Fillable Online Florida Corporate Short Form Income Tax

What is the fillable online Florida corporate short form income tax?

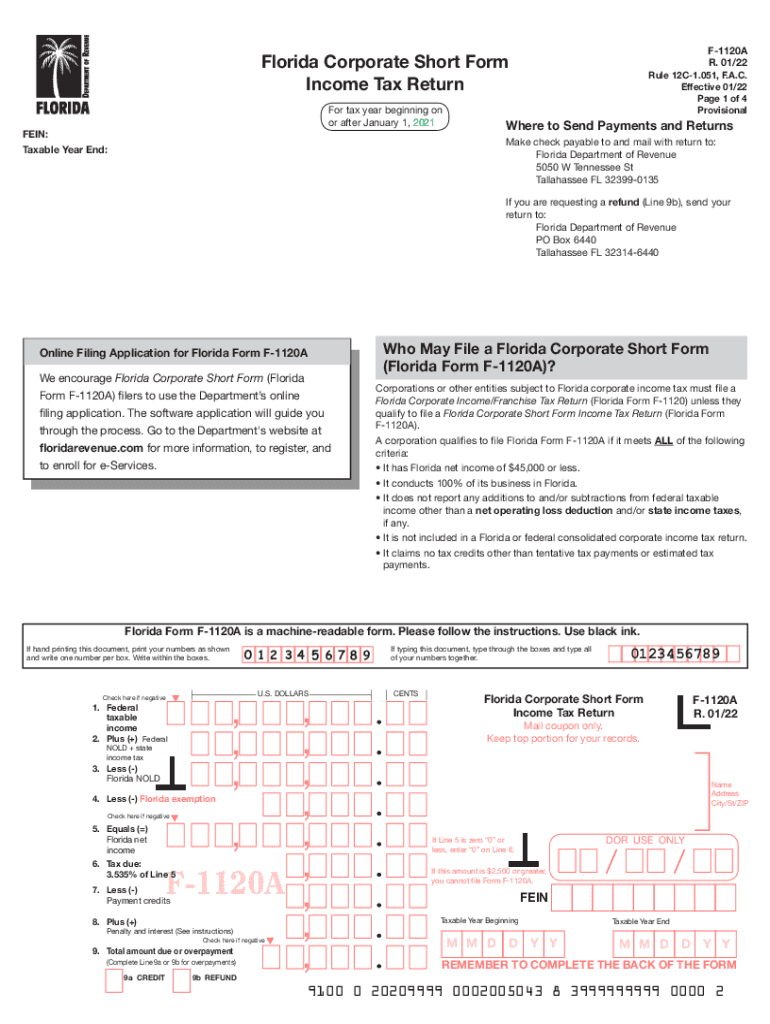

The Florida 1120A tax form, also known as the Florida corporate short form income tax, is designed for certain corporations operating in Florida. This form simplifies the tax filing process for corporations that meet specific criteria, allowing them to report their income and calculate their tax liability efficiently. The Florida Department of Revenue requires this form to ensure compliance with state tax laws and to facilitate accurate revenue collection. Corporations eligible to use this form typically have a gross income below a specified threshold, making it a streamlined option for smaller businesses.

Steps to complete the fillable online Florida corporate short form income tax

Completing the Florida 1120A tax form online involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Access the fillable online form through the Florida Department of Revenue website.

- Enter the required information, such as the corporation's name, address, and federal employer identification number (EIN).

- Input financial data, including total income, deductions, and credits, as applicable.

- Review the information for accuracy before submitting the form.

- Submit the completed form electronically and retain a copy for your records.

Legal use of the fillable online Florida corporate short form income tax

The Florida 1120A tax form is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, corporations must adhere to the guidelines set forth by the Florida Department of Revenue. This includes providing accurate information, signing the form electronically, and maintaining compliance with eSignature laws. Utilizing a trusted eSignature solution can enhance the legal standing of the submitted form, ensuring that it meets all necessary legal requirements.

Filing deadlines / important dates

Corporations must be aware of specific filing deadlines to avoid penalties and ensure compliance with Florida tax laws. Generally, the Florida 1120A tax form is due on the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is typically due by April fifteenth. It is crucial for businesses to mark these dates on their calendars and prepare their financial documents in advance to facilitate timely filing.

Required documents

To accurately complete the Florida 1120A tax form, corporations need to gather several key documents:

- Financial statements, including income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for any deductions or credits claimed.

- Federal tax returns, as they may provide necessary information for state filing.

Form submission methods (online / mail / in-person)

The Florida 1120A tax form can be submitted through various methods to accommodate different preferences:

- Online submission: Corporations can complete and submit the form electronically via the Florida Department of Revenue's online portal.

- Mail submission: Alternatively, businesses may print the completed form and mail it to the designated address provided by the Florida Department of Revenue.

- In-person submission: Corporations can also choose to deliver the form in person at local tax offices, though this method may be less common.

Eligibility criteria

To qualify for using the Florida 1120A tax form, corporations must meet specific eligibility criteria set by the Florida Department of Revenue. Generally, these criteria include:

- The corporation must be classified as a C corporation.

- Gross income should not exceed a certain threshold, which is subject to change annually.

- The corporation must be operating in Florida and subject to state corporate income tax.

Quick guide on how to complete fillable online florida corporate short form income tax

Complete Fillable Online Florida Corporate Short Form Income Tax effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents rapidly without complications. Manage Fillable Online Florida Corporate Short Form Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and electronically sign Fillable Online Florida Corporate Short Form Income Tax with ease

- Acquire Fillable Online Florida Corporate Short Form Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Fillable Online Florida Corporate Short Form Income Tax and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online florida corporate short form income tax

The best way to generate an e-signature for your PDF document online

The best way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Florida 1120A tax form?

The Florida 1120A tax form is used by corporations to report their income and calculate their tax obligations to the state of Florida. It ensures that businesses comply with state tax regulations and accurately document their financial activities. eSigning and submitting this form can be efficiently managed with airSlate SignNow.

-

How can airSlate SignNow help with the Florida 1120A tax filing process?

airSlate SignNow simplifies the Florida 1120A tax filing process by allowing businesses to easily prepare, send, and eSign their tax documents electronically. This streamlined approach saves time and ensures accuracy, helping to avoid common mistakes associated with manual filing. You can manage your tax paperwork efficiently using airSlate SignNow's features.

-

Is there a cost associated with using airSlate SignNow for Florida 1120A tax forms?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. The cost is competitive and includes features that facilitate the eSigning process, making it cost-effective for managing your Florida 1120A tax filings. You can choose a plan that best fits your business size and requirements.

-

What features does airSlate SignNow offer for managing Florida 1120A tax documents?

airSlate SignNow provides robust features including customizable templates, automated workflows, and secure document storage to help manage Florida 1120A tax documents. The platform also ensures compliance and security for sensitive information, making it a reliable choice for tax management. Its user-friendly interface allows for seamless navigation.

-

Can I integrate airSlate SignNow with my accounting software for Florida 1120A tax preparation?

Yes, airSlate SignNow can be easily integrated with various accounting software solutions, helping to streamline the Florida 1120A tax preparation process. This integration allows for smooth data transfer and reduces manual entry errors. By linking your accounting tools, you can enhance your tax filing efficiency.

-

How does eSigning aid in the Florida 1120A tax filing process?

eSigning with airSlate SignNow aids in the Florida 1120A tax filing process by ensuring documents are signed securely and promptly. This eliminates the need for physical signatures, thus expediting the submission and approval processes. It also provides a complete audit trail of signed documents for compliance purposes.

-

What benefits can businesses expect from using airSlate SignNow for Florida 1120A tax?

Businesses using airSlate SignNow for Florida 1120A tax can expect improved efficiency, reduced processing times, and enhanced security for sensitive tax documents. The convenience of electronic signing and document management allows businesses to focus on their operations rather than paperwork. Overall, it supports timely and accurate compliance.

Get more for Fillable Online Florida Corporate Short Form Income Tax

Find out other Fillable Online Florida Corporate Short Form Income Tax

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares