TAX CLIENT INTAKE FORM

What is the tax client intake form

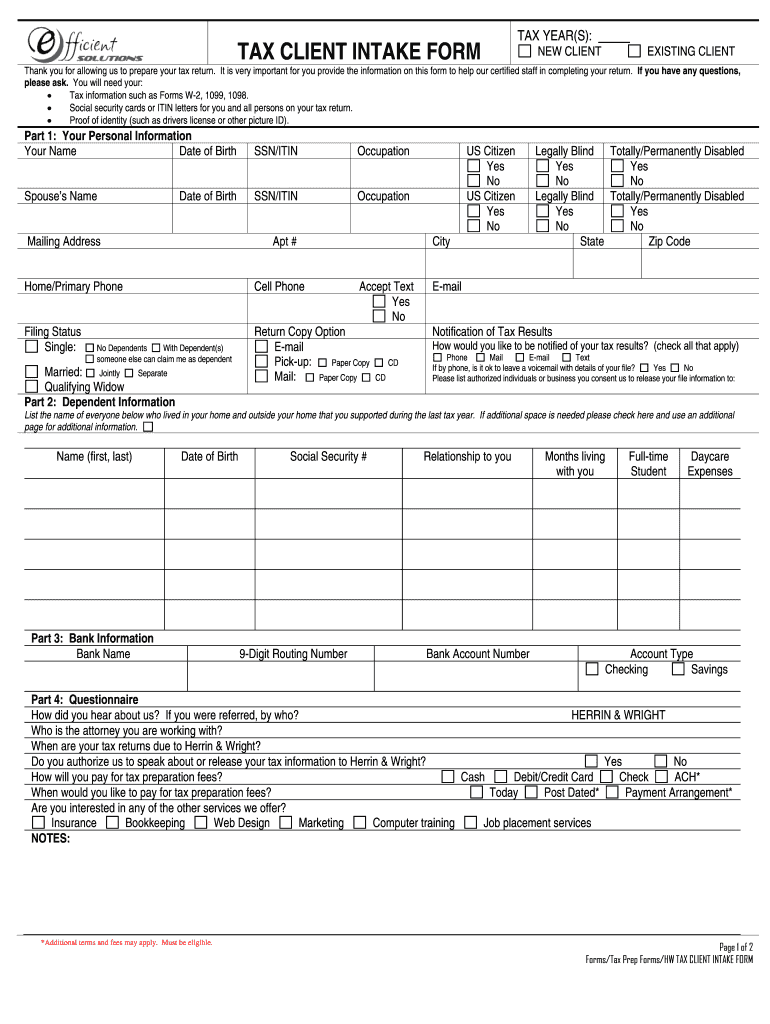

The tax client intake form is a crucial document used by tax professionals to gather essential information from clients. This form typically includes personal details such as name, address, Social Security number, and financial information relevant to tax preparation. By collecting this information, tax preparers can ensure accurate filing and compliance with IRS regulations. The form serves as a foundational tool that facilitates a smooth interaction between clients and tax professionals, allowing for a comprehensive understanding of each client's unique tax situation.

How to use the tax client intake form

Using the tax client intake form involves several straightforward steps. First, clients should carefully fill out all required fields, ensuring that the information is accurate and up-to-date. After completing the form, clients should review their entries for any errors or omissions. Once verified, the form can be submitted electronically or printed for in-person delivery to the tax preparer. Tax professionals will then analyze the information to provide tailored tax advice and prepare necessary filings. This process enhances efficiency and helps in maintaining compliance with tax laws.

Steps to complete the tax client intake form

Completing the tax client intake form requires a systematic approach to ensure all necessary information is captured. Here are the steps to follow:

- Gather personal information, including full name, address, and Social Security number.

- Collect financial documents such as W-2s, 1099s, and any relevant receipts.

- Fill out the form, making sure to provide accurate details in each section.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for physical submission to your tax professional.

Key elements of the tax client intake form

Several key elements are essential in a tax client intake form. These include:

- Personal Information: Name, address, and Social Security number.

- Income Sources: Details of all income received, including wages and investment income.

- Deductions: Information on potential deductions, such as mortgage interest and charitable contributions.

- Filing Status: Selection of the appropriate filing status, such as single, married, or head of household.

- Dependents: Information about any dependents, including their Social Security numbers and relationship to the taxpayer.

Legal use of the tax client intake form

The legal use of the tax client intake form is governed by various regulations that ensure the protection of personal data. When used correctly, the form serves as a legally binding document that establishes the relationship between the client and the tax preparer. It is essential for tax professionals to maintain compliance with laws such as the IRS guidelines and privacy regulations to safeguard client information. Proper handling of the intake form can help mitigate risks associated with data breaches and ensure that both parties understand their obligations under tax law.

Form submission methods

Clients have various options for submitting the tax client intake form, which include:

- Online Submission: Many tax professionals offer secure online platforms for clients to submit forms electronically.

- Mail: Clients can print the form and send it via postal service to their tax preparer.

- In-Person Delivery: Clients may choose to deliver the completed form directly to their tax professional during an appointment.

Quick guide on how to complete tax client intake form

Complete TAX CLIENT INTAKE FORM effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the proper form and securely archive it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage TAX CLIENT INTAKE FORM on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to adjust and eSign TAX CLIENT INTAKE FORM seamlessly

- Locate TAX CLIENT INTAKE FORM and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign TAX CLIENT INTAKE FORM and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax client intake form

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is a tax client intake form?

A tax client intake form is a document that gathers essential information from clients to help prepare their tax returns. Using airSlate SignNow, you can easily create and send this form for electronic signatures, streamlining the process and ensuring all necessary details are collected efficiently.

-

How does airSlate SignNow simplify the tax client intake form process?

airSlate SignNow simplifies the tax client intake form process by allowing users to create customizable forms that can be sent electronically. Clients can fill out and eSign the form from any device, which reduces paperwork and speeds up the information gathering needed for tax preparation.

-

What features does airSlate SignNow offer for tax client intake forms?

airSlate SignNow offers features such as customizable templates, electronic signatures, and real-time tracking for your tax client intake forms. Additionally, it provides secure storage and integrates with various accounting software, making it easier to manage client information effectively.

-

Is there a cost associated with using airSlate SignNow for tax client intake forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans are flexible, allowing you to choose one that best fits your needs while making the management of tax client intake forms affordable.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, allowing you to streamline your workflow. This means that you can send and manage your tax client intake forms seamlessly alongside your other tools.

-

What are the benefits of using an electronic tax client intake form?

Using an electronic tax client intake form through airSlate SignNow provides numerous benefits, including faster turnaround times and improved accuracy. Clients can complete forms at their convenience, which reduces delays and potential errors associated with paper-based forms.

-

How secure is my information when using airSlate SignNow for tax client intake forms?

Your information is secure when using airSlate SignNow for tax client intake forms. The platform employs advanced security measures, including encryption and secure storage, to ensure that all client data is protected, giving you peace of mind.

Get more for TAX CLIENT INTAKE FORM

- Non foreign affidavit under irc 1445 indiana form

- Owners or sellers affidavit of no liens indiana form

- Indiana occupancy form

- Complex will with credit shelter marital trust for large estates indiana form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497307031 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497307032 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497307033 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497307034 form

Find out other TAX CLIENT INTAKE FORM

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later