NY DTF it 2663 Fill Out Tax Template Online 2021

What is the NY DTF IT 2663 Form?

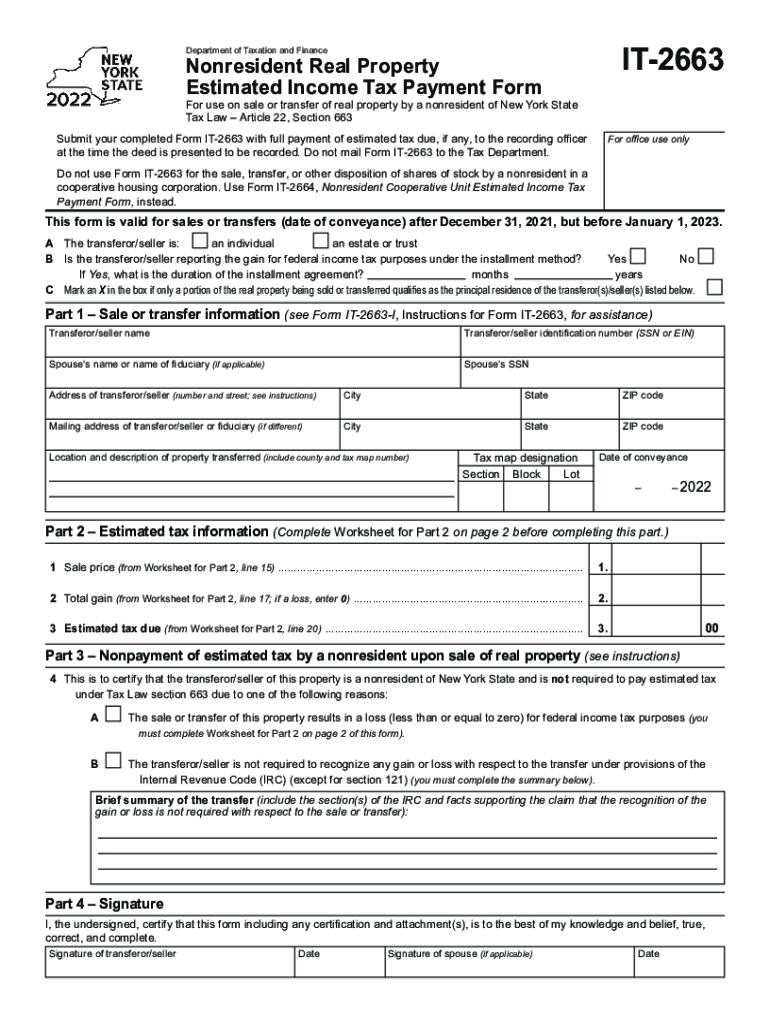

The NY DTF IT 2663 form is a state tax document used in New York for the purpose of claiming a credit for taxes paid to other jurisdictions. This form is particularly relevant for individuals who have earned income in states outside of New York and are seeking to avoid double taxation. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and maximizing potential tax credits. The IT 2663 form must be filled out accurately to reflect the income earned and taxes paid in other states.

Steps to Complete the NY DTF IT 2663 Form

Completing the NY DTF IT 2663 form involves several key steps:

- Gather necessary documentation, including W-2s and any tax returns from other states.

- Fill out personal information, such as your name, address, and Social Security number.

- Report income earned in other states and the corresponding taxes paid.

- Calculate the credit for taxes paid using the provided instructions on the form.

- Review the completed form for accuracy before submission.

Following these steps carefully helps ensure that your submission is complete and compliant with New York state tax laws.

Legal Use of the NY DTF IT 2663 Form

The NY DTF IT 2663 form is legally recognized for claiming tax credits and must be used in accordance with New York tax laws. Proper completion of this form is essential for ensuring that taxpayers receive the credits they are entitled to without facing penalties. It is important to understand that inaccurate or incomplete submissions can lead to delays in processing or potential audits. Therefore, using the form correctly is crucial for maintaining compliance with state regulations.

Filing Deadlines for the NY DTF IT 2663 Form

Filing deadlines for the NY DTF IT 2663 form typically align with the general tax filing deadlines in New York. Taxpayers should ensure that they submit the form by the due date to avoid any penalties. Generally, the deadline is April 15 for individuals, but it may vary based on specific circumstances or extensions. Staying informed about these deadlines helps taxpayers plan their submissions effectively.

Required Documents for the NY DTF IT 2663 Form

When completing the NY DTF IT 2663 form, several documents are required to support your claims:

- W-2 forms from employers showing income earned.

- Tax returns from other states where income was earned.

- Any additional documentation that verifies taxes paid to other jurisdictions.

Having these documents ready ensures a smoother filing process and helps substantiate your claims for tax credits.

Who Issues the NY DTF IT 2663 Form?

The NY DTF IT 2663 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that taxpayers adhere to state tax laws. For any questions or clarifications regarding the form, taxpayers can refer to the resources provided by the Department of Taxation and Finance.

Quick guide on how to complete ny dtf it 2663 2021 2022 fill out tax template online

Complete NY DTF IT 2663 Fill Out Tax Template Online effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage NY DTF IT 2663 Fill Out Tax Template Online on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign NY DTF IT 2663 Fill Out Tax Template Online effortlessly

- Find NY DTF IT 2663 Fill Out Tax Template Online and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign NY DTF IT 2663 Fill Out Tax Template Online and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny dtf it 2663 2021 2022 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the ny dtf it 2663 2021 2022 fill out tax template online

The way to create an e-signature for a PDF file online

The way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the IT 2663 form 2022 and who needs it?

The IT 2663 form 2022 is a New York State tax form used by taxpayers to report gains or losses from the sale of real property. If you have sold real estate in New York and are required to pay taxes on the transaction, you will need to complete the IT 2663 form 2022. It is essential for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with completing the IT 2663 form 2022?

AirSlate SignNow offers a user-friendly platform that simplifies the process of filling out and eSigning the IT 2663 form 2022. With features like document templates and real-time collaboration, users can efficiently manage and finalize their tax documents without any hassle. Our solution saves time and minimizes errors during the submission process.

-

What are the pricing options for using airSlate SignNow for IT 2663 form 2022?

AirSlate SignNow offers various pricing plans to cater to different needs, starting from a free trial to affordable monthly subscriptions. Each plan provides access to features that streamline the completion and signing of documents, including the IT 2663 form 2022. Users can choose a plan that best fits their budget and document volume.

-

What features does airSlate SignNow provide for the IT 2663 form 2022?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and document storage, all of which facilitate easier completion of the IT 2663 form 2022. Additionally, our platform supports team collaboration and ensures that all document transactions are encrypted for maximum security. These features enhance user productivity and document management.

-

Is it easy to integrate airSlate SignNow with other applications for managing the IT 2663 form 2022?

Yes, airSlate SignNow is designed for seamless integration with various applications such as Google Drive, Dropbox, and CRM systems. This interoperability allows users to easily import and manage their documents, including the IT 2663 form 2022, directly from their preferred workflow tools. Integration helps streamline the process from form completion to eSignature.

-

What benefits do I get from using airSlate SignNow for the IT 2663 form 2022?

Using airSlate SignNow for the IT 2663 form 2022 brings several benefits, including time savings, enhanced accuracy, and reduced paperwork. The platform's automation features eliminate the need for manual document handling, allowing for quicker turnaround times. Furthermore, the ability to securely eSign documents enhances convenience and compliance.

-

Can I access my IT 2663 form 2022 from any device?

Absolutely! AirSlate SignNow is a cloud-based solution, which means you can access your IT 2663 form 2022 and other documents from any internet-enabled device, including smartphones, tablets, and computers. This accessibility ensures that you can manage your tax documents on-the-go, providing flexibility and convenience for users.

Get more for NY DTF IT 2663 Fill Out Tax Template Online

Find out other NY DTF IT 2663 Fill Out Tax Template Online

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter