Fillable Online 8B BANKING CORPORATION TAX CLAIM for Form

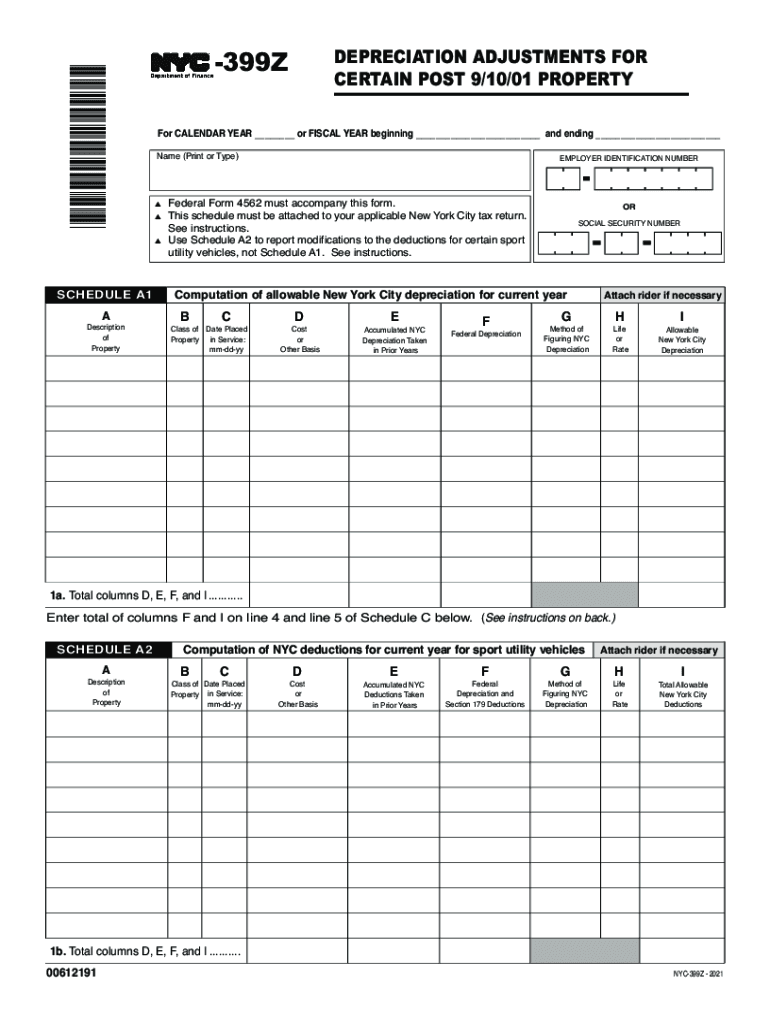

Understanding the 2021 NYC 399Z Form

The 2021 NYC 399Z form is a critical document used for reporting the New York City Banking Corporation Tax. This form is specifically designed for banking corporations operating within the city and is essential for accurately calculating tax liabilities. It requires detailed financial information, including income, deductions, and any applicable credits. Understanding the structure and requirements of the NYC 399Z is vital for compliance and ensuring accurate tax reporting.

Steps to Complete the 2021 NYC 399Z Form

Completing the 2021 NYC 399Z form involves several key steps. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form accurately, ensuring that all figures are correct and correspond to your financial records. Pay special attention to the sections requiring detailed explanations, such as adjustments and credits. Finally, review the completed form for accuracy before submission to avoid any potential penalties.

Required Documents for the 2021 NYC 399Z Form

To complete the 2021 NYC 399Z form, several documents are necessary. These include:

- Financial statements, including balance sheets and income statements.

- Records of any deductions claimed, such as operating expenses and depreciation.

- Documentation supporting any credits or adjustments made.

- Prior year tax returns for reference.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Filing Deadlines for the 2021 NYC 399Z Form

It is crucial to be aware of the filing deadlines associated with the 2021 NYC 399Z form. The form is typically due on the fifteenth day of the fourth month following the close of the tax year. For most banking corporations, this means the deadline will be April 15, 2022. Late submissions may incur penalties, so timely filing is essential to maintain compliance.

Legal Use of the 2021 NYC 399Z Form

The 2021 NYC 399Z form is legally binding when completed and submitted according to New York City tax regulations. It must be signed by an authorized representative of the banking corporation, affirming that the information provided is accurate and complete. Compliance with local tax laws is essential, as failure to file or inaccuracies can lead to legal repercussions and financial penalties.

Digital vs. Paper Version of the 2021 NYC 399Z Form

Both digital and paper versions of the 2021 NYC 399Z form are available for submission. The digital version offers the convenience of electronic filing, which can expedite processing times and reduce the risk of errors. Conversely, the paper version may be preferred by those who are more comfortable with traditional filing methods. Regardless of the format chosen, ensuring accuracy and compliance with submission guidelines is paramount.

Quick guide on how to complete fillable online 8b banking corporation tax claim for

Complete Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR effortlessly on any device

Online document management has become popular with businesses and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary for creating, editing, and electronically signing your documents swiftly without delays. Manage Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR without stress

- Locate Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online 8b banking corporation tax claim for

The best way to make an e-signature for your PDF in the online mode

The best way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2021 NYC 399z and how does it benefit my business?

The 2021 NYC 399z is a crucial form for NYC businesses that need to comply with various tax regulations. By utilizing airSlate SignNow, you can efficiently eSign and manage this document, saving time and ensuring compliance. Our platform makes it easy to fill out and submit your 2021 NYC 399z accurately and on time.

-

How does airSlate SignNow simplify the 2021 NYC 399z submission process?

airSlate SignNow streamlines the submission of the 2021 NYC 399z by providing an intuitive digital signature solution. You can easily create templates, fill in required information, and eSign documents all in one platform. This eliminates the hassle of paperwork and ensures that your submissions are compliant with NYC regulations.

-

What are the pricing options for using airSlate SignNow for the 2021 NYC 399z?

airSlate SignNow offers competitive pricing plans that cater to different business needs when managing the 2021 NYC 399z. You can choose from monthly or annual subscriptions, depending on your usage and requirements. Our plans are designed to be cost-effective, ensuring your business can efficiently handle document management and eSigning.

-

Are there any integration options available for handling the 2021 NYC 399z?

Yes, airSlate SignNow integrates seamlessly with a variety of popular business tools and applications. This means you can easily pull data from your existing systems to complete the 2021 NYC 399z without manual entry. Our integrations help improve efficiency and ensure smoother workflows across your organization.

-

What features does airSlate SignNow offer for the 2021 NYC 399z?

airSlate SignNow provides several features that enhance the handling of the 2021 NYC 399z, including customizable templates, automated reminders, and secure cloud storage. These features ensure that you have everything you need to complete and manage your documents efficiently. Moreover, you get real-time tracking for document status to stay informed at all times.

-

Is airSlate SignNow compliant with NYC regulations for the 2021 NYC 399z?

Absolutely! airSlate SignNow is designed to comply with all relevant NYC regulations when it comes to eSigning the 2021 NYC 399z. Our platform adheres to industry standards for security and legal validity, ensuring that your electronically signed documents are accepted by tax authorities.

-

What are the benefits of using airSlate SignNow for the 2021 NYC 399z compared to other solutions?

Using airSlate SignNow for the 2021 NYC 399z offers signNow benefits, such as ease of use, cost-effectiveness, and robust security features. Unlike traditional methods, our solution allows you to process documents faster and more efficiently, enabling quicker business decisions. Furthermore, our dedicated customer support is always available to assist you with any concerns.

Get more for Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR

Find out other Fillable Online 8B BANKING CORPORATION TAX CLAIM FOR

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors