IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales and Use Tax GuideIowa Department of RevenueIowa Sales and Use Tax GuideIowa Depa 2021-2026

Understanding the Iowa Sales Tax Exemption Certificate

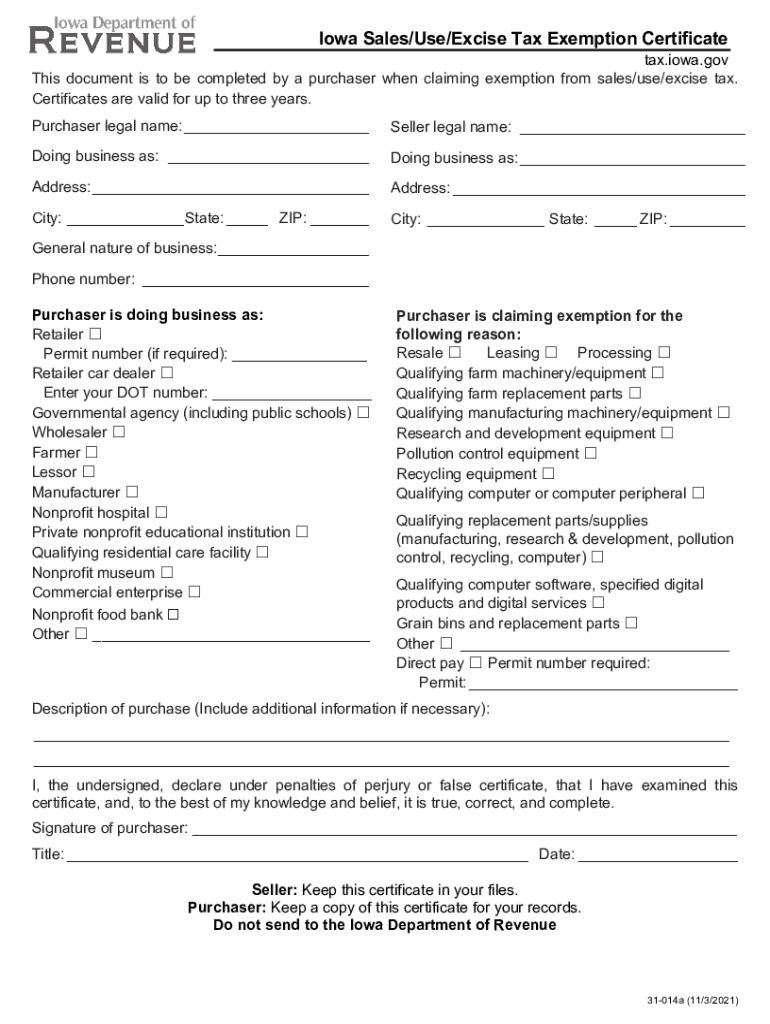

The Iowa sales tax exemption certificate is a crucial document for businesses and individuals looking to make tax-exempt purchases in Iowa. This certificate allows qualifying entities to avoid paying sales tax on certain purchases, provided they meet specific criteria. It is particularly beneficial for non-profit organizations, government entities, and businesses purchasing goods for resale. Understanding the legal framework and requirements surrounding the use of this certificate is essential for compliance and to avoid potential penalties.

How to Obtain the Iowa Sales Tax Exemption Certificate

To obtain the Iowa sales tax exemption certificate, applicants must complete the appropriate form, which is typically available through the Iowa Department of Revenue's website. The application process may require documentation proving the applicant's eligibility for tax exemption, such as proof of non-profit status or a resale certificate. Once the form is filled out, it can be submitted electronically or via mail to the designated department. It is important to ensure that all information is accurate to prevent delays in processing.

Steps to Complete the Iowa Sales Tax Exemption Certificate

Completing the Iowa sales tax exemption certificate involves several important steps:

- Gather necessary documentation, including proof of eligibility.

- Access the Iowa sales tax exemption certificate form from the Iowa Department of Revenue.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified submission methods.

Legal Use of the Iowa Sales Tax Exemption Certificate

The legal use of the Iowa sales tax exemption certificate is governed by state tax laws. Businesses and individuals must ensure that they are eligible to use this certificate for tax-exempt purchases. Misuse of the certificate, such as using it for ineligible purchases, can result in penalties, including fines and back taxes. It is essential to maintain accurate records of exempt purchases and to understand the specific items that qualify for exemption under Iowa law.

Key Elements of the Iowa Sales Tax Exemption Certificate

Several key elements are critical to the Iowa sales tax exemption certificate:

- The name and address of the purchaser.

- The type of exemption being claimed (e.g., resale, non-profit).

- A description of the items being purchased tax-exempt.

- The seller's information, including their sales tax permit number.

- Signature of the purchaser or an authorized representative.

Eligibility Criteria for the Iowa Sales Tax Exemption Certificate

Eligibility for the Iowa sales tax exemption certificate varies based on the type of entity making the purchase. Common eligible entities include:

- Non-profit organizations recognized under IRS regulations.

- Government agencies at the federal, state, or local level.

- Businesses purchasing goods for resale.

Each category has specific documentation requirements that must be fulfilled to qualify for the exemption.

Quick guide on how to complete iowa sales tax exemption certificatesiowa sales and use tax guideiowa department of revenueiowa sales and use tax guideiowa

Manage IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa on any platform using airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to modify and eSign IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa with ease

- Obtain IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then press the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Modify and eSign IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa sales tax exemption certificatesiowa sales and use tax guideiowa department of revenueiowa sales and use tax guideiowa

Create this form in 5 minutes!

How to create an eSignature for the iowa sales tax exemption certificatesiowa sales and use tax guideiowa department of revenueiowa sales and use tax guideiowa

The way to create an e-signature for a PDF file online

The way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

How to get a resale certificate in Iowa?

How can you get a resale certificate in Iowa? To get a resale certificate in Iowa, you will need to fill out the Iowa Sales/Use/Excise Tax Exemption Certificate 31-014.

-

How long are Iowa tax exempt certificates good for?

Certificates are valid for up to three years. This form must be signed by an authorized owner, partner, or corporate officer.

-

Who qualifies for sales tax exemption in Iowa?

Some customers are exempt from paying sales tax under Iowa law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

-

Am I exempt from Iowa tax?

Filing status 1, Single: If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either of the following conditions: Your Iowa taxable income from all sources, IA 1040, line 4, is $9,000 or less and you are not claimed as a dependent on another person's Iowa tax return.

-

How do you know if you are exempt from filing taxes?

In 2024, you don't need to file a tax return if all of the following are true for you: under age 65. Single filing status. don't have any special circumstances that require you to file (like self-employment income) earn less than $14,600 (which is the 2024 Standard Deduction for a taxpayer filing as Single)

-

Are you tax-exempt yes or no?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

-

What makes someone exempt from taxes?

Who Does Not Have to Pay Taxes? You generally don't have to pay taxes if your income is less than the standard deduction or the total of your itemized deductions, if you have a certain number of dependents, if you work abroad and are below the required thresholds, or if you're a qualifying non-profit organization.

-

What is the Iowa sales tax exemption certificate?

An Iowa Sales Tax Exemption Certificate is required when normally taxable items or services are sold tax free. The department making purchases exempt from Iowa sales tax needs to complete the Iowa exemption certificate linked below by completing the seller's name and address in the fields highlighted in red.

Get more for IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa

- Assignment security deed form

- 60 day notice to terminate at will lease from landlord to tenant georgia form

- Georgia 30 day notice form

- Assignment of security deed corporate mortgage holder georgia form

- Property security deed form

- G a 44 497303764 form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property georgia form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497303767 form

Find out other IOWA SALES TAX EXEMPTION CERTIFICATESIowa Sales And Use Tax GuideIowa Department Of RevenueIowa Sales And Use Tax GuideIowa Depa

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe