AK DoR 6000 Fill Out Tax Template OnlineUS Form

Key elements of the AK DoR 6000 Corporation Income Return

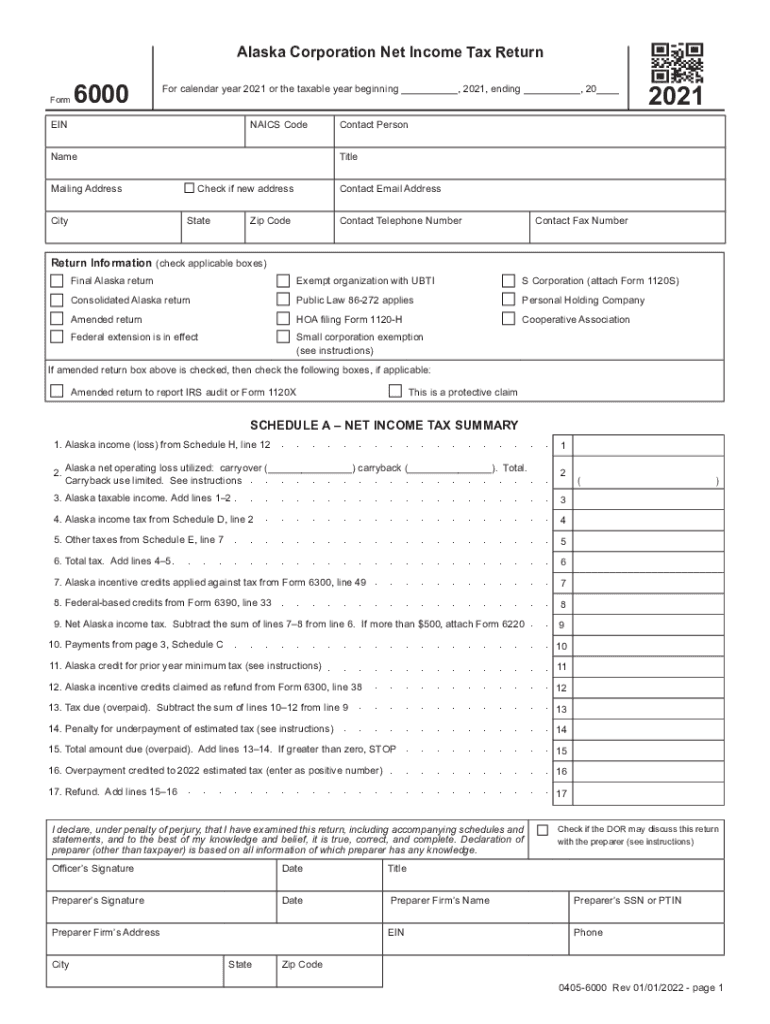

The AK DoR 6000 Corporation Income Return is a crucial document for corporations operating in Alaska. It serves as a report of the corporation's income, deductions, and tax liability for the year. Understanding its key elements is essential for accurate completion. The form includes sections for reporting gross income, allowable deductions, and credits. Corporations must also provide details about their business activities and any applicable tax rates. Accurate reporting ensures compliance with state tax laws and helps avoid potential penalties.

Steps to complete the AK DoR 6000 Corporation Income Return

Completing the AK DoR 6000 involves several important steps. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering your corporation's gross income and allowable deductions in the appropriate sections. It's important to carefully calculate your tax liability based on the current tax rates applicable to your corporation type. After completing the form, review all entries for accuracy before submitting it. Ensure that you sign and date the form to validate your submission.

Filing Deadlines / Important Dates

Timely filing of the AK DoR 6000 is essential to avoid penalties. The deadline for submitting the corporation income return typically aligns with the federal tax return due date. For most corporations, this falls on the fifteenth day of the fourth month after the end of the tax year. Corporations that operate on a calendar year basis should plan to file by April 15. It's advisable to check for any specific state extensions or changes that may affect your filing schedule.

Form Submission Methods

Corporations have several options for submitting the AK DoR 6000. The form can be filed electronically through the Alaska Department of Revenue's online portal, which provides a convenient and secure method for submission. Alternatively, corporations may choose to mail the completed form to the appropriate state office. In-person submissions are also accepted at designated locations. Each method has its own processing times, so consider this when planning your submission.

Legal use of the AK DoR 6000 Corporation Income Return

The AK DoR 6000 Corporation Income Return is legally binding once properly completed and submitted. Corporations must ensure that all information provided is accurate and truthful, as discrepancies can lead to audits or penalties. The form must be signed by an authorized individual, typically an officer of the corporation, to validate the submission. Understanding the legal implications of the information reported is crucial for maintaining compliance with state tax laws.

Required Documents

To complete the AK DoR 6000 Corporation Income Return, corporations must gather several key documents. These include financial statements, such as profit and loss statements, balance sheets, and any relevant tax documents from previous years. Additionally, documentation supporting any deductions claimed should be readily available. Having these documents organized will facilitate a smoother completion process and ensure accurate reporting of the corporation's financial status.

State-specific rules for the AK DoR 6000 Corporation Income Return

Each state has specific rules governing the completion and submission of corporation income returns. In Alaska, the AK DoR 6000 is subject to state tax laws that may differ from federal regulations. Corporations must be aware of unique deductions, credits, and tax rates applicable to their business activities. Staying informed about any changes in state tax legislation is essential for compliance and optimal tax planning.

Quick guide on how to complete ak dor 6000 2020 2021 fill out tax template onlineus

Complete AK DoR 6000 Fill Out Tax Template OnlineUS effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage AK DoR 6000 Fill Out Tax Template OnlineUS on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign AK DoR 6000 Fill Out Tax Template OnlineUS with ease

- Find AK DoR 6000 Fill Out Tax Template OnlineUS and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Select relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign AK DoR 6000 Fill Out Tax Template OnlineUS and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ak dor 6000 2020 2021 fill out tax template onlineus

The best way to create an e-signature for a PDF in the online mode

The best way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Alaska Form 6000 used for?

The Alaska Form 6000 is primarily used for businesses to report specific financial information to the state. It is essential for compliance with state regulations. By utilizing the airSlate SignNow platform, you can easily eSign the Alaska Form 6000, ensuring a smooth submission process.

-

How can airSlate SignNow help with Alaska Form 6000 submissions?

airSlate SignNow provides a user-friendly interface that allows you to send and eSign the Alaska Form 6000 efficiently. The platform streamlines document management and ensures that all signatures are captured legally. This results in faster processing and compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for Alaska Form 6000?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans are cost-effective considering the time and resources saved when handling the Alaska Form 6000 electronically. You can choose a plan that fits your budget while ensuring compliance.

-

What features does airSlate SignNow offer for the Alaska Form 6000?

airSlate SignNow provides several features such as document templates, secure eSigning, and tracking capabilities for the Alaska Form 6000. These features enhance collaboration and ensure that all parties are informed about the document's status. Additionally, the platform integrates seamlessly with other tools.

-

Can I integrate airSlate SignNow with other applications for Alaska Form 6000?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and Salesforce. This allows you to manage the Alaska Form 6000 alongside tools you already use, creating a more cohesive workflow for your business.

-

What are the benefits of digitizing the Alaska Form 6000 with airSlate SignNow?

Digitizing the Alaska Form 6000 with airSlate SignNow provides numerous benefits, including reduced processing times and enhanced security. You also gain the ability to track document progress and store forms securely in the cloud. This ultimately helps businesses stay organized and compliant.

-

How secure is airSlate SignNow when handling the Alaska Form 6000?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and complies with industry standards to ensure the safety of your data, including the Alaska Form 6000. You can trust that your sensitive information is protected throughout the eSigning process.

Get more for AK DoR 6000 Fill Out Tax Template OnlineUS

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure maryland form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497310242 form

- Maryland failure form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497310244 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497310245 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497310246 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497310247 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497310248 form

Find out other AK DoR 6000 Fill Out Tax Template OnlineUS

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation