California Form 100x 2019

What is the California Form 100x

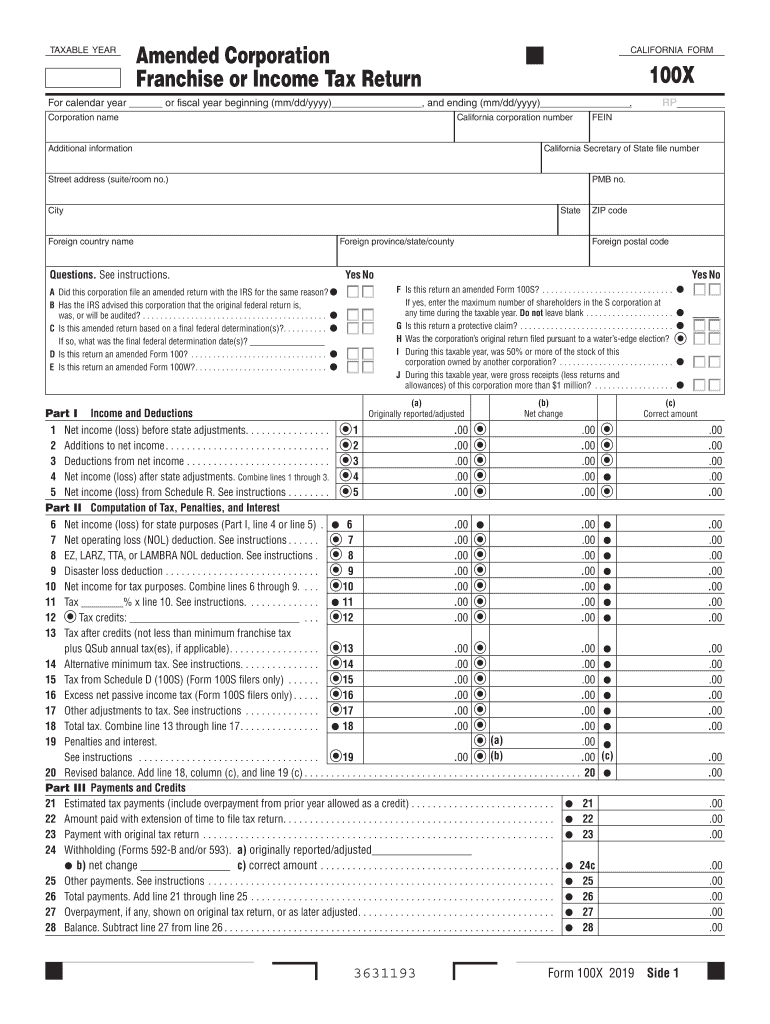

The California Form 100x is a tax form used by corporations to amend their California corporate income tax returns. This form allows businesses to correct errors or make adjustments to previously filed returns for the tax years specified. It is essential for ensuring compliance with California tax laws and for accurately reporting income, deductions, and credits. The form is specifically designed for corporations that need to amend their original Form 100 filings.

Steps to complete the California Form 100x

Completing the California Form 100x involves several key steps to ensure accuracy and compliance. Start by gathering all relevant financial documents and your original Form 100. Next, carefully review the original return to identify the specific areas that need correction. Fill out the Form 100x by entering the corrected information in the appropriate sections. Ensure that you provide a detailed explanation of the amendments made, as this will help the California Franchise Tax Board understand the changes. Finally, review the completed form for accuracy before submitting it.

Legal use of the California Form 100x

The legal use of the California Form 100x is crucial for maintaining compliance with state tax regulations. When properly completed and submitted, this form serves as an official request to amend a previously filed tax return. It is important to ensure that all information is accurate and that the form is submitted within the designated time frame to avoid potential penalties. The form must be signed by an authorized representative of the corporation, affirming that the information provided is true and complete.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 100x are critical to avoid penalties and interest. Generally, the amended return must be filed within six months of the original return's due date. For corporations, this typically means that if the original return was due on March 15, the amended return must be filed by September 15. It is advisable to check for any specific extensions or changes in deadlines that may apply to your situation, especially during tax season.

Required Documents

To complete the California Form 100x, certain documents are required to support the amendments being made. These may include the original Form 100, any relevant schedules or attachments that were part of the original filing, and documentation that justifies the changes, such as corrected financial statements or receipts. Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included.

Form Submission Methods (Online / Mail / In-Person)

The California Form 100x can be submitted through various methods, providing flexibility for businesses. Corporations can file the form online through the California Franchise Tax Board's website, which offers a secure and efficient way to submit amendments. Alternatively, the form can be mailed to the appropriate address provided by the Franchise Tax Board. In-person submissions may also be possible at designated tax offices, although this option may vary based on location and current regulations.

Quick guide on how to complete k 120 corporation income tax return kansas department of

Effortlessly Prepare California Form 100x on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage California Form 100x on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign California Form 100x with Ease

- Find California Form 100x and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow parts of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Choose how you wish to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign California Form 100x to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 120 corporation income tax return kansas department of

Create this form in 5 minutes!

How to create an eSignature for the k 120 corporation income tax return kansas department of

How to make an electronic signature for your K 120 Corporation Income Tax Return Kansas Department Of in the online mode

How to create an electronic signature for the K 120 Corporation Income Tax Return Kansas Department Of in Chrome

How to make an electronic signature for putting it on the K 120 Corporation Income Tax Return Kansas Department Of in Gmail

How to create an eSignature for the K 120 Corporation Income Tax Return Kansas Department Of right from your smartphone

How to make an electronic signature for the K 120 Corporation Income Tax Return Kansas Department Of on iOS devices

How to create an eSignature for the K 120 Corporation Income Tax Return Kansas Department Of on Android

People also ask

-

What is a filable form 100x?

A filable form 100x is a customizable digital template that allows users to input and manage specific information. This form is designed to streamline processes for businesses needing to collect data efficiently. With airSlate SignNow, incorporating a filable form 100x into your workflow is seamless and enhances document accuracy.

-

How can a filable form 100x benefit my business?

Utilizing a filable form 100x simplifies the document completion process for your team and clients. It reduces the time spent on paperwork and increases overall efficiency. By leveraging airSlate SignNow's features, your business can ensure that data is captured accurately and securely.

-

Is there a cost associated with using the filable form 100x through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the filable form 100x. These plans are designed to accommodate businesses of all sizes, providing advanced features at competitive prices. By investing in a subscription, you'll gain valuable tools to enhance your document management.

-

What features does airSlate SignNow offer for the filable form 100x?

airSlate SignNow provides a range of features for the filable form 100x, including drag-and-drop editing, signature capture, and integration capabilities. You can easily customize your forms to meet specific needs and track responses in real-time. These features ensure that your forms are both functional and user-friendly.

-

Can I integrate the filable form 100x with other applications?

Absolutely! airSlate SignNow allows seamless integration of the filable form 100x with various applications, including CRM systems, cloud storage, and project management tools. This integration streamlines your workflow and keeps all your important data synchronized across platforms.

-

Is it easy to create a filable form 100x using airSlate SignNow?

Yes, creating a filable form 100x in airSlate SignNow is user-friendly and intuitive. With its drag-and-drop functionality, you can quickly design and customize your forms without requiring extensive technical skills. You can have your form up and running in no time!

-

What kind of support can I expect when using the filable form 100x?

When you choose airSlate SignNow for the filable form 100x, you gain access to comprehensive customer support. This support includes tutorials, a knowledge base, and live chat assistance to help you maximize the use of your forms. Our team is dedicated to ensuring your success with our platform.

Get more for California Form 100x

- 2014 wyldlife bowlathon sponsor letter delta young life form

- Transfer midlothian isd form

- Scr carrier packet scr air form

- To download the feea emergency assistance application federal feea form

- Sbd 6398 san permit appl r0313doc co walworth wi form

- Concealed weapons flathead county form

- Summons circuit court of cook county cookcountycourt form

- W2 public partnership form

Find out other California Form 100x

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple