Form it 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form Tax Year 2024-2026

What is the Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form?

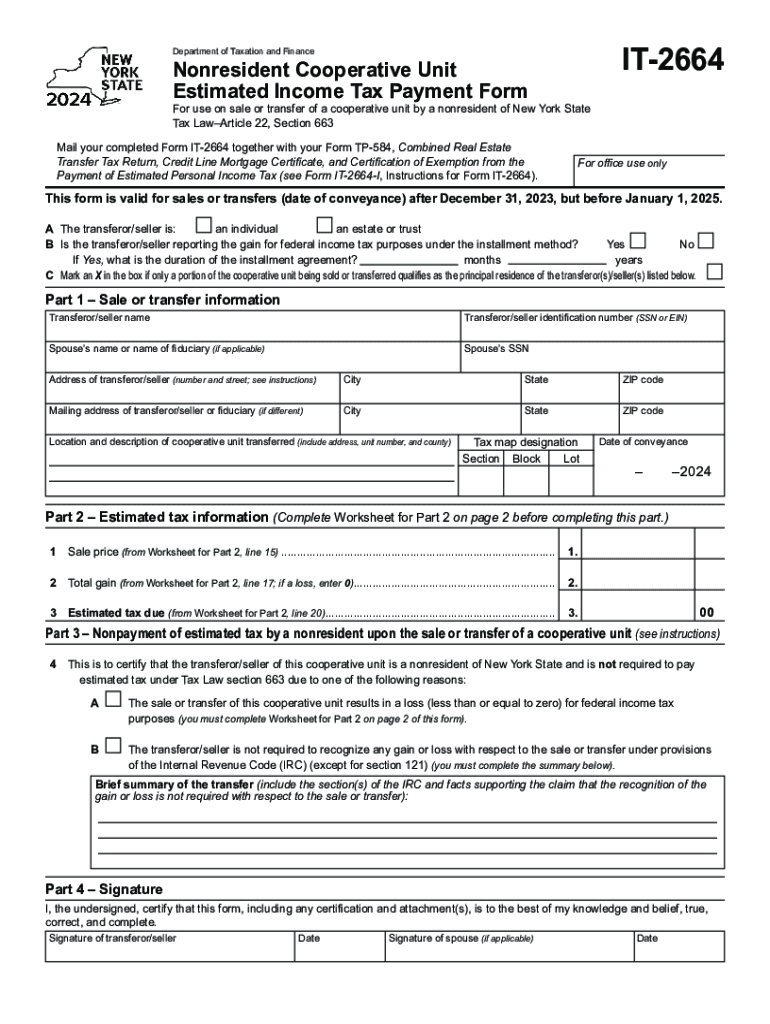

The Form IT 2664 is a tax document used by nonresident cooperative units in New York to report and pay estimated income taxes. This form is specifically designed for cooperatives that operate in New York but have members who reside outside the state. It allows these entities to calculate their estimated tax liability based on their income, ensuring compliance with New York state tax regulations. Understanding this form is crucial for nonresident cooperatives to avoid penalties and ensure proper tax payments.

How to Use the Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form

To effectively use the Form IT 2664, nonresident cooperatives must first gather all necessary financial information. This includes income statements, expense reports, and any other relevant documentation that reflects the cooperative's financial performance. The form requires specific details about the cooperative's income, deductions, and credits applicable to nonresidents. Once all information is compiled, the cooperative can fill out the form accurately, ensuring that all calculations are correct to avoid underpayment or overpayment of taxes.

Steps to Complete the Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form

Completing the Form IT 2664 involves several steps:

- Gather all financial documents related to the cooperative's income and expenses.

- Calculate the total income for the tax year, including any taxable income derived from New York sources.

- Determine allowable deductions and credits that apply to the cooperative.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline to avoid penalties.

Key Elements of the Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form

The Form IT 2664 includes several key elements that are essential for accurate reporting:

- Identification Information: This includes the cooperative's name, address, and taxpayer identification number.

- Income Details: A section to report total income earned by the cooperative during the tax year.

- Deductions: Areas to list any deductions the cooperative is eligible for, which can reduce taxable income.

- Estimated Tax Calculation: A calculation section to determine the estimated tax owed based on the reported income and deductions.

- Signature: A section requiring the signature of an authorized representative of the cooperative.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2664 are critical to ensure compliance with New York tax laws. The form must be submitted by the 15th day of the fourth month following the end of the cooperative's tax year. For cooperatives operating on a calendar year basis, this typically means the form is due by April 15. It is important to keep track of these deadlines to avoid late fees and penalties.

Legal Use of the Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form

The legal use of Form IT 2664 is mandated by New York state tax law for nonresident cooperatives. This form serves as a declaration of estimated tax payments and ensures that cooperatives meet their tax obligations. Proper use of the form not only helps in compliance but also protects the cooperative from potential audits and penalties associated with incorrect tax filings. It is advisable for cooperatives to consult with a tax professional to ensure all legal requirements are met when using this form.

Create this form in 5 minutes or less

Find and fill out the correct form it 2664 nonresident cooperative unit estimated income tax payment form tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 2664 nonresident cooperative unit estimated income tax payment form tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ny it 2664 and how does it relate to airSlate SignNow?

Ny it 2664 refers to a specific regulation that impacts electronic signatures in New York. airSlate SignNow complies with these regulations, ensuring that your eSignatures are legally binding and secure. This compliance helps businesses streamline their document processes while adhering to state laws.

-

How much does airSlate SignNow cost for businesses in New York?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses in New York. With features tailored to meet the needs of ny it 2664 compliance, you can select a plan that fits your budget while ensuring legal adherence. Contact our sales team for detailed pricing information.

-

What features does airSlate SignNow offer to support ny it 2664 compliance?

airSlate SignNow offers a range of features that support ny it 2664 compliance, including secure eSigning, document tracking, and audit trails. These features ensure that all electronic signatures are verifiable and legally binding. Additionally, our platform is user-friendly, making it easy for businesses to manage their documents efficiently.

-

Can airSlate SignNow integrate with other software for businesses in New York?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect with them to streamline your document processes while ensuring compliance with ny it 2664. Check our integrations page for a full list of compatible applications.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. By complying with ny it 2664, businesses can ensure their electronic signatures are valid and recognized. This not only saves time but also improves customer satisfaction by simplifying the signing process.

-

Is airSlate SignNow suitable for small businesses in New York?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses in New York. With its cost-effective pricing and features that comply with ny it 2664, small businesses can leverage the power of electronic signatures without breaking the bank. Our platform is scalable, allowing you to grow as your business needs evolve.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents through advanced encryption and secure storage solutions. Our compliance with ny it 2664 means that your eSignatures and documents are protected under state regulations. We also provide features like two-factor authentication to further enhance security and protect sensitive information.

Get more for Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form Tax Year

- Usace safety inspection checklist form

- Fmla leave tracker form

- Hbuhsd physical form

- Performance management feedback form for colleagues or co workers

- Using sage 50 accounting pdf download form

- United kingdom islamic bank britain form

- Form 1040 sp u s individual income tax return spanish version 624654294

- Field rental agreement template 787742269 form

Find out other Form IT 2664 Nonresident Cooperative Unit Estimated Income Tax Payment Form Tax Year

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free