Investment Policy Sdttc Com 2020-2026

Understanding the sdttc Form

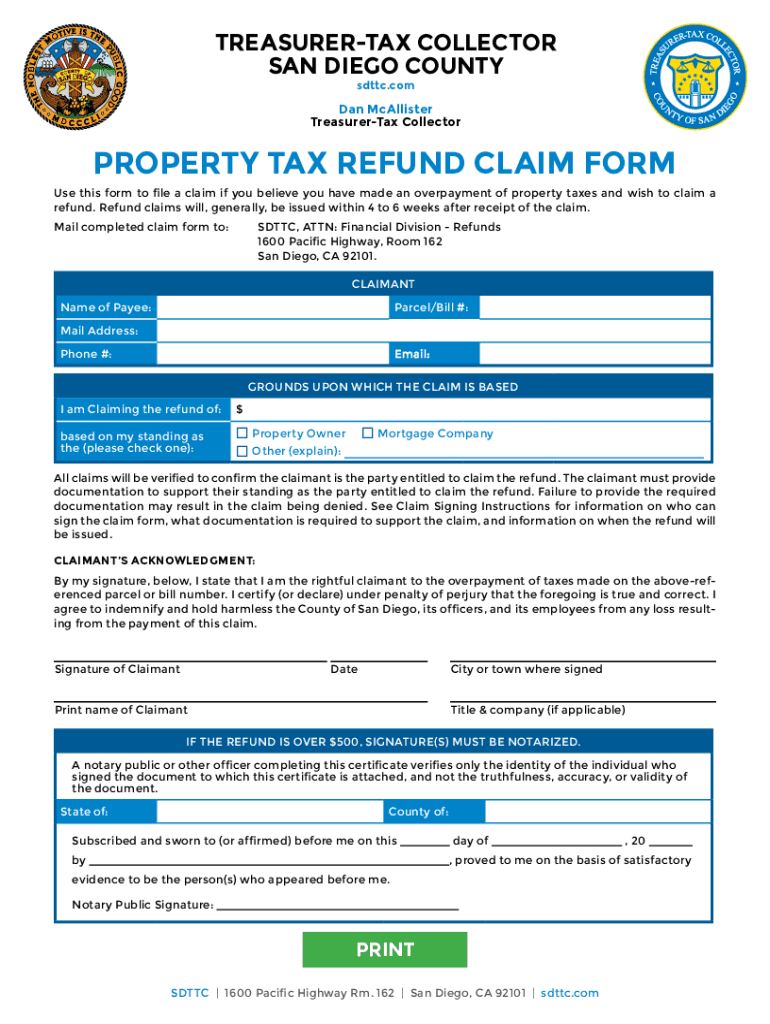

The sdttc form, or the property tax refund claim form, is essential for individuals seeking to reclaim overpaid property taxes. This form allows taxpayers to formally request a refund from their local tax authority. Understanding its purpose and the process involved is crucial for ensuring that your claim is valid and processed efficiently.

Steps to Complete the sdttc Form

Completing the sdttc form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of property ownership and tax payment records. Next, fill out the form with accurate personal information, property details, and the specific refund amount being claimed. It's important to review the completed form for any errors before submission. Finally, submit the form either online or via mail, depending on your local tax authority's guidelines.

Required Documents for the sdttc Form

To successfully file the sdttc form, you must provide certain documents. These typically include:

- Proof of property ownership, such as a deed or title.

- Receipts or statements showing property tax payments.

- Any previous correspondence with the tax authority regarding your property.

Ensuring that all required documents are included with your claim can help prevent delays in processing.

Filing Methods for the sdttc Form

The sdttc form can be submitted through various methods, offering flexibility to taxpayers. Common options include:

- Online Submission: Many jurisdictions allow for digital submission through their official websites.

- Mail: You can print the completed form and send it via postal service to the appropriate tax authority.

- In-Person: Some taxpayers prefer to deliver their forms directly to the tax office.

Choosing the right submission method can depend on your preference and the specific requirements of your local tax authority.

Eligibility Criteria for the sdttc Refund

To qualify for a refund using the sdttc form, certain eligibility criteria must be met. Generally, you must be the owner of the property in question and have paid property taxes that exceed your liability. Additionally, there may be specific deadlines for filing your claim, which can vary by state. Understanding these criteria is essential for a successful refund application.

IRS Guidelines Related to the sdttc Form

The IRS provides guidelines that may impact how property tax refunds are treated for federal tax purposes. Generally, if you receive a refund, it may need to be reported as income in the year you receive it, depending on whether you received a tax benefit from the deduction in the previous year. Familiarizing yourself with these guidelines can help ensure compliance and accurate reporting on your tax return.

Quick guide on how to complete investment policy sdttccom

Effortlessly Prepare Investment Policy Sdttc com on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without any delays. Manage Investment Policy Sdttc com on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Edit and eSign Investment Policy Sdttc com with Ease

- Find Investment Policy Sdttc com and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of your documents or redact sensitive information with specific tools provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Investment Policy Sdttc com to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct investment policy sdttccom

Create this form in 5 minutes!

How to create an eSignature for the investment policy sdttccom

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the ca sdttc refund process through airSlate SignNow?

The ca sdttc refund process involves requesting a refund for your signed documents using airSlate SignNow. To initiate this, users can log into their account, navigate to the billing section, and follow the prompts. The process is straightforward, ensuring you have the support needed to quickly resolve any issues.

-

How does airSlate SignNow simplify the ca sdttc refund request?

airSlate SignNow provides a user-friendly interface that makes submitting a ca sdttc refund request easy. You can quickly prepare and send the required documents electronically, reducing the time and effort necessary when dealing with refunds. With our platform, you'll have clarity and simplicity at every step.

-

Are there any fees associated with the ca sdttc refund process using airSlate SignNow?

No, submitting a ca sdttc refund request through airSlate SignNow does not incur additional fees. Our goal is to provide a cost-effective solution for your signing and document management needs without hidden charges during the refund process. Transparency is key to our service.

-

What features does airSlate SignNow offer that assist with the ca sdttc refund?

airSlate SignNow includes features like document tracking, templates, and electronic signatures, all of which assist in handling the ca sdttc refund seamlessly. These features ensure that every step of the refund process is recorded and accessible, providing peace of mind and efficiency for users.

-

How long does the ca sdttc refund take once requested through airSlate SignNow?

Typically, the ca sdttc refund process can take a few business days once properly requested through airSlate SignNow. The time may vary based on external factors, but our system is designed to expedite the process whenever possible. You’ll receive updates to keep you informed throughout.

-

Can I send additional documentation for my ca sdttc refund using airSlate SignNow?

Yes, airSlate SignNow allows you to easily include additional documentation when submitting your ca sdttc refund request. Simply attach the required files directly within the platform, ensuring that everything necessary is submitted at once. This feature streamlines the entire refund process.

-

Is airSlate SignNow compatible with other platforms for managing ca sdttc refunds?

airSlate SignNow integrates seamlessly with various applications, allowing you to manage your ca sdttc refund alongside other business processes. Whether using CRM systems or project management tools, our integrations help ensure that your document workflow remains efficient and effective.

Get more for Investment Policy Sdttc com

- Siding contractor package arkansas form

- Refrigeration contractor package arkansas form

- Drainage contractor package arkansas form

- Tax free exchange package arkansas form

- Ar sublease form

- Buy sell agreement package arkansas form

- Option to purchase package arkansas form

- Amendment of lease package arkansas form

Find out other Investment Policy Sdttc com

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document