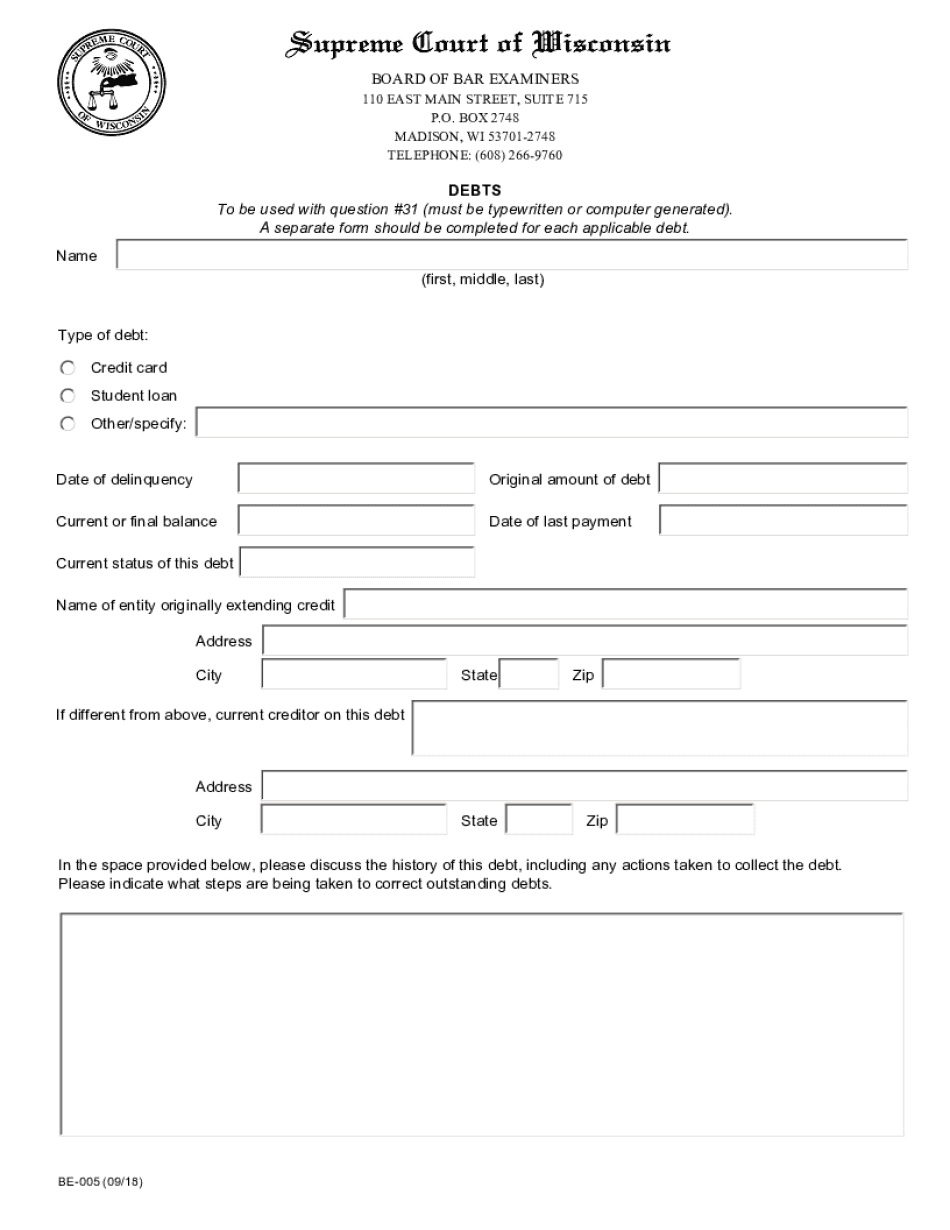

a Separate Form Should Be Completed for Each Applicable Debt 2018-2026

What is the be 005 form?

The be 005 form is a specific document used for reporting debts in various contexts. It serves as a formal declaration of outstanding financial obligations, allowing individuals and businesses to communicate their debt status clearly. This form is essential for maintaining transparency in financial dealings and is often required by institutions for processing applications or assessing creditworthiness.

Key elements of the be 005 form

Understanding the key elements of the be 005 form is crucial for accurate completion. The form typically includes:

- Debtor Information: Details about the individual or entity that owes the debt.

- Creditor Information: Information about the party to whom the debt is owed.

- Debt Amount: The total amount of the debt being reported.

- Debt Description: A brief explanation of the nature of the debt.

- Signature: A signature or digital signature to validate the form.

Steps to complete the be 005 form

Completing the be 005 form involves several important steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary details about the debts being reported.

- Fill Out the Form: Enter the required information in the appropriate sections of the form.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Sign the Form: Provide your signature or digital signature to authenticate the document.

- Submit the Form: Follow the designated submission method, whether online, by mail, or in person.

Legal use of the be 005 form

The be 005 form holds legal significance when properly completed and submitted. It is essential to adhere to relevant laws and regulations governing debt reporting. Compliance with these legal frameworks ensures that the form is recognized as a valid document in financial and legal contexts. Proper use of the form can protect the rights of both debtors and creditors and facilitate fair financial practices.

Form submission methods

There are several methods available for submitting the be 005 form, allowing for flexibility based on user preference:

- Online Submission: Many institutions accept electronic submissions, making it convenient to complete and send the form digitally.

- Mail Submission: For those who prefer traditional methods, mailing a hard copy of the form is an option.

- In-Person Submission: Some situations may require delivering the form directly to a designated office or agency.

Examples of using the be 005 form

The be 005 form can be utilized in various scenarios, including:

- Reporting personal debts for loan applications.

- Documenting business debts for financial audits.

- Providing proof of debt in legal proceedings.

Each of these examples highlights the form's versatility in managing financial obligations and ensuring compliance with reporting requirements.

Quick guide on how to complete a separate form should be completed for each applicable debt

Effortlessly prepare A Separate Form Should Be Completed For Each Applicable Debt on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you need to swiftly create, modify, and eSign your documents without delays. Manage A Separate Form Should Be Completed For Each Applicable Debt on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign A Separate Form Should Be Completed For Each Applicable Debt with ease

- Find A Separate Form Should Be Completed For Each Applicable Debt and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign A Separate Form Should Be Completed For Each Applicable Debt while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a separate form should be completed for each applicable debt

Create this form in 5 minutes!

How to create an eSignature for the a separate form should be completed for each applicable debt

How to generate an e-signature for your PDF in the online mode

How to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an e-signature for a PDF document on Android OS

People also ask

-

What is 'be 005' in relation to airSlate SignNow?

'Be 005' refers to a specific feature within airSlate SignNow that enhances document signing efficiency. This feature allows users to create and send documents effortlessly, ensuring a seamless eSigning experience for all parties involved.

-

How does airSlate SignNow pricing work for the 'be 005' functionality?

The pricing for airSlate SignNow, including the 'be 005' functionality, is designed to be cost-effective for businesses of all sizes. Different pricing tiers are available, allowing you to choose a plan that best meets your budget and signing needs while leveraging the benefits of 'be 005.'

-

What features does 'be 005' offer to enhance document management?

'Be 005' offers features such as customizable templates, automated reminders, and comprehensive audit trails. These functionalities streamline document management, making it easier for users to track the signing process and maintain compliance.

-

Can I integrate other software with airSlate SignNow's 'be 005' feature?

Yes, airSlate SignNow's 'be 005' feature seamlessly integrates with a variety of third-party applications. This facilitates a holistic workflow, allowing you to connect your existing systems and optimize your processes for improved efficiency.

-

What are the main benefits of using airSlate SignNow 'be 005' for businesses?

Using airSlate SignNow's 'be 005' empowers businesses to achieve faster turnaround times on documents while reducing paper usage. It enhances collaboration and ensures that all signatories have a smooth experience, leading to increased productivity and customer satisfaction.

-

Is there a trial period available for airSlate SignNow's 'be 005' features?

Yes, airSlate SignNow offers a trial period allowing prospective users to explore 'be 005' features without financial commitment. This trial enables you to assess how well the functionalities meet your business needs before making a purchase.

-

What types of documents can I create using 'be 005' in airSlate SignNow?

'Be 005' in airSlate SignNow allows you to create a wide range of documents, including contracts, agreements, and forms. Its flexibility supports various industries, enabling you to customize documents based on your specific requirements.

Get more for A Separate Form Should Be Completed For Each Applicable Debt

Find out other A Separate Form Should Be Completed For Each Applicable Debt

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free