100x 2021-2025 Form

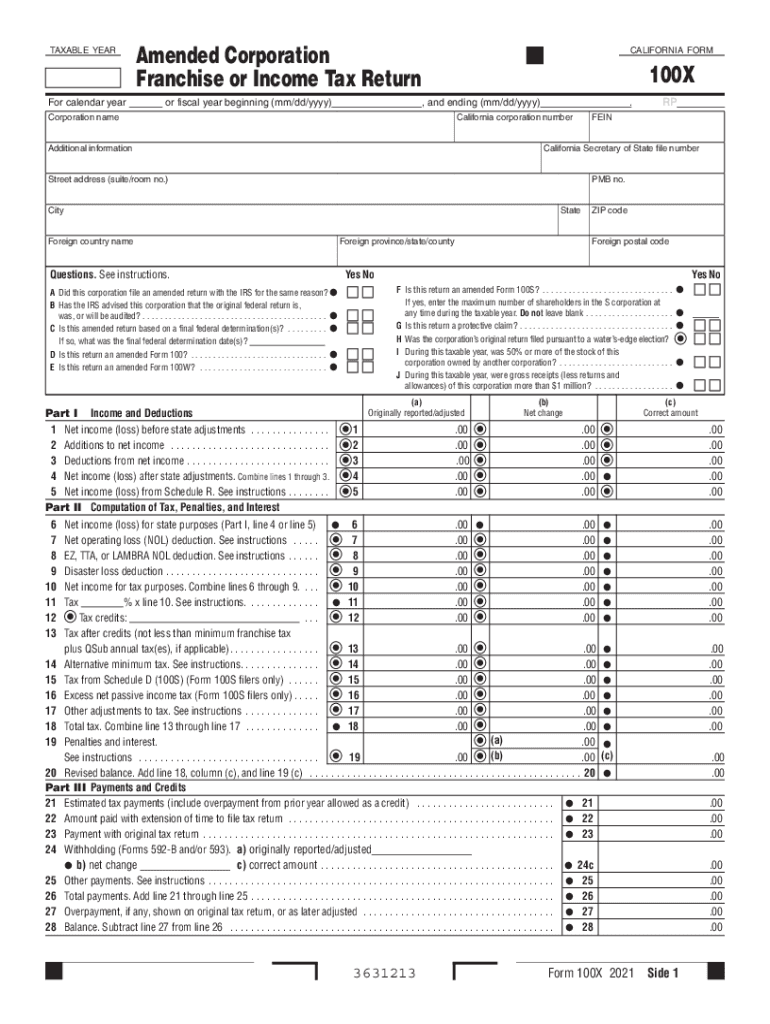

What is the Form 100x Amended Corporation Franchise or Income Tax Return?

The Form 100x is an essential document used by corporations in the United States to amend previously filed franchise or income tax returns. It allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. This form is particularly important for corporations that need to adjust reported income, deductions, or credits that may have been inaccurately reported in their original submissions.

Steps to Complete the Form 100x Amended Corporation Franchise or Income Tax Return

Completing the Form 100x requires careful attention to detail. Here are the key steps involved:

- Gather all relevant financial documents and previous tax returns.

- Clearly indicate the tax year for which you are amending the return.

- Provide accurate information in the designated sections, ensuring that all changes are clearly marked.

- Attach any supporting documents that justify the amendments, such as revised financial statements.

- Review the completed form for accuracy before submission.

Legal Use of the Form 100x Amended Corporation Franchise or Income Tax Return

The legal validity of the Form 100x hinges on adherence to specific guidelines set forth by state tax authorities. To ensure that the amended return is accepted, it must be signed by an authorized representative of the corporation. Additionally, the form must comply with all relevant tax laws, including proper documentation of any changes made. Failure to follow these legal requirements may result in penalties or rejection of the amended return.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100x can vary based on the state and the specific tax year being amended. Generally, corporations should file the amended return within a certain period after the original return was submitted, often within three years. It is crucial to check the specific deadlines for the state in which the corporation operates to avoid late fees or penalties.

Who Issues the Form 100x?

The Form 100x is issued by the state tax authority, which is responsible for overseeing corporate tax compliance. Each state may have its own version of the form, tailored to its specific tax regulations. Corporations should ensure they are using the correct form for their state to avoid complications during the filing process.

Examples of Using the Form 100x Amended Corporation Franchise or Income Tax Return

Corporations may find themselves needing to use the Form 100x in various scenarios, such as:

- Correcting a miscalculation of taxable income reported in the original return.

- Updating deductions that were initially overlooked or misreported.

- Adjusting credits claimed based on new information or changes in tax law.

Each of these examples highlights the importance of accurately reflecting a corporation's financial position and compliance with tax obligations.

Quick guide on how to complete 100s instructions 2021

Effortlessly prepare 100s instructions 2021 on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-conscious alternative to conventional printed and signed materials, since you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly and without holdups. Manage form 100x from any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to amend and electronically sign 100x income with ease

- Find 100x form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Select pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to store your changes.

- Decide how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from your preferred gadget. Modify and electronically sign 100x corporation form while ensuring outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 100x amended

Related searches to 100x amended return

Create this form in 5 minutes!

How to create an eSignature for the 100x corporation

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an e-signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask 100s 2021

-

What is form 100x and how can it benefit my business?

Form 100x is a powerful document management tool that enables businesses to create, send, and eSign forms efficiently. By automating your document workflows, you can save time and reduce errors, ultimately enhancing productivity. With airSlate SignNow's form 100x, you can streamline your business processes and ensure compliance.

-

How much does it cost to use form 100x?

The pricing for using form 100x varies based on the plan you choose with airSlate SignNow. They offer flexible pricing tailored to suit different business needs, ensuring that you get the best value for your investment. For a detailed breakdown of costs, visit the pricing page on our website.

-

What features are included with form 100x?

Form 100x includes a variety of features such as customizable templates, eSigning capabilities, real-time tracking, and automated reminders. These features make it easy for businesses to manage their documents seamlessly. Additionally, you can collaborate with team members and collect payments if needed.

-

Can form 100x integrate with other software?

Yes, form 100x integrates smoothly with popular tools such as Google Drive, Salesforce, and Zapier. This means you can connect your existing software ecosystem with airSlate SignNow to further enhance your document management processes. Our integration capabilities ensure a seamless workflow across multiple platforms.

-

Is form 100x secure for sensitive information?

Absolutely! Form 100x prioritizes the security of your data by implementing advanced encryption and access controls. airSlate SignNow complies with industry standards to protect sensitive information, giving you peace of mind as you manage your important documents. Your security is our top priority.

-

How user-friendly is the form 100x interface?

The form 100x interface is designed to be intuitive and user-friendly, making it accessible for users of all skill levels. With its simple drag-and-drop functionalities, you can easily create and manage your forms without any technical difficulties. Training resources and customer support are also available to assist you.

-

What types of documents can I create using form 100x?

You can create a variety of documents with form 100x, including contracts, waivers, and consent forms. The flexibility of airSlate SignNow allows you to customize these documents to fit your specific needs. Whether it's for internal use or client onboarding, form 100x has you covered.

Get more for 100x form online

- Texaslawhelporg expunction form

- Portsmouth redevelopment and housing authority form

- Form cr 001 stanislaus 2012

- Code aw casino form

- Fp 76 rehabilitation questionnaire1doc application form interstate rehab llc

- Homeless court los angeles 2017 form

- Access vr form

- How to fill discharge form for patient 2011

Find out other 100x form printable

- Electronic signature Missouri Pharmacy Services Agreement Easy

- Electronic signature Missouri Pharmacy Services Agreement Safe

- Electronic signature Montana Pharmacy Services Agreement Online

- Electronic signature Montana Pharmacy Services Agreement Computer

- How To Electronic signature Missouri Pharmacy Services Agreement

- Electronic signature Montana Pharmacy Services Agreement Mobile

- Electronic signature Montana Pharmacy Services Agreement Now

- Electronic signature Nebraska Pharmacy Services Agreement Online

- How Do I Electronic signature Missouri Pharmacy Services Agreement

- Electronic signature Montana Pharmacy Services Agreement Later

- Electronic signature Montana Pharmacy Services Agreement Myself

- Help Me With Electronic signature Missouri Pharmacy Services Agreement

- Electronic signature Montana Pharmacy Services Agreement Free

- Electronic signature Nebraska Pharmacy Services Agreement Computer

- Electronic signature Montana Pharmacy Services Agreement Secure

- How Can I Electronic signature Missouri Pharmacy Services Agreement

- Electronic signature Montana Pharmacy Services Agreement Fast

- Electronic signature Montana Pharmacy Services Agreement Easy

- Electronic signature Montana Pharmacy Services Agreement Simple

- Electronic signature Nebraska Pharmacy Services Agreement Mobile