TENNESSEE DEPARTMENT of REVENUE Franchise and Excise Tax 2021-2026

What is the Tennessee Department of Revenue Franchise and Excise Tax?

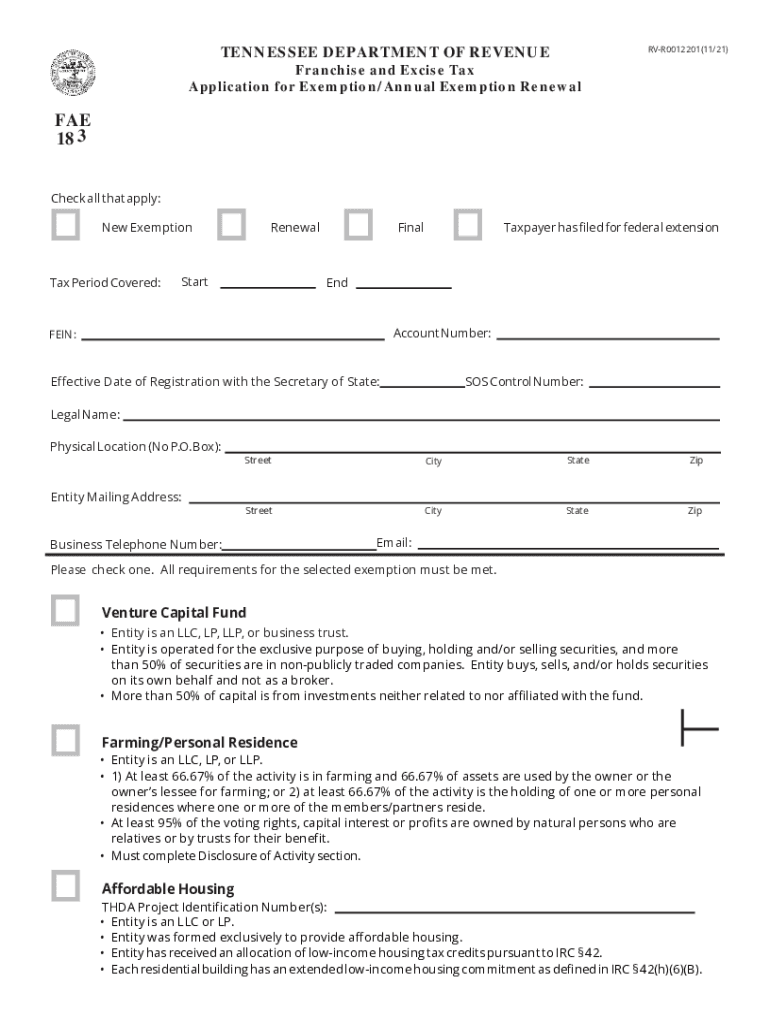

The Tennessee Department of Revenue administers the Franchise and Excise Tax, which applies to most businesses operating in the state. This tax is imposed on the net earnings of corporations and limited liability companies (LLCs), as well as on the value of their assets. The Franchise Tax is based on the greater of a company's net worth or the book value of its property, while the Excise Tax is calculated on the net earnings of the business. Understanding these taxes is essential for compliance and financial planning for businesses in Tennessee.

Steps to Complete the Tennessee Department of Revenue Franchise and Excise Tax

Completing the Tennessee Franchise and Excise Tax involves several key steps:

- Gather necessary financial documents, including balance sheets and income statements.

- Determine your business's net worth and net earnings for the tax year.

- Calculate the Franchise Tax based on the greater of your net worth or the book value of your property.

- Calculate the Excise Tax based on your net earnings.

- Complete the appropriate forms, such as the TN Form FAE 183, ensuring all information is accurate.

- Review the calculations for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Franchise and Excise Tax in Tennessee. Typically, the tax return is due on the fifteenth day of the fourth month following the end of your fiscal year. For most businesses operating on a calendar year, this means the due date is April 15. Extensions may be available, but businesses must file for them before the original due date to avoid penalties.

Required Documents

To accurately complete the Tennessee Franchise and Excise Tax forms, businesses need to prepare several documents:

- Balance sheet and income statement for the tax year.

- Records of any adjustments to income or deductions.

- Documentation supporting asset valuations.

- Previous tax returns for reference.

Penalties for Non-Compliance

Failure to comply with the Franchise and Excise Tax requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action by the state. It is essential for businesses to file their returns on time and ensure all calculations are accurate to avoid these consequences.

Who Issues the Form?

The Tennessee Department of Revenue is responsible for issuing the Franchise and Excise Tax forms, including the TN Form FAE 183. This form is used by corporations and LLCs to report their Franchise and Excise Tax liabilities. The department provides guidance and resources to assist businesses in completing the form correctly.

Quick guide on how to complete tennessee department of revenue franchise and excise tax

Easily set up TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax effortlessly

- Locate TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax and click on Get Form to commence.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for such needs.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee department of revenue franchise and excise tax

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenue franchise and excise tax

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What are the tn fae 183 instructions for eSigning documents using airSlate SignNow?

The tn fae 183 instructions for eSigning documents in airSlate SignNow provide step-by-step guidance on how to electronically sign and send your documents efficiently. This ensures compliance with legal standards, making it easy to manage important paperwork securely.

-

How much does airSlate SignNow cost, and do the tn fae 183 instructions vary by plan?

Pricing for airSlate SignNow is competitive, with several plans available to suit different business needs. While the core tn fae 183 instructions remain consistent across plans, additional features might vary, enhancing functionality depending on the subscription level.

-

What features are included in the tn fae 183 instructions for airSlate SignNow?

The tn fae 183 instructions include essential features such as document templates, real-time tracking, and integration capabilities with various apps. These streamline the signing process, ensuring a user-friendly experience while maintaining document integrity.

-

What are the benefits of following the tn fae 183 instructions for airSlate SignNow?

By following the tn fae 183 instructions, users can ensure that they are adhering to best practices in electronic signing. This minimizes errors and accelerates the document workflow, ultimately saving time and resources for your business.

-

Can I integrate airSlate SignNow with other applications while using the tn fae 183 instructions?

Yes, airSlate SignNow allows for seamless integration with numerous applications, enhancing productivity. The tn fae 183 instructions provide detailed guidance on how to integrate these applications effectively to streamline your workflow.

-

Are the tn fae 183 instructions suitable for businesses of all sizes?

Absolutely! The tn fae 183 instructions are designed to cater to businesses of all sizes, from small startups to large enterprises. This flexibility means that everyone can benefit from airSlate SignNow's eSigning capabilities.

-

How can I access the tn fae 183 instructions when using airSlate SignNow?

Accessing the tn fae 183 instructions is easy within the airSlate SignNow platform. Simply navigate to the support section on the website, where you can find comprehensive resources, including user guides and video tutorials.

Get more for TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax

- Mutual release of notice of contract with affidavit individual louisiana form

- Quitclaim deed by two individuals to llc louisiana form

- Warranty deed from two individuals to llc louisiana form

- Mutual release contract agreement form

- Statement privilege form

- Quitclaim deed by two individuals to corporation louisiana form

- Warranty deed from two individuals to corporation louisiana form

- Contract completion form

Find out other TENNESSEE DEPARTMENT OF REVENUE Franchise And Excise Tax

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract