Fillable Online Form it 2664 Fax Email Print pdfFiller 2022

Understanding the 2014 NY Form IT-2664

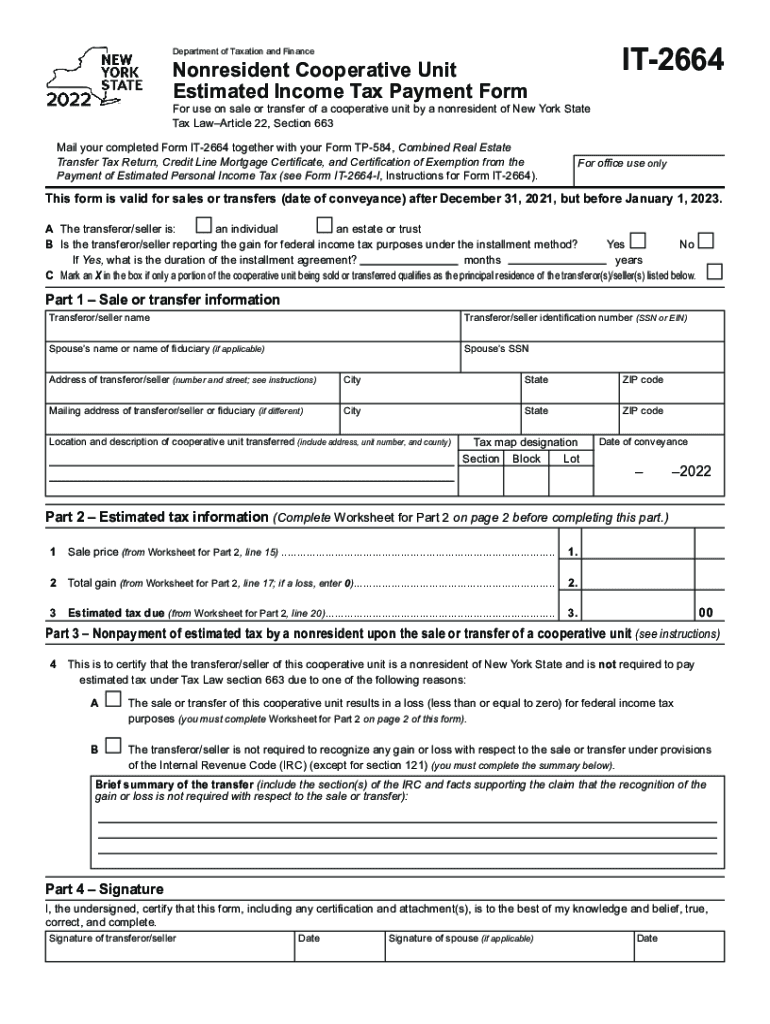

The 2014 NY Form IT-2664 is a crucial document for individuals and businesses in New York who need to report and pay estimated taxes. This form is specifically designed for those who are required to make estimated tax payments, ensuring compliance with state tax regulations. The form captures essential information regarding the taxpayer's income, deductions, and tax credits, which are necessary for calculating the estimated tax liability.

Steps to Complete the 2014 NY Form IT-2664

Completing the 2014 NY Form IT-2664 involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including income statements and previous tax returns.

- Calculate Estimated Income: Determine your expected income for the year, including wages, business income, and any other sources.

- Determine Deductions and Credits: Identify any deductions and credits you may be eligible for, which will impact your estimated tax.

- Fill Out the Form: Enter the calculated figures into the appropriate sections of the form, ensuring accuracy.

- Review and Submit: Double-check all entries for correctness before submitting the form electronically or via mail.

Filing Deadlines for the 2014 NY Form IT-2664

It is essential to be aware of the filing deadlines for the 2014 NY Form IT-2664 to avoid penalties. Generally, estimated tax payments are due quarterly. The specific due dates for the 2014 tax year are:

- April 15, 2014

- June 15, 2014

- September 15, 2014

- January 15, 2015

Filing on time ensures compliance with New York State tax laws and helps avoid interest and penalties.

Legal Use of the 2014 NY Form IT-2664

The 2014 NY Form IT-2664 is legally binding when completed and submitted according to state regulations. To ensure its validity:

- Use a reliable method for electronic submission, ensuring that the signature is compliant with eSignature laws.

- Maintain records of all submitted forms and any correspondence with the tax authority.

- Be aware of any updates to tax laws that may affect the filing process or requirements.

Form Submission Methods for the 2014 NY Form IT-2664

Taxpayers have several options for submitting the 2014 NY Form IT-2664:

- Online Submission: Utilize the New York State Department of Taxation and Finance's online portal for a quick and secure filing process.

- Mail: Print the completed form and send it to the designated address provided by the tax authority.

- In-Person: Visit a local tax office to submit the form directly, if preferred.

Choosing the right submission method can enhance the efficiency and security of your tax filing process.

Quick guide on how to complete fillable online form it 2664 fax email print pdffiller

Manage Fillable Online Form IT 2664 Fax Email Print PdfFiller seamlessly on any device

Digital document handling has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents quickly without any hold-ups. Process Fillable Online Form IT 2664 Fax Email Print PdfFiller on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to adjust and eSign Fillable Online Form IT 2664 Fax Email Print PdfFiller with ease

- Locate Fillable Online Form IT 2664 Fax Email Print PdfFiller and select Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your adjustments.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign Fillable Online Form IT 2664 Fax Email Print PdfFiller and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online form it 2664 fax email print pdffiller

Create this form in 5 minutes!

How to create an eSignature for the fillable online form it 2664 fax email print pdffiller

The way to create an e-signature for a PDF file in the online mode

The way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What are 2014 NY forms available for e-signing with airSlate SignNow?

airSlate SignNow offers a variety of 2014 NY forms that can be easily e-signed, including tax forms and legal contracts. Our platform supports seamless integration with these forms, making it easier for businesses to handle documentation without stress. You can quickly find and utilize the essential 2014 NY forms in our template library.

-

How does pricing work for using 2014 NY forms on airSlate SignNow?

Pricing for using 2014 NY forms with airSlate SignNow is flexible and tailored to your business needs. We offer a range of subscription plans that allow you to access unlimited document signing and e-signature features. Whether you are a small business or a large corporation, our pricing is designed to be cost-effective.

-

What features make airSlate SignNow suitable for completing 2014 NY forms?

airSlate SignNow provides a user-friendly interface along with features such as document templates, in-app notifications, and real-time tracking for 2014 NY forms. Our platform supports multiple signature options, ensuring compliance and ease of use for all users. These features streamline the completion process for any legal or business forms.

-

Can airSlate SignNow integrate with other software for handling 2014 NY forms?

Yes, airSlate SignNow can integrate seamlessly with various third-party applications for managing 2014 NY forms. This allows you to connect with platforms such as CRM and project management tools, enhancing your workflow efficiency. Integration means you can automate document sending and receiving, saving you valuable time.

-

What are the benefits of e-signing 2014 NY forms with airSlate SignNow?

E-signing 2014 NY forms with airSlate SignNow offers numerous benefits, including enhanced security, reduced turnaround time, and better compliance with legal standards. This digital process eliminates the need for physical paperwork, ensuring your documents are processed quickly and safely. Additionally, it helps to maintain an organized archive of your signed forms.

-

Is it safe to use airSlate SignNow for 2014 NY forms?

Absolutely, airSlate SignNow employs top-notch security measures to protect your 2014 NY forms. Our platform utilizes encryption, secure storage, and robust authentication methods to keep your documents safe and confidential. You can trust that your sensitive information is handled with the utmost care.

-

How can I get started with airSlate SignNow for 2014 NY forms?

Getting started with airSlate SignNow for 2014 NY forms is simple. You can sign up for a free trial on our website, explore our features, and access the library of forms. Once you're ready, choose a subscription plan that best fits your business needs, and start e-signing your documents today!

Get more for Fillable Online Form IT 2664 Fax Email Print PdfFiller

Find out other Fillable Online Form IT 2664 Fax Email Print PdfFiller

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form