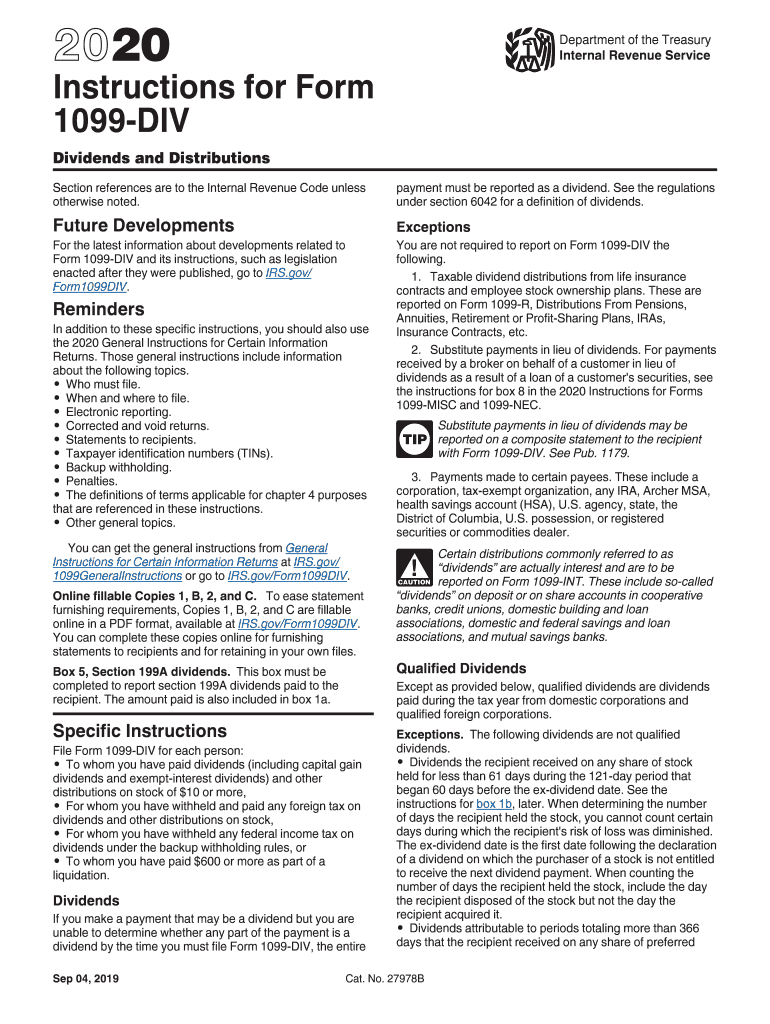

Instructions for Form 1099 DIV Internal Revenue Service 2020

What is the Instructions For Form 1099 DIV Internal Revenue Service

The Instructions for Form 1099 DIV are essential documents provided by the Internal Revenue Service (IRS) that guide taxpayers in reporting dividends and distributions. This form is used to report dividends paid to shareholders, including cash dividends, stock dividends, and other distributions. Understanding these instructions is crucial for ensuring accurate reporting and compliance with IRS regulations.

Steps to complete the Instructions For Form 1099 DIV Internal Revenue Service

Completing the Instructions for Form 1099 DIV involves several key steps:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Determine the total amount of dividends paid during the tax year.

- Fill out the form accurately, ensuring all sections are completed, including boxes for ordinary dividends, qualified dividends, and any federal income tax withheld.

- Review the completed form for accuracy and completeness to avoid potential penalties.

- Submit the form to the IRS and provide copies to the recipients by the specified deadlines.

Legal use of the Instructions For Form 1099 DIV Internal Revenue Service

The legal use of the Instructions for Form 1099 DIV is vital for compliance with federal tax laws. This form must be filed by any entity that pays dividends to shareholders, ensuring that all income is reported accurately. Failure to comply with these regulations can result in penalties, including fines and additional tax liability. It is essential for businesses and individuals to adhere to these guidelines to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for Form 1099 DIV are critical for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the dividends were paid. Recipients must also receive their copies by this date. It is important to keep track of these dates to ensure timely filing and avoid penalties for late submissions.

Who Issues the Form

The Form 1099 DIV is typically issued by corporations, mutual funds, and other entities that distribute dividends to shareholders. These issuers are responsible for accurately reporting the amount of dividends paid and providing the necessary information to both the IRS and the recipients. Understanding who issues the form can help taxpayers identify their reporting requirements and ensure compliance.

Penalties for Non-Compliance

Non-compliance with the reporting requirements for Form 1099 DIV can lead to significant penalties. The IRS imposes fines for late filing, incorrect information, and failure to provide copies to recipients. Penalties can vary based on the severity of the violation, with potential fines ranging from fifty to five hundred dollars per form. It is essential to understand these consequences to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete 2020 instructions for form 1099 div internal revenue service

Accomplish Instructions For Form 1099 DIV Internal Revenue Service effortlessly on any gadget

Digital document administration has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Instructions For Form 1099 DIV Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and ease any document-related procedure today.

Steps to modify and eSign Instructions For Form 1099 DIV Internal Revenue Service with ease

- Find Instructions For Form 1099 DIV Internal Revenue Service and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your choice. Alter and eSign Instructions For Form 1099 DIV Internal Revenue Service and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1099 div internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1099 div internal revenue service

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the form IRS dividend and how do I use it?

The form IRS dividend is a tax document you'll need to report dividend income to the IRS. To use it, first gather all relevant financial information and fill out the form accurately. With airSlate SignNow, you can easily eSign and send your completed form IRS dividend to ensure timely filing.

-

How can airSlate SignNow help me with form IRS dividend submissions?

AirSlate SignNow simplifies the process of completing and submitting your form IRS dividend. Our platform provides a user-friendly interface to create, fill, and eSign documents securely. This means you save time and reduce errors while managing your important tax documents.

-

Is airSlate SignNow cost-effective for preparing a form IRS dividend?

Yes, airSlate SignNow offers a cost-effective solution for preparing your form IRS dividend. With our flexible pricing plans, you can access essential features without breaking the bank, making it an ideal choice for both individuals and businesses looking to streamline their tax processes.

-

Can I integrate airSlate SignNow with other tools for handling form IRS dividend?

Absolutely! AirSlate SignNow supports seamless integrations with various tools such as cloud storage services and accounting software, making it easy to manage your form IRS dividend alongside other financial documents. This integration helps maintain a smooth workflow and enhances productivity.

-

What features does airSlate SignNow offer for managing form IRS dividend?

AirSlate SignNow provides features such as templates, reminders, and document tracking, all designed to optimize your form IRS dividend management. These capabilities help you stay organized and ensure that you never miss critical deadlines during tax season.

-

Is eSigning the form IRS dividend legally binding?

Yes, eSigning the form IRS dividend through airSlate SignNow is legally binding and compliant with e-signature legislation. This secure method ensures the authenticity and integrity of your document, giving you peace of mind when submitting important tax forms.

-

What types of documents can I create besides the form IRS dividend?

In addition to the form IRS dividend, airSlate SignNow allows you to create and manage a variety of documents such as contracts, agreements, and consent forms. This versatility makes it a comprehensive tool for all your documentation needs, particularly during tax preparation.

Get more for Instructions For Form 1099 DIV Internal Revenue Service

- Peterborough city council blue badge form

- Brighton hove city council form

- Blue badge norfolk form

- Solihull metropolitan borough council licensing department central form

- Wwwnwleicsgovukdhpnwlformapril13a claim for discretionary housing payments dhp nwleicsgovuk

- Sex application form 37176650

- Uniform grant liverpool

- Council choice based lettings form

Find out other Instructions For Form 1099 DIV Internal Revenue Service

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed