Form 4506 T Rev 11 Request for Transcript of Tax Return 2021

What is the Form 4506-T?

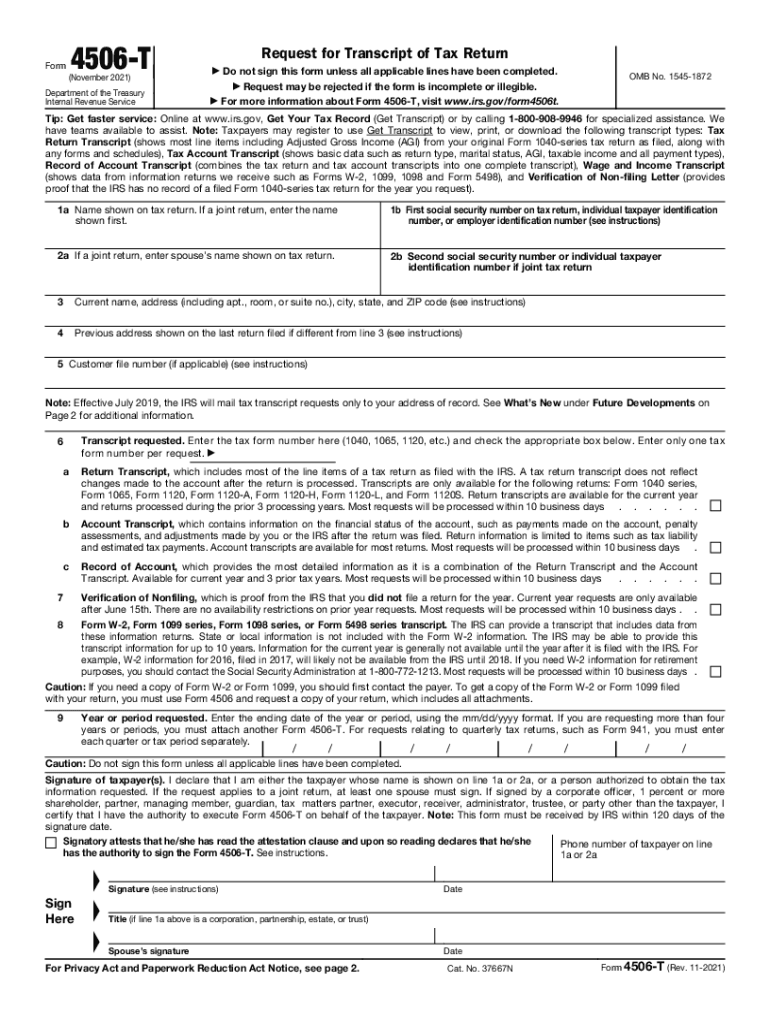

The Form 4506-T, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers to request a copy of their tax return transcripts from the Internal Revenue Service (IRS). This form is particularly useful for individuals who need to verify their income or tax filing status for various purposes, such as applying for loans, mortgages, or financial aid. The transcript provides essential information, including adjusted gross income, filing status, and the type of tax return filed.

How to Use the Form 4506-T

To effectively use the Form 4506-T, taxpayers must complete it accurately to ensure the IRS can process the request without delays. The form requires personal information, including the taxpayer's name, Social Security number, and address. Additionally, it asks for the type of transcript needed and the tax years for which the transcripts are requested. Once completed, the form can be submitted either online through the IRS website or by mailing it to the appropriate address listed on the form.

Steps to Complete the Form 4506-T

Completing the Form 4506-T involves several straightforward steps:

- Provide your personal information, including your name, Social Security number, and address.

- Select the type of transcript you need, such as a tax return transcript or an account transcript.

- Indicate the tax years for which you are requesting transcripts.

- Sign and date the form to authorize the IRS to release your information.

- Submit the form online or mail it to the IRS address specified for your state.

Legal Use of the Form 4506-T

The Form 4506-T is legally recognized as a valid request for tax information. It is essential for various legal and financial processes, ensuring that the information provided is accurate and up to date. Compliance with IRS regulations when using this form protects the taxpayer's rights and ensures that their information is handled securely. It is advisable to keep a copy of the submitted form for personal records.

IRS Guidelines for the Form 4506-T

The IRS provides specific guidelines on how to complete and submit the Form 4506-T. Taxpayers are encouraged to review these guidelines to avoid common mistakes that could delay the processing of their requests. Key points include ensuring that all information is legible, using the correct mailing address based on the state of residence, and understanding the different types of transcripts available. Following these guidelines helps facilitate a smoother process when obtaining tax transcripts.

Form Submission Methods

The Form 4506-T can be submitted through multiple methods, accommodating different preferences. Taxpayers can choose to submit the form online via the IRS website, which offers a quick and efficient option. Alternatively, the form can be printed and mailed to the IRS. It is important to select the appropriate submission method based on individual circumstances and to ensure that the form is sent to the correct address to avoid delays.

Quick guide on how to complete form 4506 t rev 11 2021 request for transcript of tax return

Access Form 4506 T Rev 11 Request For Transcript Of Tax Return effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any interruptions. Manage Form 4506 T Rev 11 Request For Transcript Of Tax Return on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign Form 4506 T Rev 11 Request For Transcript Of Tax Return with ease

- Find Form 4506 T Rev 11 Request For Transcript Of Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sharing your form, whether it be via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 4506 T Rev 11 Request For Transcript Of Tax Return and ensure impeccable communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 t rev 11 2021 request for transcript of tax return

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t rev 11 2021 request for transcript of tax return

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

How can I use airSlate SignNow to irs get transcript online?

With airSlate SignNow, you can easily send and receive documents that are required for obtaining your IRS transcripts online. Our platform allows you to create, sign, and manage these documents efficiently, streamlining the process signNowly.

-

Is airSlate SignNow free for irs get transcript online?

While airSlate SignNow offers a range of pricing plans, there are no free options available that are suitable for the purpose of irs get transcript online. However, our plans are designed to be cost-effective, ensuring you get the best value for your needs.

-

What features does airSlate SignNow offer for irs get transcript online?

Our platform provides features that are ideal for obtaining documents needed to irs get transcript online. These include customizable templates, secure eSigning, and comprehensive document management tools to help you track your submissions easily.

-

How do I integrate airSlate SignNow for my business to irs get transcript online?

Integrating airSlate SignNow to irs get transcript online is straightforward with our API and integration options with popular software. You can enhance your document workflow by connecting SignNow with your existing systems for seamless operations.

-

Can I use airSlate SignNow on mobile devices for irs get transcript online?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to manage and sign documents from your smartphone or tablet while you irs get transcript online. This flexibility ensures that you can access your documents anytime, anywhere.

-

What security features does airSlate SignNow provide for irs get transcript online?

airSlate SignNow employs advanced security measures such as encryption, compliance with GDPR and HIPAA, and secure data storage. These features ensure that your documents related to irs get transcript online are safe and protected.

-

What are the benefits of using airSlate SignNow to irs get transcript online?

Using airSlate SignNow to irs get transcript online helps to save you time and reduce paperwork. The platform simplifies the signing process, allows for quick document turnaround, and provides detailed tracking to ensure you stay informed about your submissions.

Get more for Form 4506 T Rev 11 Request For Transcript Of Tax Return

- Lease subordination agreement idaho form

- Apartment rules and regulations idaho form

- Agreed cancellation of lease idaho form

- Amendment of residential lease idaho form

- Agreement for payment of unpaid rent idaho form

- Commercial lease assignment from tenant to new tenant idaho form

- Tenant consent to background and reference check idaho form

- Residential lease or rental agreement for month to month idaho form

Find out other Form 4506 T Rev 11 Request For Transcript Of Tax Return

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe