Form 100X Amended Corporation Franchise or Income Tax Return 2020

What is the Form 100X Amended Corporation Franchise Or Income Tax Return

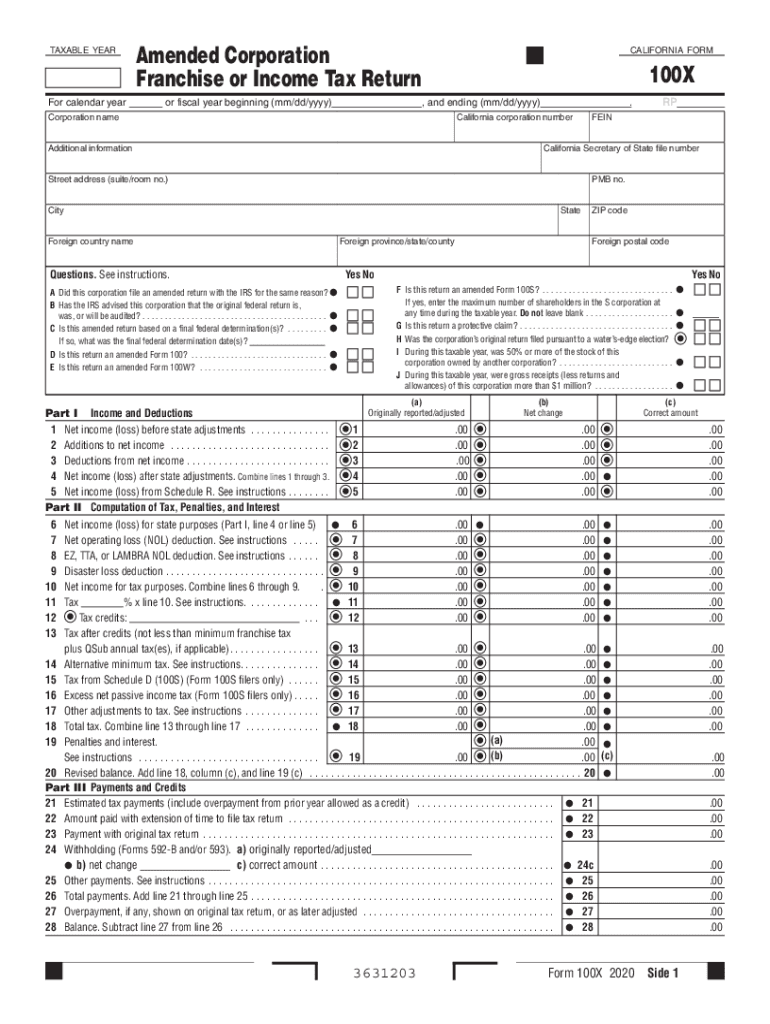

The Form 100X is utilized by corporations in California to amend their previously filed Franchise or Income Tax Returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. It is specifically designed for corporations that need to adjust their income, deductions, or credits reported in their original submissions. By filing the Form 100X, corporations can rectify inaccuracies and potentially recover overpaid taxes or address underreported liabilities.

How to use the Form 100X Amended Corporation Franchise Or Income Tax Return

Using the Form 100X involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the California Franchise Tax Board (FTB) website. Next, gather all necessary documentation that supports the amendments being made, such as financial statements or previous tax returns. Fill out the form accurately, clearly indicating the changes and providing explanations where necessary. Once completed, submit the form according to the guidelines provided by the FTB, either electronically or via mail.

Steps to complete the Form 100X Amended Corporation Franchise Or Income Tax Return

Completing the Form 100X requires careful attention to detail. Follow these steps for accurate filing:

- Obtain the latest version of the Form 100X from the FTB website.

- Review your original tax return to identify the specific areas that need correction.

- Fill in the form, ensuring that all necessary fields are completed, including your corporation's name, address, and tax identification number.

- Provide a clear explanation of the amendments being made in the designated section.

- Attach any supporting documents that justify the changes.

- Review the completed form for accuracy before submission.

- Submit the form by the appropriate deadline, ensuring compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100X are critical to avoid penalties. Typically, the amended return must be filed within six months of the original due date of the return being amended. It is essential to check the specific deadlines for the tax year in question, as they may vary. For example, if the original return was due on March 15, the amended return should be submitted by September 15 of the same year. Staying informed about these dates helps ensure timely compliance with California tax laws.

Key elements of the Form 100X Amended Corporation Franchise Or Income Tax Return

The Form 100X includes several key elements that are crucial for proper completion. These elements consist of:

- Identification Information: This includes the corporation's name, address, and California Corporation Number.

- Original Return Information: Details about the original return being amended, including the tax year and amounts reported.

- Amendment Details: A section to describe the specific changes being made, including reasons for the amendments.

- Signature: The form must be signed by an authorized representative of the corporation to validate the submission.

Legal use of the Form 100X Amended Corporation Franchise Or Income Tax Return

The legal use of the Form 100X is governed by California tax laws. It serves as an official document for corporations to amend their tax obligations, ensuring that all filings are accurate and comply with state regulations. By using this form, corporations can correct any inaccuracies in their tax returns, which is essential for maintaining good standing with the California Franchise Tax Board. Proper use of the Form 100X can also protect corporations from potential penalties associated with incorrect filings.

Quick guide on how to complete 2020 form 100x amended corporation franchise or income tax return

Effortlessly Prepare Form 100X Amended Corporation Franchise Or Income Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents promptly without delays. Manage Form 100X Amended Corporation Franchise Or Income Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Form 100X Amended Corporation Franchise Or Income Tax Return with Ease

- Locate Form 100X Amended Corporation Franchise Or Income Tax Return and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors requiring you to print new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Edit and electronically sign Form 100X Amended Corporation Franchise Or Income Tax Return and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 100x amended corporation franchise or income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 100x amended corporation franchise or income tax return

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is a filable form 100x?

A filable form 100x is a specialized document that allows users to input and submit information directly online. With airSlate SignNow, you can easily create, manage, and eSign your filable form 100x, streamlining your workflow and ensuring accuracy.

-

How much does it cost to use the filable form 100x feature with airSlate SignNow?

The cost of using the filable form 100x feature with airSlate SignNow varies depending on the subscription plan you choose. We offer flexible pricing that caters to businesses of all sizes, making it a cost-effective solution for managing your filable form 100x and other documents.

-

What are the key features of airSlate SignNow's filable form 100x?

AirSlate SignNow's filable form 100x includes features like customizable templates, user-friendly editing, and secure eSigning capabilities. These features enhance user experience, ensuring that your forms are not only easy to fill out but also legally binding.

-

How does airSlate SignNow improve the eSigning process for filable form 100x?

AirSlate SignNow simplifies the eSigning process for filable form 100x by enabling automated workflows and instant notifications. This efficient approach reduces the turnaround time for document approval, allowing your business to operate more smoothly.

-

Can I integrate filable form 100x with other software tools?

Yes, airSlate SignNow allows seamless integration of your filable form 100x with various CRM and project management tools. This capability helps streamline your processes and ensures that your team can work effectively across different platforms.

-

Is it secure to send and eSign filable form 100x using airSlate SignNow?

Absolutely! AirSlate SignNow utilizes advanced encryption to secure your data while sending and eSigning filable form 100x. This commitment to security provides peace of mind, as your sensitive information remains protected throughout the process.

-

What benefits can businesses gain from using filable form 100x?

Businesses can enhance efficiency, reduce paper usage, and improve accuracy by adopting filable form 100x. The transition to airSlate SignNow's digital solution helps organizations save time and resources, ultimately leading to better productivity.

Get more for Form 100X Amended Corporation Franchise Or Income Tax Return

Find out other Form 100X Amended Corporation Franchise Or Income Tax Return

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF