Tax Collection Treasurer Tax Collector 2017

Understanding the Tax Collection Treasurer Tax Collector

The Tax Collection Treasurer Tax Collector is a vital entity responsible for managing property tax collections within a jurisdiction. This office ensures that property taxes are collected efficiently and effectively, which helps fund essential public services such as education, infrastructure, and public safety. The treasurer tax collector also oversees the distribution of collected taxes to various government agencies, ensuring that funds are allocated appropriately. Understanding the role of this office is crucial for property owners who need to navigate the tax collection process.

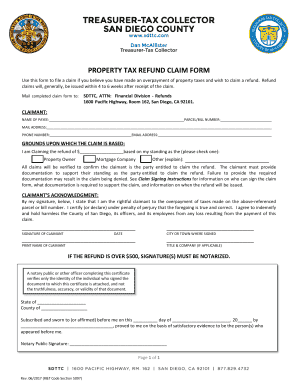

Steps to Complete the Tax Collection Treasurer Tax Collector Form

Completing the Tax Collection Treasurer Tax Collector form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including property details, ownership documentation, and any relevant tax identification numbers. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is essential to review the form for any errors before submission. Finally, submit the completed form through the designated method, whether online, by mail, or in person, ensuring that you adhere to any specific submission guidelines provided by the treasurer tax collector's office.

Required Documents for the Tax Collection Treasurer Tax Collector Form

When preparing to submit the Tax Collection Treasurer Tax Collector form, certain documents are typically required to support your application. These may include:

- Proof of property ownership, such as a deed or title

- Identification documents, like a driver's license or state ID

- Tax identification numbers, including Social Security numbers or Employer Identification Numbers (EIN)

- Any previous tax statements or correspondence from the tax collector's office

Having these documents ready will facilitate a smoother submission process and help avoid delays.

Legal Use of the Tax Collection Treasurer Tax Collector Form

The Tax Collection Treasurer Tax Collector form must be used in compliance with local, state, and federal regulations. The form serves as a legal document that can affect property tax assessments and obligations. Therefore, it is essential to ensure that all information provided is accurate and truthful. Misrepresentation or failure to comply with legal requirements can result in penalties or legal repercussions. Understanding the legal implications of the form helps property owners fulfill their obligations while protecting their rights.

Filing Deadlines and Important Dates

Filing deadlines for the Tax Collection Treasurer Tax Collector form can vary by state and local jurisdiction. It is crucial to be aware of these deadlines to avoid penalties or interest on unpaid taxes. Generally, property tax forms must be submitted by specific dates each year, often aligning with the tax assessment calendar. Keeping track of these important dates ensures timely submission and compliance with tax obligations.

Examples of Using the Tax Collection Treasurer Tax Collector Form

There are various scenarios in which property owners may need to utilize the Tax Collection Treasurer Tax Collector form. For instance, a homeowner may need to file for a property tax refund due to overpayment or changes in property value. Additionally, property owners may use the form to challenge an assessment or apply for tax exemptions. Understanding these examples helps clarify the form's purpose and the situations in which it is applicable.

Quick guide on how to complete tax collection treasurer tax collector

Manage Tax Collection Treasurer Tax Collector effortlessly on any gadget

Digital document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without any hold-ups. Handle Tax Collection Treasurer Tax Collector on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Tax Collection Treasurer Tax Collector without hassle

- Obtain Tax Collection Treasurer Tax Collector and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Tax Collection Treasurer Tax Collector and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax collection treasurer tax collector

Create this form in 5 minutes!

People also ask

-

What is the sdttc form?

The sdttc form is a document that businesses can use to facilitate secure transactions. With airSlate SignNow, you can easily fill out, sign, and manage your sdttc form online, streamlining your workflow and ensuring compliance.

-

How can I eSign the sdttc form using airSlate SignNow?

To eSign the sdttc form with airSlate SignNow, simply upload your document, add your signature, and send it for approval. Our platform makes it easy to eSign electronically, eliminating the need for printing and scanning.

-

Is there a cost to use airSlate SignNow for processing the sdttc form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that provides access to features for managing your sdttc form, ensuring cost-effectiveness without sacrificing quality.

-

What features does airSlate SignNow offer for handling the sdttc form?

airSlate SignNow offers a range of features for working with the sdttc form, including templates, real-time tracking, and automated reminders. These capabilities help you streamline your document processes and enhance productivity.

-

Can I integrate airSlate SignNow with other software for the sdttc form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage your sdttc form within your existing workflows. This helps in enhancing collaboration and data management.

-

What are the benefits of using airSlate SignNow for the sdttc form?

Using airSlate SignNow for the sdttc form offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform makes document management simple and ensures your forms are always compliant.

-

How secure is the process of signing the sdttc form with airSlate SignNow?

Security is a top priority at airSlate SignNow. When signing the sdttc form, your data is encrypted and protected, ensuring the integrity and confidentiality of your documents throughout the signing process.

Get more for Tax Collection Treasurer Tax Collector

Find out other Tax Collection Treasurer Tax Collector

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online