.

-

Can I customize my documents using airSlate SignNow with the 8718 plan?

Absolutely! Users can customize their documents extensively using airSlate SignNow in the 8718 plan. This includes adding fields, branding options, and personalized messages which make the signing experience unique and tailored to your business needs.

-

What types of businesses benefit most from the 8718 features of airSlate SignNow?

The 8718 features of airSlate SignNow are particularly beneficial for small to medium-sized businesses that require efficient document management solutions. However, larger enterprises can also take advantage of our scalable solutions tailored to their complex documentation needs.

Get more for Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request

- Quitclaim deed from husband and wife to husband and wife georgia form

- Warranty deed from husband and wife to husband and wife georgia form

- Georgia revocation form

- Georgia agreement form

- Amendment to postnuptial property agreement georgia georgia form

- Quitclaim deed from husband and wife to an individual georgia form

- Deed wife to 497303633 form

- Statement claim draft form

Find out other Form 8718 Rev November User Fee For Exempt Organization Determination Letter Request

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile