Form 4506 T Request for Transcript of Tax Return Official 2023

What is the Form 4506-T Request for Transcript of Tax Return?

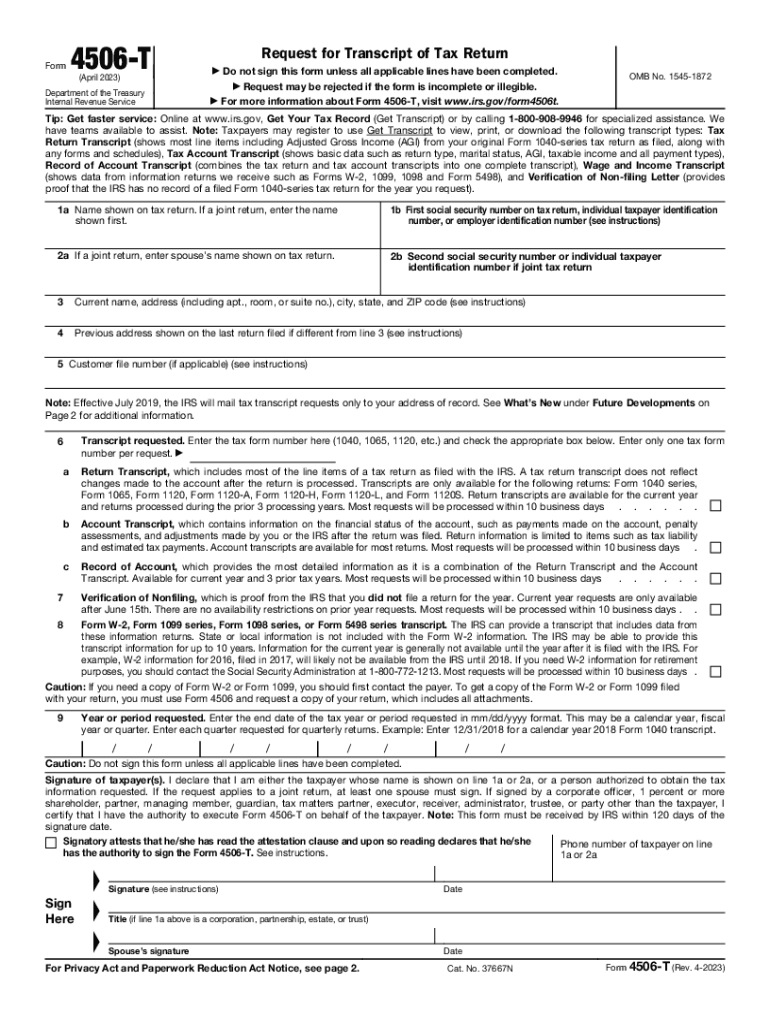

The Form 4506-T is an official document used by taxpayers to request a transcript of their tax return from the Internal Revenue Service (IRS). This form allows individuals to obtain various types of transcripts, including tax return transcripts, account transcripts, and wage and income transcripts. The information provided in these transcripts can be crucial for various purposes, such as applying for loans, verifying income, or resolving tax issues. Understanding the specific types of transcripts available and their uses can help taxpayers make informed decisions when requesting their IRS transcripts.

How to Use the Form 4506-T Request for Transcript of Tax Return

Using the Form 4506-T is straightforward. Taxpayers need to fill out the form with their personal information, including their name, Social Security number, and address. Additionally, they must specify the type of transcript they are requesting and the tax years for which they need the information. After completing the form, it can be submitted to the IRS either online, by mail, or in person, depending on the taxpayer's preference. It is essential to ensure all information is accurate to avoid delays in processing the request.

Steps to Complete the Form 4506-T Request for Transcript of Tax Return

Completing the Form 4506-T involves several key steps:

- Provide Personal Information: Fill in your name, Social Security number, and address accurately.

- Select Transcript Type: Indicate the type of transcript you need, such as a tax return transcript or account transcript.

- Specify Tax Years: Clearly state the tax years for which you are requesting transcripts.

- Sign and Date: Ensure you sign and date the form to validate your request.

- Submit the Form: Choose your submission method—online, by mail, or in person.

Legal Use of the Form 4506-T Request for Transcript of Tax Return

The Form 4506-T is legally recognized and serves as an official request for information from the IRS. It is important to understand that the information received from the IRS is confidential and should only be used for legitimate purposes, such as applying for loans or verifying income for tax-related matters. Misuse of the information obtained through this form can lead to legal repercussions. Therefore, taxpayers should ensure they comply with all applicable laws and regulations when using the transcripts.

IRS Guidelines for the Form 4506-T Request for Transcript of Tax Return

The IRS has specific guidelines for completing and submitting the Form 4506-T. Taxpayers should ensure they are using the most current version of the form, which can be found on the IRS website. Additionally, the IRS provides detailed instructions on how to fill out the form correctly to avoid common mistakes that could delay processing. It is advisable to review these guidelines thoroughly before submission to ensure compliance and efficiency in obtaining the requested transcripts.

Form Submission Methods for the 4506-T Request for Transcript of Tax Return

There are several methods available for submitting the Form 4506-T to the IRS:

- Online Submission: Taxpayers can submit their request electronically through the IRS website, which may expedite the process.

- Mail Submission: The completed form can be mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person Submission: Some taxpayers may choose to deliver the form in person at their local IRS office, although this option may vary by location.

Quick guide on how to complete form 4506 t request for transcript of tax return official

Complete Form 4506 T Request For Transcript Of Tax Return Official seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Form 4506 T Request For Transcript Of Tax Return Official on any platform with the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

The easiest way to modify and electronically sign Form 4506 T Request For Transcript Of Tax Return Official effortlessly

- Find Form 4506 T Request For Transcript Of Tax Return Official and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form; by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or missing files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 4506 T Request For Transcript Of Tax Return Official and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 t request for transcript of tax return official

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t request for transcript of tax return official

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS transcript?

An IRS transcript is a summary of your tax return information provided by the Internal Revenue Service. It includes details such as your adjusted gross income and tax filing status. Understanding your IRS transcript can help in filing accurate tax returns and applying for loans or financial aid.

-

How can I obtain my IRS transcript?

You can obtain your IRS transcript online, by mail, or through a tax professional. The fastest way to access it is via the IRS website using their 'Get Transcript' tool. This will allow you to view and download your IRS transcript within minutes.

-

What features does airSlate SignNow offer for managing IRS transcripts?

airSlate SignNow provides features that allow you to easily eSign and share documents like IRS transcripts. You can upload your IRS transcript directly into the platform, making it easy to manage and send for signatures. Its user-friendly interface ensures that you can navigate through your documents with ease.

-

Is airSlate SignNow a secure way to send IRS transcripts?

Yes, airSlate SignNow ensures that your IRS transcripts are transmitted securely with bank-level encryption. You can trust that your personal information is protected while using our platform to send sensitive documents. Security features also include document tracking and secure audit trails.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a range of pricing plans suitable for different business sizes and needs. Each plan includes features for eSigning and document management, helping you streamline processes associated with IRS transcripts. To find the best plan for you, check our pricing page for detailed options.

-

Can airSlate SignNow integrate with other applications for handling IRS transcripts?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and Salesforce, allowing you to manage IRS transcripts seamlessly. This integration simplifies the workflow and enhances your document management experience by connecting all your tools in one place.

-

What are the benefits of using airSlate SignNow for IRS transcripts?

Using airSlate SignNow for IRS transcripts streamlines the process of document handling and signatures. The platform enhances collaboration by allowing multiple parties to review and sign documents efficiently. Additionally, you save time and reduce errors with automated workflows designed to simplify the management of IRS transcripts.

Get more for Form 4506 T Request For Transcript Of Tax Return Official

- Name change notification form north carolina

- Commercial building or space lease north carolina form

- Judicial employment form

- Judicial branch of government application for work or employment continuation page north carolina form

- Nc legal documents 497317079 form

- Guardian documents form

- North carolina civil form

- Affidavit minor form

Find out other Form 4506 T Request For Transcript Of Tax Return Official

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now