4506 T Form 2008

What is the 4506 T Form

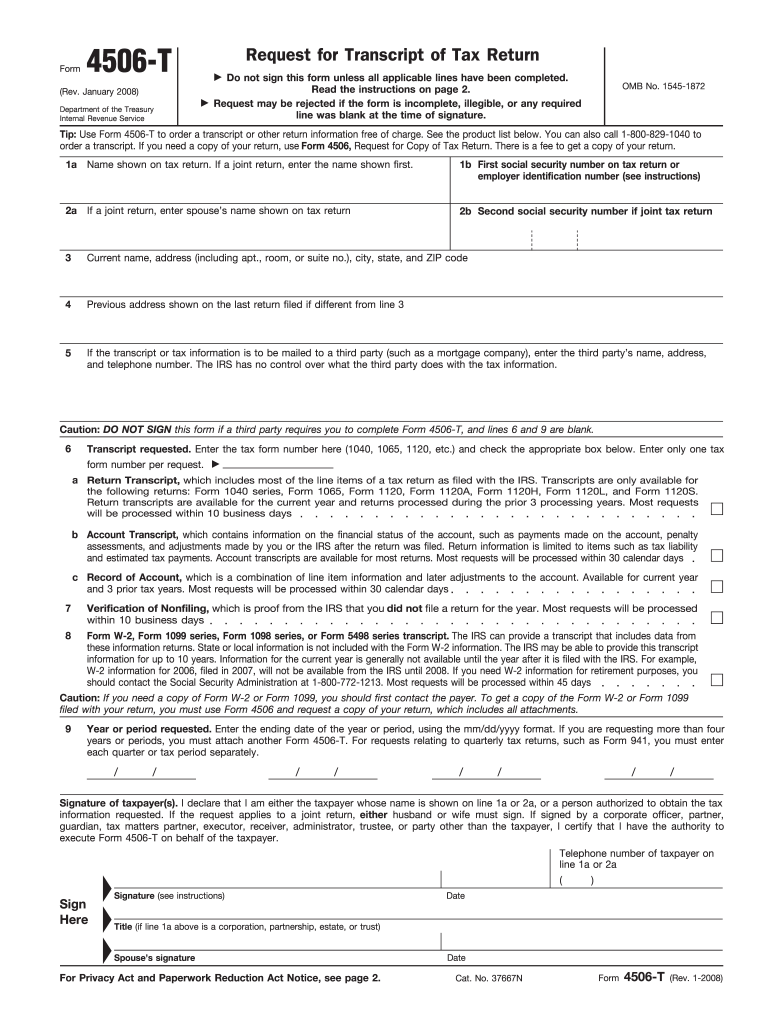

The 4506 T Form, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers in the United States to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is particularly useful for individuals who need to verify their income for various purposes, such as applying for loans or financial aid. The 4506 T Form allows taxpayers to obtain a summary of their tax information without needing to submit a full tax return.

How to use the 4506 T Form

Using the 4506 T Form involves several straightforward steps. First, complete the form by providing your personal information, including your name, Social Security number, and address. Next, indicate the type of transcript you are requesting and the tax years for which you need the information. After filling out the form, you can submit it to the IRS either by mail or electronically, depending on your preference. The IRS typically processes requests within a few weeks, but processing times may vary.

Steps to complete the 4506 T Form

Completing the 4506 T Form requires careful attention to detail. Follow these steps for successful submission:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your name and Social Security number accurately.

- Provide your current address and any previous addresses if applicable.

- Select the type of transcript you need, such as a tax return transcript or an account transcript.

- Specify the tax years for which you are requesting transcripts.

- Sign and date the form to validate your request.

Legal use of the 4506 T Form

The 4506 T Form is legally recognized as a valid document for obtaining tax information from the IRS. It complies with federal regulations, ensuring that the information requested is protected and used appropriately. Taxpayers should ensure they understand the implications of sharing their tax information and use the form solely for legitimate purposes, such as loan applications or financial verifications.

Key elements of the 4506 T Form

Several key elements make up the 4506 T Form. These include:

- Taxpayer Information: Personal details such as name, Social Security number, and address.

- Transcript Type: Options to request different types of transcripts, including tax return transcripts and account transcripts.

- Signature: The form must be signed and dated by the taxpayer to authorize the release of information.

- Tax Years: Specification of the years for which transcripts are being requested.

Form Submission Methods

The 4506 T Form can be submitted to the IRS through various methods. Taxpayers can choose to send the completed form by mail to the appropriate IRS address based on their location. Alternatively, some taxpayers may have the option to submit the form electronically through authorized e-file providers. It is essential to verify the submission method to ensure timely processing of the request.

Quick guide on how to complete 2008 4506 t form

Complete 4506 T Form effortlessly on any device

Online document administration has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage 4506 T Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign 4506 T Form with ease

- Locate 4506 T Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign 4506 T Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 4506 t form

Create this form in 5 minutes!

How to create an eSignature for the 2008 4506 t form

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the 4506 T Form and why is it important?

The 4506 T Form is a request for the IRS to release a taxpayer's tax return information to third parties. It's crucial for lenders, financial institutions, and businesses that need to verify income for loan applications or other financial assessments. Using airSlate SignNow, you can easily eSign and manage 4506 T Forms, streamlining your document workflow.

-

How does airSlate SignNow help with 4506 T Forms?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign 4506 T Forms quickly and securely. Our advanced features ensure that all parties can review and sign documents in real time, reducing delays and improving efficiency. With airSlate SignNow, managing your 4506 T Forms becomes a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for 4506 T Forms?

Yes, airSlate SignNow provides various pricing plans tailored to meet different business needs. Whether you're a small business or a large enterprise, you can find a plan that includes features for handling 4506 T Forms efficiently. We also offer a free trial, so you can explore our services before committing.

-

Can I integrate airSlate SignNow with other tools for managing 4506 T Forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to enhance your workflow for 4506 T Forms. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure that your eSigning process is cohesive and effective.

-

What security measures does airSlate SignNow have for 4506 T Forms?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect all documents, including 4506 T Forms, during transmission and storage. Additionally, we comply with industry standards and regulations to ensure that your sensitive information remains confidential and secure.

-

How can I track the status of my 4506 T Forms using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your sent 4506 T Forms through our intuitive dashboard. You will receive real-time notifications when a document is viewed, signed, or completed, ensuring you stay informed throughout the process. This feature enhances transparency and helps you manage your document flow effectively.

-

What features does airSlate SignNow offer for 4506 T Form management?

airSlate SignNow provides a range of features tailored for efficient management of 4506 T Forms, including customizable templates, bulk sending, and automated reminders. These tools help you streamline the signing process, save time, and reduce errors when dealing with important tax documents. Our platform is designed to simplify your paperwork.

Get more for 4506 T Form

- Screening checklist for contraindications to vaccines for children and teens immunize form

- Jv 184 form

- Disclaimer of inheritance form california

- Affidavit of heirship texas form

- General power of attorney for financial affairs form

- Femdom contract form

- Simple divorce intake form petitioner

- Client will questionnaire wessels amp dixon pc form

Find out other 4506 T Form

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online