Instructions for Form IT2663 Department of Taxation and

Understanding the Income Tax MW506NRS Form

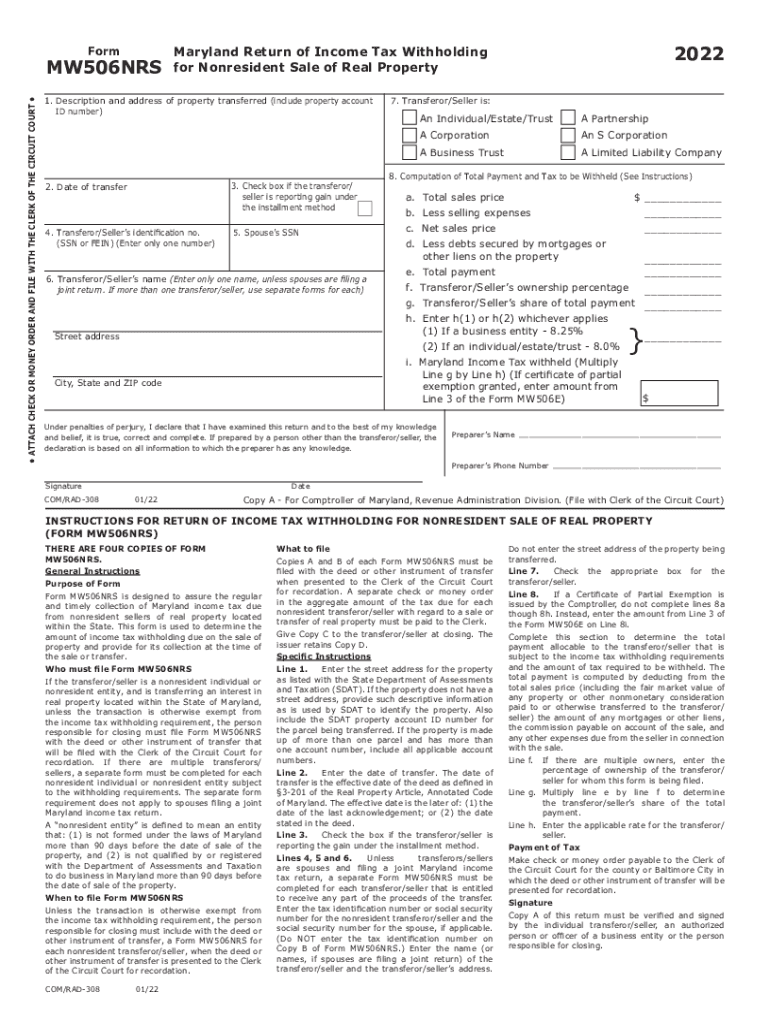

The income tax MW506NRS form is specifically designed for nonresidents who have income from Maryland sources. This form is essential for individuals who do not reside in Maryland but earn income within the state, such as rental income or wages. The MW506NRS allows these individuals to report their income accurately and ensure compliance with Maryland tax laws. Understanding the purpose and requirements of this form is crucial for nonresidents to avoid potential penalties and ensure proper tax reporting.

Steps to Complete the Income Tax MW506NRS Form

Completing the income tax MW506NRS form involves several key steps:

- Gather all necessary income documentation, including W-2s or 1099s related to Maryland income.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your Maryland-source income accurately in the designated sections of the form.

- Calculate any applicable deductions or credits available to nonresidents.

- Review the completed form for accuracy before submission.

Filing Deadlines for the MW506NRS Form

It is important to be aware of the filing deadlines associated with the income tax MW506NRS form. Generally, the form must be submitted by the due date for filing individual income tax returns, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be adjusted. Timely submission is essential to avoid late fees and interest on any taxes owed.

Required Documents for Filing the MW506NRS Form

To successfully file the income tax MW506NRS form, you will need to gather several documents:

- W-2 forms from employers if you received wages.

- 1099 forms for any freelance or contract work performed.

- Records of any rental income earned from properties located in Maryland.

- Documentation for any deductions you plan to claim.

Penalties for Non-Compliance with the MW506NRS Form

Failure to file the income tax MW506NRS form or inaccuracies in reporting can lead to penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest charges on any unpaid taxes.

- Potential audits by the Maryland Comptroller's office.

Understanding these penalties underscores the importance of accurate and timely filing.

Who Issues the MW506NRS Form

The income tax MW506NRS form is issued by the Comptroller of Maryland. This state agency is responsible for tax administration and ensuring compliance with Maryland tax laws. They provide guidance and resources for individuals who need assistance with the form and the filing process.

Quick guide on how to complete instructions for form it2663 department of taxation and

Complete Instructions For Form IT2663 Department Of Taxation And effortlessly on any device

Web-based document organization has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents quickly and efficiently. Manage Instructions For Form IT2663 Department Of Taxation And on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and electronically sign Instructions For Form IT2663 Department Of Taxation And without any hassle

- Locate Instructions For Form IT2663 Department Of Taxation And and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form hunting, or mistakes that necessitate the printing of new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Instructions For Form IT2663 Department Of Taxation And and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it2663 department of taxation and

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What is income tax mw506nrs and how do I utilize it?

The income tax mw506nrs is a specific form used in certain jurisdictions to report income tax obligations. To utilize it effectively, businesses should gather relevant financial data, complete the form accurately, and ensure it is submitted within tax deadlines. Using airSlate SignNow can simplify the process by allowing you to eSign documents securely and efficiently.

-

How can airSlate SignNow help with the income tax mw506nrs process?

AirSlate SignNow streamlines the income tax mw506nrs submission by providing an easy-to-use platform for sending and signing documents. You can ensure that all necessary tax forms are correctly filled out and securely signed, which reduces the chances of errors and makes tax compliance easier for your business.

-

What are the pricing options for airSlate SignNow related to income tax mw506nrs?

AirSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing income tax mw506nrs submissions. These plans provide access to powerful features and tools, ensuring that you can manage your eSigning needs without breaking your budget.

-

Are there any specific features in airSlate SignNow that benefit income tax mw506nrs users?

Yes, airSlate SignNow offers features like customizable templates and automated workflows that signNowly benefit users who handle income tax mw506nrs. These tools simplify document management, reduce administrative burdens, and help ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for managing income tax mw506nrs?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and finance software, allowing you to manage your income tax mw506nrs submissions more effectively. This integration reduces manual work and enhances overall efficiency in your tax preparation processes.

-

How does eSigning improve the handling of income tax mw506nrs documents?

eSigning enhances the handling of income tax mw506nrs documents by providing a faster, more secure way to sign and send forms. It eliminates the need for printing, scanning, and faxing, ensuring that your tax documentation is processed quickly and securely, which is particularly important during tax season.

-

What are the benefits of using airSlate SignNow for income tax mw506nrs?

Using airSlate SignNow for income tax mw506nrs offers numerous benefits such as enhanced security, accelerated document workflows, and easy access from any device. These advantages contribute to a more organized approach to tax preparation and help reduce stress during filing periods.

Get more for Instructions For Form IT2663 Department Of Taxation And

- Maryland sale form

- Quitclaim deed from corporation to husband and wife maryland form

- Warranty deed from corporation to husband and wife maryland form

- Quitclaim deed from corporation to individual maryland form

- Md corporation 497310132 form

- Quitclaim deed from corporation to llc maryland form

- Maryland land instrument intake sheet form

- Quitclaim deed from corporation to corporation maryland form

Find out other Instructions For Form IT2663 Department Of Taxation And

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe