Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re

What is the MW508A Form?

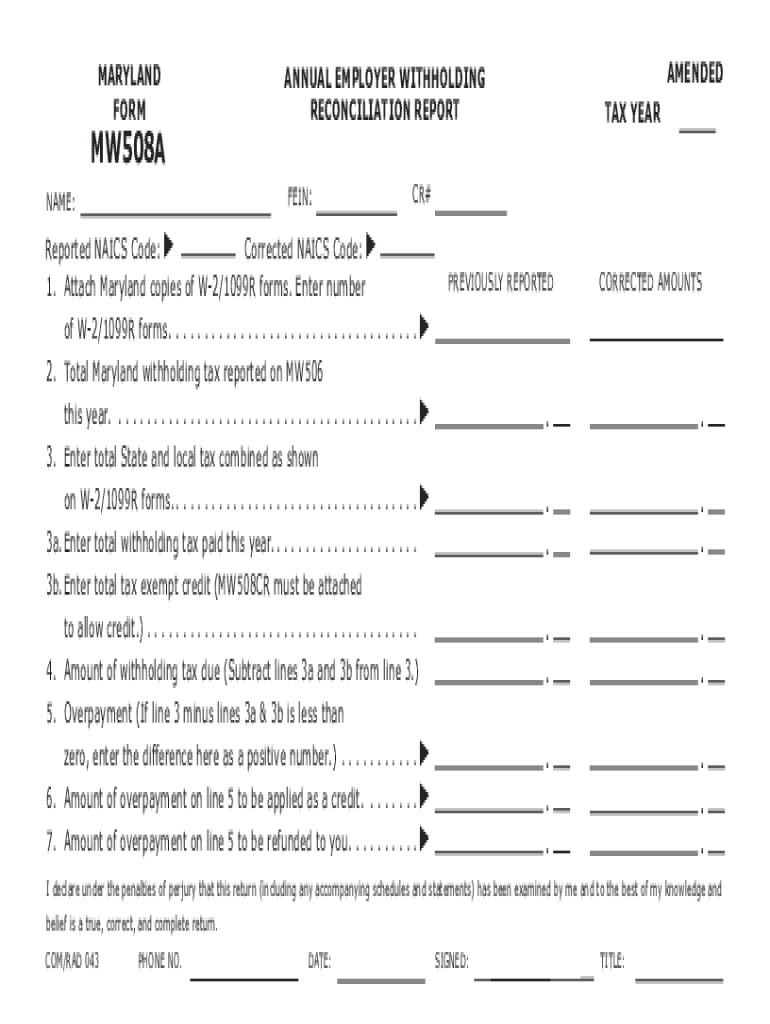

The MW508A form, also known as the Maryland Annual Employer Withholding Reconciliation Report, is a crucial document for employers in Maryland. This form is used to report the total amount of state income tax withheld from employees’ wages throughout the tax year. It serves as a summary of the employer's withholding obligations and ensures compliance with state tax regulations. Employers must file this form annually to reconcile their withholding records with the Maryland Comptroller's office.

Steps to Complete the MW508A Form

Completing the MW508A form requires careful attention to detail. Here are the essential steps:

- Gather all payroll records for the tax year, including total wages paid and state income tax withheld.

- Fill in the employer information section, including your business name, address, and federal employer identification number (FEIN).

- Report total wages and the amount of Maryland income tax withheld in the designated fields.

- Double-check all entries for accuracy to avoid discrepancies.

- Sign and date the form before submission.

Legal Use of the MW508A Form

The MW508A form is legally binding when completed accurately and submitted on time. It must comply with Maryland state tax laws, which require employers to report withholding amounts for their employees. Failure to submit this form can result in penalties and interest charges. Therefore, it is essential for employers to understand their legal obligations regarding this form to maintain compliance with state regulations.

Filing Deadlines for the MW508A Form

Employers must be aware of the filing deadlines for the MW508A form to avoid penalties. The form is typically due by January 31 of the year following the tax year being reported. For example, for the 2021 tax year, the MW508A form must be submitted by January 31, 2022. It is advisable to check for any updates or changes to filing deadlines that may occur.

How to Obtain the MW508A Form

The MW508A form can be easily obtained from the Maryland Comptroller's website. Employers can download the form in PDF format, which can be printed and filled out manually. Additionally, some payroll software may offer integrated solutions for generating this form, simplifying the process for employers.

Key Elements of the MW508A Form

The MW508A form includes several key elements that must be accurately reported. These include:

- Employer identification information, including name and FEIN.

- Total wages paid to employees during the tax year.

- Total Maryland state income tax withheld.

- Signature of the employer or authorized representative.

Penalties for Non-Compliance with the MW508A Form

Non-compliance with the MW508A filing requirements can lead to significant penalties. Employers who fail to file the form by the deadline may incur late fees and interest on unpaid taxes. Additionally, repeated failures to comply can result in increased scrutiny from tax authorities and potential legal consequences. It is vital for employers to prioritize timely and accurate filing to avoid these issues.

Quick guide on how to complete tax year 2020 form mw508a annual employer withholding reconciliation report form mw508a annual employer withholding

Effortlessly Prepare Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any hurdles. Manage Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re with Ease

- Obtain Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or black out sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how to send your form: by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax year 2020 form mw508a annual employer withholding reconciliation report form mw508a annual employer withholding

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask

-

What is the 2020 mw508a and how does it work with airSlate SignNow?

The 2020 mw508a is a document type that can be easily managed within airSlate SignNow. It allows businesses to create, send, and eSign important documents efficiently, ensuring that all necessary parties can access and complete their signature requirements quickly and securely.

-

What are the features of airSlate SignNow for handling 2020 mw508a documents?

airSlate SignNow provides several key features for 2020 mw508a documents, including customizable templates, automated workflows, and robust security options. Users can track the status of their documents in real-time and receive notifications when signatures are completed, streamlining the entire process.

-

Is airSlate SignNow cost-effective for managing 2020 mw508a transactions?

Yes, airSlate SignNow offers competitive pricing plans that are cost-effective for businesses of all sizes managing 2020 mw508a documents. By reducing manual processes and accelerating turnaround times, companies can save both time and money while ensuring compliance and accuracy in their document management.

-

Can I integrate airSlate SignNow with other tools for managing 2020 mw508a documents?

Absolutely! airSlate SignNow offers integrations with various third-party applications, including CRM systems, cloud storage services, and productivity tools. This allows businesses to enhance their workflow efficiency when handling 2020 mw508a documents, ensuring a seamless experience across platforms.

-

How secure is airSlate SignNow when it comes to 2020 mw508a documents?

Security is a top priority for airSlate SignNow, especially with sensitive documents like the 2020 mw508a. The platform uses advanced encryption protocols to protect user data and ensures compliance with industry standards, giving users peace of mind that their documents are safe during transmission and storage.

-

What benefits does airSlate SignNow provide for businesses using the 2020 mw508a?

Using airSlate SignNow for the 2020 mw508a allows businesses to streamline their document management processes, improve collaboration, and enhance efficiency. With features like reusable templates and automated reminders, companies can signNowly reduce the time spent on paperwork while increasing productivity.

-

How can I get started with airSlate SignNow for my 2020 mw508a needs?

Getting started with airSlate SignNow for your 2020 mw508a needs is simple. Just sign up for an account, choose the pricing plan that suits your business, and begin uploading your 2020 mw508a documents. The user-friendly interface will guide you through the process of sending and eSigning documents effortlessly.

Get more for Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re

- Satisfaction release or cancellation of mortgage by individual massachusetts form

- Partial release of property from mortgage for corporation massachusetts form

- Partial release of property from mortgage by individual holder massachusetts form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy massachusetts form

- Warranty deed for parents to child with reservation of life estate massachusetts form

- Warranty deed for separate or joint property to joint tenancy massachusetts form

- Warranty deed to separate property of one spouse to both spouses as joint tenants massachusetts form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries massachusetts form

Find out other Tax Year Form MW508A Annual Employer Withholding Reconciliation Report Form MW508A Annual Employer Withholding Reconciliation Re

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer