Tax Return Transcript Form 2012

What is the Tax Return Transcript Form

The Tax Return Transcript Form is an official document provided by the IRS that summarizes your tax return information. It includes details such as your filing status, adjusted gross income, and taxable income for a specific tax year. This form is often required for various financial applications, such as loans or grants, where proof of income is necessary. The 2T T specifically pertains to tax information from the year 2012, making it crucial for anyone needing to verify their income or tax status for that year.

How to obtain the Tax Return Transcript Form

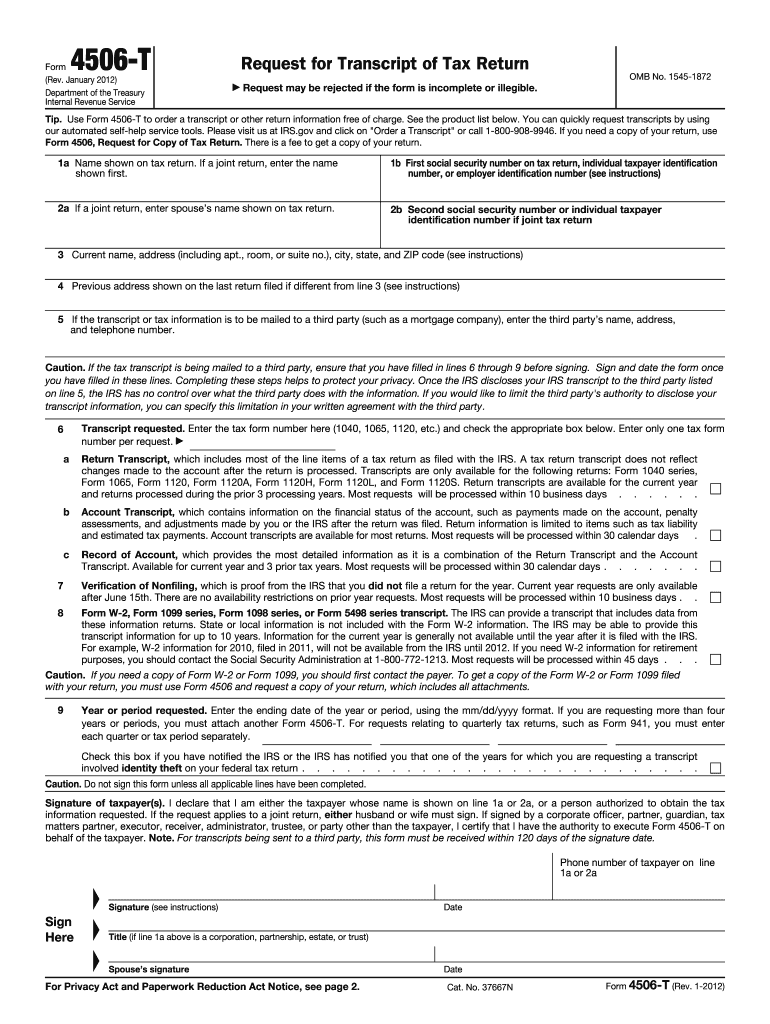

To obtain the Tax Return Transcript Form, you can request it online through the IRS website, by mail, or by phone. For online requests, you will need to create an account or log in to your existing account on the IRS site. If you prefer to request it by mail, you can complete Form 4506-T, which allows you to request transcripts for multiple years. When requesting by phone, you can call the IRS directly and provide the necessary information to receive your transcript. Ensure you have your personal details, such as your Social Security number and the tax year you are requesting, ready for a smooth process.

Steps to complete the Tax Return Transcript Form

Completing the Tax Return Transcript Form involves several straightforward steps. First, ensure you have the correct form, which is the 4506-T for requesting transcripts. Next, fill out your personal information, including your name, Social Security number, and address. Specify the tax year you need, in this case, 2012. You may also need to indicate the type of transcript you are requesting. After completing the form, review it for accuracy, then submit it either online, by mail, or via fax, depending on your preference.

Legal use of the Tax Return Transcript Form

The Tax Return Transcript Form is legally recognized and can be used to verify income for various purposes, such as applying for federal student aid, mortgages, or other financial assistance programs. It serves as an official document that lenders and institutions accept as proof of income. However, it is important to ensure that the form is used in compliance with applicable laws and regulations, particularly regarding privacy and data protection. Always keep your personal information secure when submitting this form.

Key elements of the Tax Return Transcript Form

Key elements of the Tax Return Transcript Form include the taxpayer's name, Social Security number, tax year, and the type of transcript requested. Additionally, it provides a summary of the taxpayer's filing status, adjusted gross income, and other pertinent tax details. Understanding these elements is essential for accurately completing the form and ensuring that the information provided meets the requirements of the requesting institution.

Filing Deadlines / Important Dates

Filing deadlines for tax returns and associated forms can vary, but it is essential to be aware of key dates. For the 2012 tax year, the deadline for filing was typically April 15, 2013. If you are requesting a transcript for a specific purpose, such as applying for financial aid, ensure you check the relevant deadlines set by the institution or program. Keeping track of these dates helps avoid delays in processing your requests and ensures compliance with any necessary requirements.

Quick guide on how to complete tax return transcript 2012 form

Discover the simplest method to complete and endorse your Tax Return Transcript Form

Are you still spending valuable time preparing your official papers on printed copies instead of handling them online? airSlate SignNow provides a superior approach to complete and endorse your Tax Return Transcript Form and other forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage your documentation promptly and in accordance with official standards - robust PDF editing, organization, safeguarding, signing, and sharing functionalities all available through an intuitive interface.

Only a few steps are needed to finalize the completion and endorsement of your Tax Return Transcript Form:

- Upload the fillable template to the editor using the Get Form button.

- Identify the information you need to include in your Tax Return Transcript Form.

- Move between the fields using the Next feature to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input your details in the blanks.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Blackout irrelevant sections.

- Press Sign to generate a legally enforceable eSignature using your preferred method.

- Add the Date next to your signature and complete your task with the Done button.

Store your completed Tax Return Transcript Form in the Documents folder within your account, download it, or save it to your preferred cloud storage. Our platform also provides versatile file sharing options. There’s no need to print your forms when submitting them to the relevant public office - accomplish it via email, fax, or by requesting USPS “snail mail” delivery from your profile. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct tax return transcript 2012 form

Create this form in 5 minutes!

How to create an eSignature for the tax return transcript 2012 form

How to make an eSignature for your Tax Return Transcript 2012 Form in the online mode

How to generate an eSignature for the Tax Return Transcript 2012 Form in Google Chrome

How to make an electronic signature for putting it on the Tax Return Transcript 2012 Form in Gmail

How to make an electronic signature for the Tax Return Transcript 2012 Form from your smartphone

How to make an eSignature for the Tax Return Transcript 2012 Form on iOS

How to make an electronic signature for the Tax Return Transcript 2012 Form on Android devices

People also ask

-

What is a Tax Return Transcript Form and why do I need it?

A Tax Return Transcript Form is a summary of your tax return information that the IRS provides. It is often required for loan applications, financial aid, and other verification processes. Using airSlate SignNow, you can easily manage and eSign documents related to your Tax Return Transcript Form, streamlining your financial documentation.

-

How does airSlate SignNow help with the Tax Return Transcript Form process?

airSlate SignNow simplifies the process of obtaining and managing your Tax Return Transcript Form. Our platform allows you to securely send and eSign documents, which saves time and minimizes errors. With our easy-to-use interface, you can track the progress of your Tax Return Transcript Form submissions effortlessly.

-

Is there a cost associated with using airSlate SignNow for my Tax Return Transcript Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our cost-effective solution allows you to manage your Tax Return Transcript Form and other documents without breaking the bank. You can choose a plan that best fits your usage requirements, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with other tools for my Tax Return Transcript Form?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of applications, enhancing your workflow for managing the Tax Return Transcript Form. Whether you use CRM systems, document storage solutions, or financial software, our integrations allow for a smooth transition and efficient document management.

-

What are the security features of airSlate SignNow when handling my Tax Return Transcript Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect your sensitive information, including Tax Return Transcript Forms, during transmission and storage. Our platform complies with industry standards to ensure that your documents remain confidential and secure.

-

How can I track the status of my Tax Return Transcript Form with airSlate SignNow?

With airSlate SignNow, you have the ability to track the status of your Tax Return Transcript Form in real time. Our dashboard provides updates on document activity, including when it has been viewed, signed, or completed. This feature keeps you informed throughout the entire process.

-

What types of documents can I send along with my Tax Return Transcript Form?

In addition to the Tax Return Transcript Form, airSlate SignNow allows you to send and eSign various types of documents. This flexibility means you can manage accompanying financial documents, agreements, and contracts all in one place. Our platform is designed to support your comprehensive document management needs.

Get more for Tax Return Transcript Form

- Pwgsc tpsgc 540 form

- Rcsd geometry local mathematics curriculum form

- Ct 200 v 210625331 form

- Tuscaloosa county business license form

- What are waves review and reinforce answer key form

- Pre bcontractb disclosure bcaliforniab lobel financial form

- Revised complaint form 10 16 08 doc

- Application for certified copy of an arizona birth certificate form

Find out other Tax Return Transcript Form

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile