Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate

Understanding the Form 590 Withholding Exemption Certificate

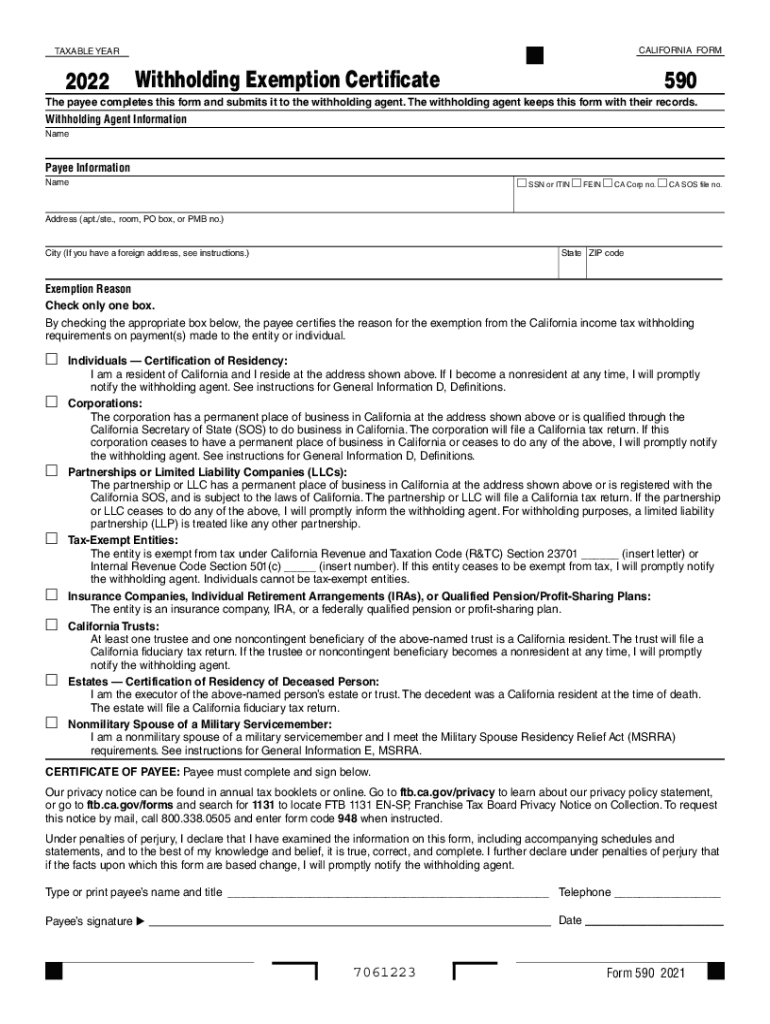

The Form 590 Withholding Exemption Certificate is a crucial document for California taxpayers. It allows individuals to claim exemption from withholding on certain types of income. This form is particularly important for those who expect to owe no California income tax for the year. By submitting this form, taxpayers can ensure they do not have unnecessary amounts withheld from their paychecks or other income sources.

Steps to Complete the Form 590 Withholding Exemption Certificate

Completing the Form 590 is straightforward. Here are the essential steps:

- Download the Form 590 from the California Franchise Tax Board website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the type of income for which you are claiming exemption.

- Sign and date the form to certify that the information provided is accurate.

Ensure that you keep a copy of the completed form for your records. This may be required for future reference or in case of an audit.

Legal Use of the Form 590 Withholding Exemption Certificate

The Form 590 serves a legal purpose in the context of tax withholding. By submitting this certificate, you are legally asserting that you qualify for withholding exemption based on your expected tax liability. It is essential to understand that providing false information on this form can lead to penalties, including fines and back taxes owed. Therefore, accuracy and honesty are paramount when filling out this document.

Eligibility Criteria for the Form 590 Withholding Exemption Certificate

To qualify for the withholding exemption using Form 590, you must meet specific criteria:

- You expect to owe no California income tax for the current tax year.

- Your total income is below the threshold that requires withholding.

- You are a resident of California or have income sourced from California.

Review these criteria carefully to ensure you are eligible before submitting the form.

How to Obtain the Form 590 Withholding Exemption Certificate

The Form 590 can be easily obtained through the California Franchise Tax Board's official website. It is available for download in PDF format, allowing you to print and complete it at your convenience. Additionally, some employers may provide this form directly to their employees, so it is worth checking with your HR department if you are unsure where to find it.

Filing Deadlines for the Form 590 Withholding Exemption Certificate

It is vital to be aware of the filing deadlines associated with the Form 590. Generally, this form should be submitted to your employer before the first paycheck of the tax year to ensure that your withholding exemption is applied correctly. If you miss this deadline, you may need to wait until the next tax year to claim your exemption.

Quick guide on how to complete 2022 form 590 withholding exemption certificate 2022 form 590 withholding exemption certificate

Complete Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate with ease

- Locate Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 590 withholding exemption certificate 2022 form 590 withholding exemption certificate

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF on Android OS

People also ask

-

What are the key features of airSlate SignNow in 2022?

In 2022, airSlate SignNow offers a robust set of features including electronic signatures, document templates, and secure cloud storage. These tools empower businesses to streamline their document workflows effectively. Additionally, the platform allows customization and automation to fit unique business needs.

-

How does airSlate SignNow's pricing structure work in 2022?

In 2022, airSlate SignNow provides flexible pricing plans that cater to different types of businesses. Users can choose from monthly or annual subscriptions which include various features. The cost-effectiveness of these plans makes it a suitable choice for companies looking to manage their document signing processes efficiently.

-

What benefits does airSlate SignNow provide for remote teams in 2022?

For remote teams in 2022, airSlate SignNow enhances collaboration by allowing multiple users to sign documents from anywhere at any time. The easy-to-use interface promotes a seamless experience, ensuring that important documents are signed quickly and securely. This reduces delays and enhances productivity among remote workers.

-

Can airSlate SignNow integrate with other software in 2022?

Yes, in 2022, airSlate SignNow offers several integrations with popular applications such as Salesforce, Google Drive, and Microsoft Office. These integrations help businesses streamline their operations by connecting their document management solutions with their existing software. This ensures a smooth transition and improved workflow.

-

Is airSlate SignNow compliant with legal standards in 2022?

In 2022, airSlate SignNow complies with industry regulations including ESIGN and UETA, ensuring that electronic signatures are legally binding. This compliance guarantees that businesses can use the platform with confidence, knowing that their transactions and documents meet legal standards. This is crucial for any organization looking to maintain integrity in their signing processes.

-

What types of documents can I eSign with airSlate SignNow in 2022?

In 2022, airSlate SignNow allows users to eSign a variety of documents such as contracts, agreements, and forms. The platform supports multiple document formats, making it flexible for different business needs. This versatility enables organizations to handle all their signing requirements in one place.

-

How secure is airSlate SignNow for document management in 2022?

Security is a top priority for airSlate SignNow in 2022, with features including data encryption, multi-factor authentication, and secure cloud storage. This ensures that sensitive documents are protected at all times. Businesses can trust that their information remains safe while using the platform.

Get more for Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate

Find out other Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF