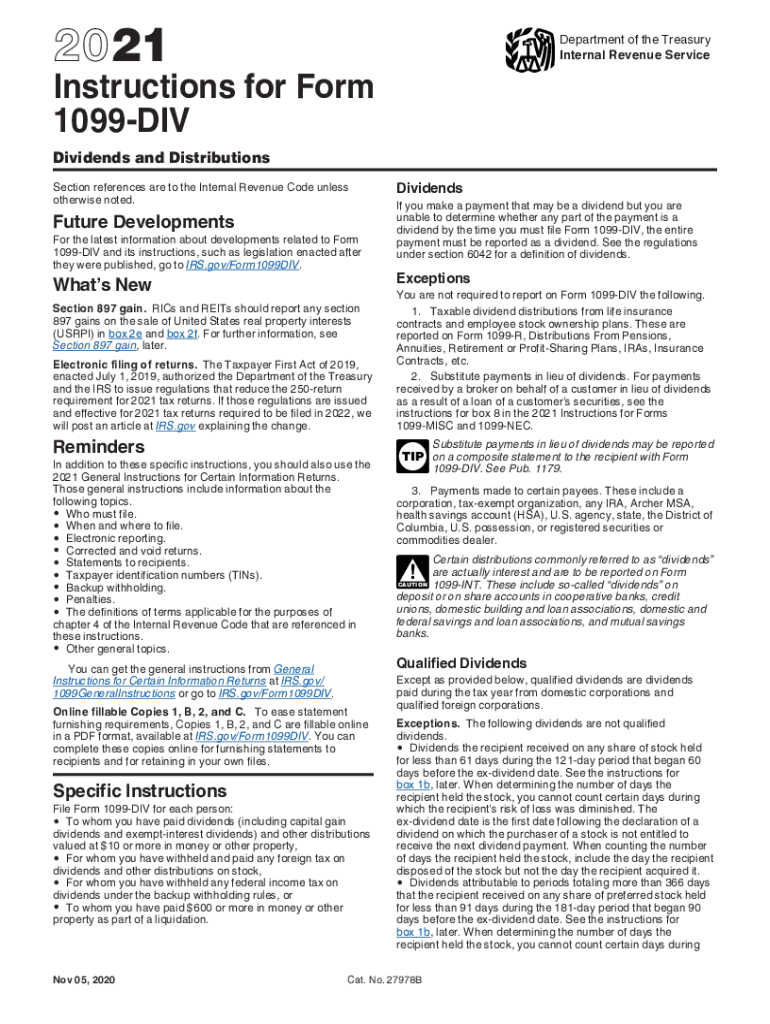

Instructions for Form 1099 DIV Internal Revenue Service 2021

What is the Instructions For Form 1099 DIV Internal Revenue Service

The Instructions for Form 1099 DIV provide essential guidance for reporting dividends and distributions received by taxpayers. This form is crucial for individuals and entities that have received dividends from stocks, mutual funds, or other investments. The IRS requires this form to ensure accurate reporting of income for tax purposes. It outlines the necessary information that must be included, such as the payer's details, the recipient's information, and the total amount of dividends received during the tax year.

Steps to complete the Instructions For Form 1099 DIV Internal Revenue Service

Completing the Instructions for Form 1099 DIV involves several key steps:

- Gather all relevant information, including the names and addresses of both the payer and recipient.

- Determine the total amount of dividends paid to the recipient during the tax year.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the specified deadline, either electronically or via mail.

Legal use of the Instructions For Form 1099 DIV Internal Revenue Service

The legal use of the Instructions for Form 1099 DIV is vital for compliance with IRS regulations. This form must be accurately filled out and submitted to report dividend income, which is subject to taxation. Failure to comply with these requirements can lead to penalties and interest charges. It is important for taxpayers to understand the legal implications of the information reported on this form, ensuring that all data is truthful and complete.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 1099 DIV. These guidelines include instructions on the format of the form, the information required, and the deadlines for submission. Adhering to these guidelines is essential for ensuring that the form is processed correctly and that taxpayers avoid any potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 1099 DIV are crucial for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the dividends were paid. If the deadline falls on a weekend or holiday, the submission is typically due the next business day. It is important for taxpayers to be aware of these dates to avoid late filing penalties.

Who Issues the Form

The Form 1099 DIV is issued by financial institutions, corporations, and other entities that pay dividends to shareholders. These payers are responsible for providing accurate information on the form, including the total amount of dividends distributed. Recipients of the form should ensure they receive it from the payer to accurately report their income on their tax returns.

Quick guide on how to complete 2021 instructions for form 1099 div internal revenue service

Complete Instructions For Form 1099 DIV Internal Revenue Service smoothly on any device

Digital document management has become favored by both companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to generate, modify, and electronically sign your documents swiftly and without interruptions. Manage Instructions For Form 1099 DIV Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Instructions For Form 1099 DIV Internal Revenue Service without effort

- Obtain Instructions For Form 1099 DIV Internal Revenue Service and select Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to deliver your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Instructions For Form 1099 DIV Internal Revenue Service and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for form 1099 div internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2021 instructions for form 1099 div internal revenue service

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is a 1099 div IRS form?

The 1099 div IRS form is a tax document used to report dividends and distributions to taxpayers. This form is essential for individuals or businesses that earn dividend income and need to accurately report it to the IRS. Understanding how to read and complete the 1099 div IRS form can help ensure you meet your tax obligations.

-

How can airSlate SignNow help with the 1099 div IRS form?

airSlate SignNow streamlines the process of sending and signing the 1099 div IRS form. With our user-friendly platform, you can easily create, eSign, and share your tax documents securely. This enhances efficiency, ensuring that you meet filing deadlines with confidence.

-

What features does airSlate SignNow offer for managing 1099 div IRS forms?

Our platform offers robust features like templates for 1099 div IRS forms, bulk sending capabilities, and secure electronic signatures. These tools simplify the management and distribution of tax documents, allowing for a smoother workflow during tax season. Stay organized and compliant with our comprehensive solution.

-

Is there a cost associated with using airSlate SignNow for 1099 div IRS forms?

Yes, airSlate SignNow offers affordable pricing plans tailored to businesses of all sizes. The plans include features specifically designed to manage 1099 div IRS forms, which can save you time and reduce errors. Review our pricing page to find a plan that meets your needs.

-

Can I integrate airSlate SignNow with other software for handling 1099 div IRS forms?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and CRM software, making it easier to manage your 1099 div IRS forms alongside your other business processes. This integration ensures that your tax reporting and documentation are always up-to-date.

-

What benefits does eSigning the 1099 div IRS form provide?

eSigning the 1099 div IRS form through airSlate SignNow offers several benefits, including faster processing times and reduced paperwork. Electronic signatures are legally binding and protect your documents with encryption, ensuring that your sensitive information remains safe and secure. This modern approach minimizes delays commonly associated with paper documents.

-

How does airSlate SignNow ensure the security of my 1099 div IRS forms?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods, secure cloud storage, and strict access controls to safeguard your 1099 div IRS forms. This commitment to security ensures that your sensitive tax information remains confidential and protected against unauthorized access.

Get more for Instructions For Form 1099 DIV Internal Revenue Service

- Correction statement and agreement hawaii form

- Closing statement hawaii form

- Flood zone statement and authorization hawaii form

- Name affidavit of buyer hawaii form

- Name affidavit of seller hawaii form

- Non foreign affidavit under irc 1445 hawaii form

- Owners or sellers affidavit of no liens hawaii form

- Affidavit of occupancy and financial status hawaii form

Find out other Instructions For Form 1099 DIV Internal Revenue Service

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now