SCHEDULE in 117 Credit for Income Tax Paid to Other State Form

Understanding the SCHEDULE IN 117 Credit for Income Tax Paid to Other State

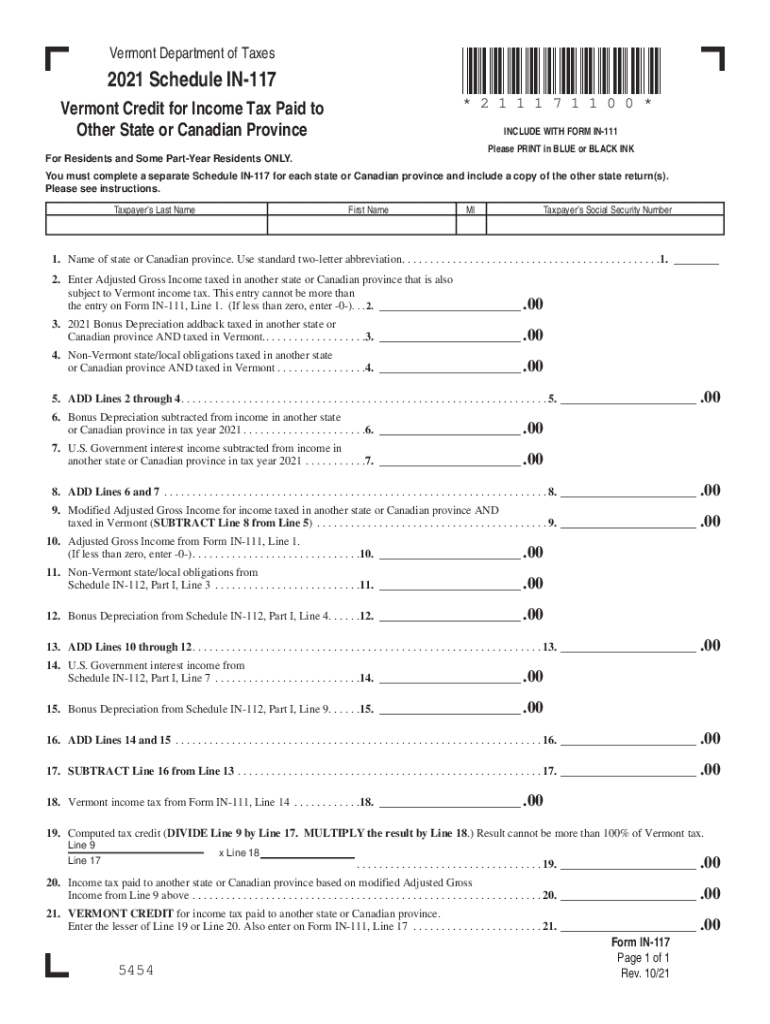

The SCHEDULE IN 117 Credit allows taxpayers in Vermont to claim a credit for income taxes paid to other states. This credit is designed to prevent double taxation, ensuring that residents do not pay taxes on the same income in multiple jurisdictions. To qualify for this credit, taxpayers must have paid income tax to another state on income that is also subject to Vermont income tax. The credit can significantly reduce the overall tax liability for individuals who earn income in multiple states.

Steps to Complete the SCHEDULE IN 117 Credit

Completing the SCHEDULE IN 117 Credit involves several key steps:

- Gather documentation of taxes paid to the other state, including forms and receipts.

- Fill out the SCHEDULE IN 117 form, providing details about the income earned and taxes paid to the other state.

- Calculate the credit amount based on the lesser of the tax paid to the other state or the Vermont tax liability on the same income.

- Attach the completed SCHEDULE IN 117 to your Vermont income tax return.

Eligibility Criteria for the SCHEDULE IN 117 Credit

To be eligible for the SCHEDULE IN 117 Credit, taxpayers must meet specific criteria:

- Be a resident of Vermont for the tax year in question.

- Have paid income tax to another state on income that is also taxed by Vermont.

- Provide proof of the taxes paid to the other state, such as tax returns or payment receipts.

Required Documents for the SCHEDULE IN 117 Credit

When applying for the SCHEDULE IN 117 Credit, taxpayers should prepare the following documents:

- Tax returns from the other state where income tax was paid.

- Proof of payment, such as canceled checks or bank statements.

- The completed SCHEDULE IN 117 form.

Filing Deadlines for the SCHEDULE IN 117 Credit

It is crucial to be aware of the filing deadlines for the SCHEDULE IN 117 Credit. Typically, Vermont income tax returns, including any credits, must be filed by April 15 of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that they submit their forms and any supporting documentation by the deadline to avoid penalties.

Form Submission Methods for the SCHEDULE IN 117 Credit

Taxpayers can submit the SCHEDULE IN 117 Credit through various methods:

- Online submission via the Vermont Department of Taxes website, if applicable.

- Mailing a paper copy of the completed form along with the Vermont income tax return to the appropriate address.

- In-person submission at designated tax offices, where available.

Quick guide on how to complete schedule in 117 credit for income tax paid to other state

Prepare SCHEDULE IN 117 Credit For Income Tax Paid To Other State effortlessly on any gadget

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without hindrances. Manage SCHEDULE IN 117 Credit For Income Tax Paid To Other State on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest method to modify and eSign SCHEDULE IN 117 Credit For Income Tax Paid To Other State without hassle

- Find SCHEDULE IN 117 Credit For Income Tax Paid To Other State and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign SCHEDULE IN 117 Credit For Income Tax Paid To Other State and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule in 117 credit for income tax paid to other state

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What is the VT 117 tax form and its purpose?

The VT 117 tax form is used in Vermont for reporting and paying various state taxes. It helps individuals and businesses ensure compliance with state tax regulations. Understanding how to properly fill out the VT 117 tax form is crucial for avoiding penalties and legal issues.

-

How can airSlate SignNow help with the VT 117 tax process?

airSlate SignNow streamlines the process of preparing and signing the VT 117 tax form by allowing users to eSign documents securely. This simplifies the workflow, saving time and ensuring that all necessary signatures are obtained promptly. With airSlate SignNow, you can easily keep track of your tax documentation.

-

Is airSlate SignNow affordable for small businesses needing to manage VT 117 tax filings?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to manage their VT 117 tax filings. With flexible pricing plans, you can choose the option that best fits your budget while still accessing essential eSignature features. This makes it easier for small businesses to stay compliant without overspending.

-

Can I integrate airSlate SignNow with tax software when handling the VT 117 tax?

Absolutely! airSlate SignNow can be integrated with various tax software platforms, enhancing your workflow when dealing with the VT 117 tax form. By syncing data between your tax software and airSlate SignNow, you can reduce errors and streamline the documentation process.

-

What security measures does airSlate SignNow offer for handling the VT 117 tax form?

airSlate SignNow prioritizes security, featuring robust encryption and compliance with industry standards to protect your VT 117 tax information. Our platform ensures that your sensitive data is safeguarded during the signing process. You can trust airSlate SignNow to maintain confidentiality and integrity for all your tax documents.

-

Are there features specific to tax documentation in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax documentation, including customizable templates for the VT 117 tax form. With our easy-to-use drag-and-drop interface, you can create and modify documents effortlessly. This functionality helps ensure all necessary information is included accurately.

-

How quickly can I complete the VT 117 tax form using airSlate SignNow?

With airSlate SignNow, you can complete the VT 117 tax form quickly and efficiently, often in just a few minutes. Our streamlined document preparation and signing process allows you to gather the required signatures and finalize your tax forms rapidly. This efficiency helps you meet filing deadlines with ease.

Get more for SCHEDULE IN 117 Credit For Income Tax Paid To Other State

- Letter tenant landlord 497309691 form

- Temporary lease agreement to prospective buyer of residence prior to closing massachusetts form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497309693 form

- Letter from landlord to tenant returning security deposit less deductions massachusetts form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return massachusetts form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return form

- Letter from tenant to landlord containing request for permission to sublease massachusetts form

- Ma sublease form

Find out other SCHEDULE IN 117 Credit For Income Tax Paid To Other State

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online