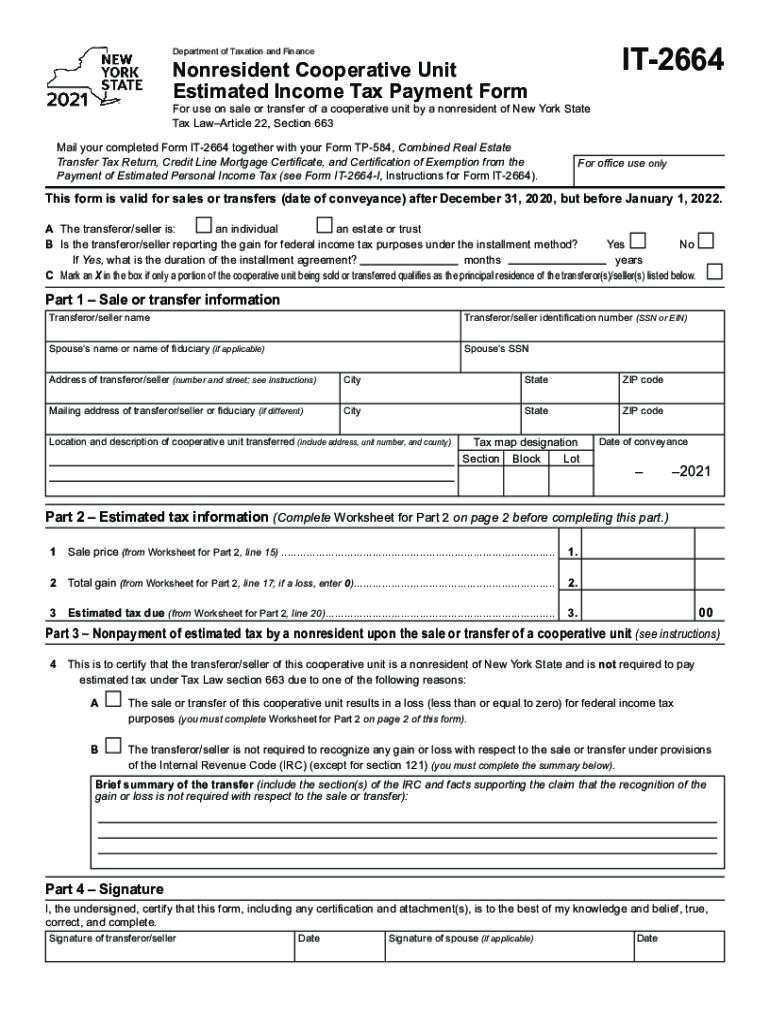

it 2664 Department of Taxation and Finance 2021

What is the IT 2664 Department Of Taxation And Finance

The IT 2664 form is a New York State tax form used by fiduciaries to report estimated tax payments for the estate or trust. This form is essential for ensuring that any tax liabilities are met in a timely manner, helping to avoid penalties and interest charges. The New York State Department of Taxation and Finance requires this form to facilitate proper tax collection from estates or trusts that generate income.

Steps to complete the IT 2664 Department Of Taxation And Finance

Completing the IT 2664 form involves several key steps:

- Gather necessary information, including the estate or trust's income details.

- Calculate the estimated tax liability based on the income generated.

- Fill out the IT 2664 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online, by mail, or in person, depending on your preference.

Legal use of the IT 2664 Department Of Taxation And Finance

The IT 2664 form is legally binding when completed and submitted according to New York State tax laws. It must be filled out accurately to ensure compliance with tax regulations. Failure to submit the form or providing incorrect information can lead to penalties, including fines and interest on unpaid taxes. Utilizing a reliable eSignature platform can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IT 2664 form. Generally, the estimated tax payments are due quarterly. The specific due dates may vary each year, so it is advisable to check the New York State Department of Taxation and Finance website for the most current information. Missing these deadlines can result in penalties and interest charges on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The IT 2664 form can be submitted through various methods to accommodate different preferences:

- Online: Submit the form electronically through the New York State Department of Taxation and Finance website.

- By Mail: Print the completed form and send it to the appropriate tax office address as specified by the Department.

- In-Person: Deliver the form directly to a local tax office if you prefer face-to-face interaction.

Who Issues the Form

The IT 2664 form is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax collection and ensuring compliance with state tax laws. They provide the necessary forms and guidance for taxpayers, including fiduciaries managing estates or trusts.

Quick guide on how to complete it 2664 department of taxation and finance

Complete IT 2664 Department Of Taxation And Finance easily on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to find the correct template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without interruptions. Manage IT 2664 Department Of Taxation And Finance on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign IT 2664 Department Of Taxation And Finance effortlessly

- Obtain IT 2664 Department Of Taxation And Finance and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select your preferred method to share your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign IT 2664 Department Of Taxation And Finance and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 2664 department of taxation and finance

Create this form in 5 minutes!

How to create an eSignature for the it 2664 department of taxation and finance

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the 2018 NY form and who needs it?

The 2018 NY form refers to the tax forms that New York residents must complete for tax reporting. It is essential for individuals and businesses operating in New York to ensure they file these forms accurately to avoid penalties and ensure compliance.

-

How can airSlate SignNow help with the 2018 NY form?

airSlate SignNow streamlines the signing and management of your 2018 NY form by providing a user-friendly electronic signature solution. This ensures faster processing and easier collaboration with your tax professionals or partners.

-

Is airSlate SignNow cost-effective for managing the 2018 NY form?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit different business needs, making it a cost-effective solution for managing the 2018 NY form. By reducing paperwork and increasing efficiency, businesses can save money when preparing their tax documents.

-

What features does airSlate SignNow offer for the 2018 NY form?

airSlate SignNow provides various features such as electronic signatures, document templates, and cloud storage, all of which aid in preparing the 2018 NY form. These features are designed to simplify document management and ensure compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software for my 2018 NY form?

Absolutely! airSlate SignNow seamlessly integrates with several third-party applications, allowing you to sync your data and streamline the preparation process for the 2018 NY form. This integration helps maintain consistency and accuracy across your business operations.

-

What are the benefits of using airSlate SignNow for the 2018 NY form?

Using airSlate SignNow for the 2018 NY form brings numerous benefits, including improved efficiency, enhanced security, and a better overall user experience. The platform allows for easy tracking of document statuses and ensures that your forms are signed promptly.

-

Is there customer support available for using airSlate SignNow with the 2018 NY form?

Yes, airSlate SignNow provides customer support to assist users with any queries related to the 2018 NY form. Whether you need help with features or troubleshooting issues, our support team is readily available to ensure a smooth experience.

Get more for IT 2664 Department Of Taxation And Finance

- Rental application equal housing opportunity form

- Romania visa application form pdf

- Hesto application form 2022

- Zambia police application forms

- S95 practice test multiple choice form

- Typical plant and animal cells diagram and coloring activity form

- Parents waiver for ojt form

- Blank coverage cert ma pfl form

Find out other IT 2664 Department Of Taxation And Finance

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement