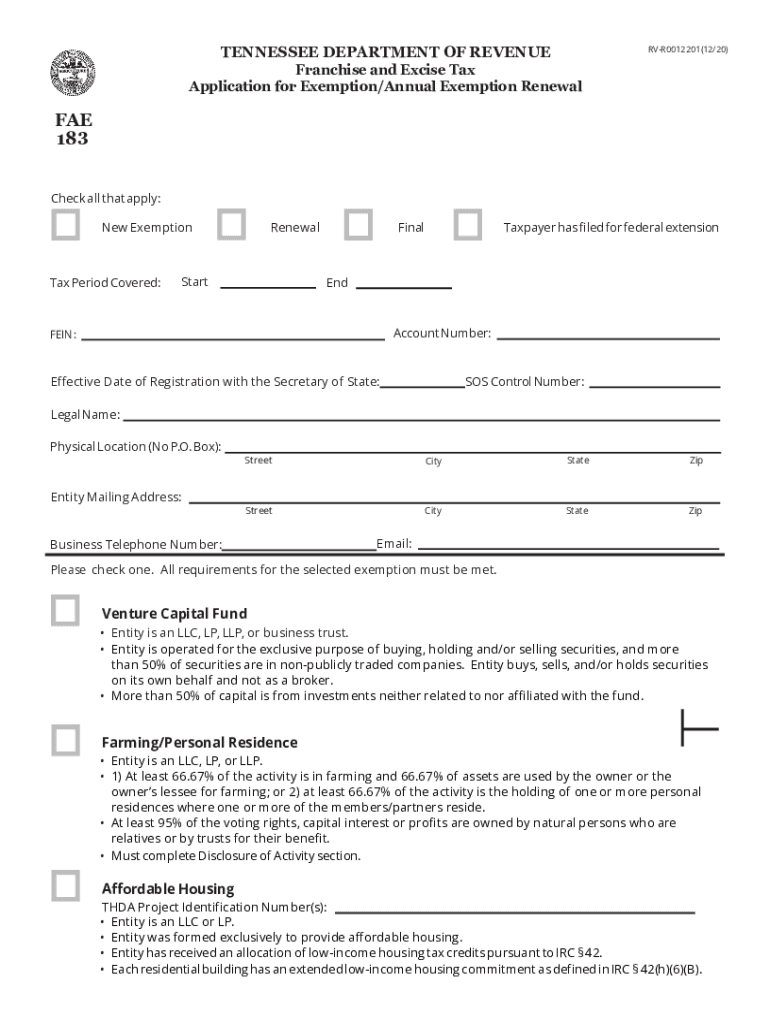

FAE183 F&E Application for ExeptionAnnual Exemption Renewal FAE183 F&E Application for ExeptionAnnual Exemption 2020

What is the 2018 TC 69C Notice Change Account Printable?

The 2018 TC 69C Notice Change Account is a form used by businesses to report changes to their account information with the Tennessee Department of Revenue. This notice is essential for maintaining accurate records and ensuring compliance with state regulations. It allows businesses to update details such as ownership changes, address modifications, and other pertinent information that may affect their tax obligations. The form is designed to be straightforward, making it accessible for all business owners to complete.

Steps to Complete the 2018 TC 69C Notice Change Account

Completing the 2018 TC 69C Notice Change Account involves several key steps:

- Gather necessary information, including your current account details and the specific changes you need to report.

- Access the printable version of the form, ensuring you have the most recent version for accuracy.

- Fill out the form clearly, providing all required information, including your business name, account number, and the nature of the changes.

- Review the completed form for any errors or omissions to avoid delays in processing.

- Submit the form according to the instructions provided, either by mail or electronically if applicable.

Legal Use of the 2018 TC 69C Notice Change Account

The 2018 TC 69C Notice Change Account is legally recognized by the Tennessee Department of Revenue for updating business account information. Properly completing and submitting this form ensures that your business remains in good standing and compliant with state tax laws. Failure to report changes can lead to penalties or issues with your tax filings, making it crucial to use this form correctly.

Required Documents for the 2018 TC 69C Notice Change Account

When completing the 2018 TC 69C Notice Change Account, certain documents may be required to support your changes. These can include:

- Proof of ownership changes, such as a partnership agreement or articles of incorporation.

- Identification documents for the new owners or responsible parties.

- Any previous correspondence with the Department of Revenue regarding your account.

Form Submission Methods for the 2018 TC 69C Notice Change Account

The 2018 TC 69C Notice Change Account can be submitted through various methods, depending on your preference and the requirements set by the Tennessee Department of Revenue. Common submission methods include:

- Mailing the completed form to the designated address provided on the form.

- Submitting the form electronically if the department allows for online submissions.

- In-person submission at a local Department of Revenue office, if applicable.

Eligibility Criteria for Filing the 2018 TC 69C Notice Change Account

All businesses registered with the Tennessee Department of Revenue are eligible to file the 2018 TC 69C Notice Change Account. It is particularly important for businesses that have undergone changes in ownership, structure, or location. Ensuring that your business information is up to date helps maintain compliance and avoids potential legal issues.

Quick guide on how to complete fae183 fampampe application for exeptionannual exemption renewal fae183 fampampe application for exeptionannual exemption

Effortlessly Prepare FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling easy access to the correct form and secure online storage. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption with ease

- Locate FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form—via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fae183 fampampe application for exeptionannual exemption renewal fae183 fampampe application for exeptionannual exemption

Create this form in 5 minutes!

How to create an eSignature for the fae183 fampampe application for exeptionannual exemption renewal fae183 fampampe application for exeptionannual exemption

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2018 tc 69c notice change account printable?

The 2018 tc 69c notice change account printable is a form that allows you to notify relevant authorities of changes to your account information. It is essential for ensuring your records remain accurate and up-to-date.

-

How can I access the 2018 tc 69c notice change account printable?

You can easily access the 2018 tc 69c notice change account printable through airSlate SignNow. Our platform provides fast and convenient access to printable forms that can be signed electronically.

-

Is there a cost associated with using the 2018 tc 69c notice change account printable on airSlate SignNow?

Using the 2018 tc 69c notice change account printable on airSlate SignNow is cost-effective. We offer various pricing plans tailored to fit your business needs, ensuring you get the best value for your document management solutions.

-

Can I integrate the 2018 tc 69c notice change account printable with other applications?

Yes, airSlate SignNow offers integrations with various applications, which makes it easy to use the 2018 tc 69c notice change account printable alongside your existing tools. This adaptability enhances your workflow efficiency.

-

What are the benefits of using airSlate SignNow for the 2018 tc 69c notice change account printable?

Using airSlate SignNow for the 2018 tc 69c notice change account printable offers numerous benefits, including streamlined document signing, enhanced security, and easy sharing capabilities. You'll save time and reduce paperwork signNowly.

-

How secure is the 2018 tc 69c notice change account printable on airSlate SignNow?

The security of your documents, including the 2018 tc 69c notice change account printable, is a top priority for airSlate SignNow. We implement robust encryption and compliance measures to ensure that your sensitive information is fully protected.

-

Can I track the status of my 2018 tc 69c notice change account printable?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your 2018 tc 69c notice change account printable. You’ll receive notifications when it's viewed or signed, keeping you informed throughout the process.

Get more for FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption

Find out other FAE183 F&E Application For ExeptionAnnual Exemption Renewal FAE183 F&E Application For ExeptionAnnual Exemption

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors