Maryland Form EL101 Maryland Income Tax Declaration for 2021

What is the Maryland Form EL101 Maryland Income Tax Declaration For

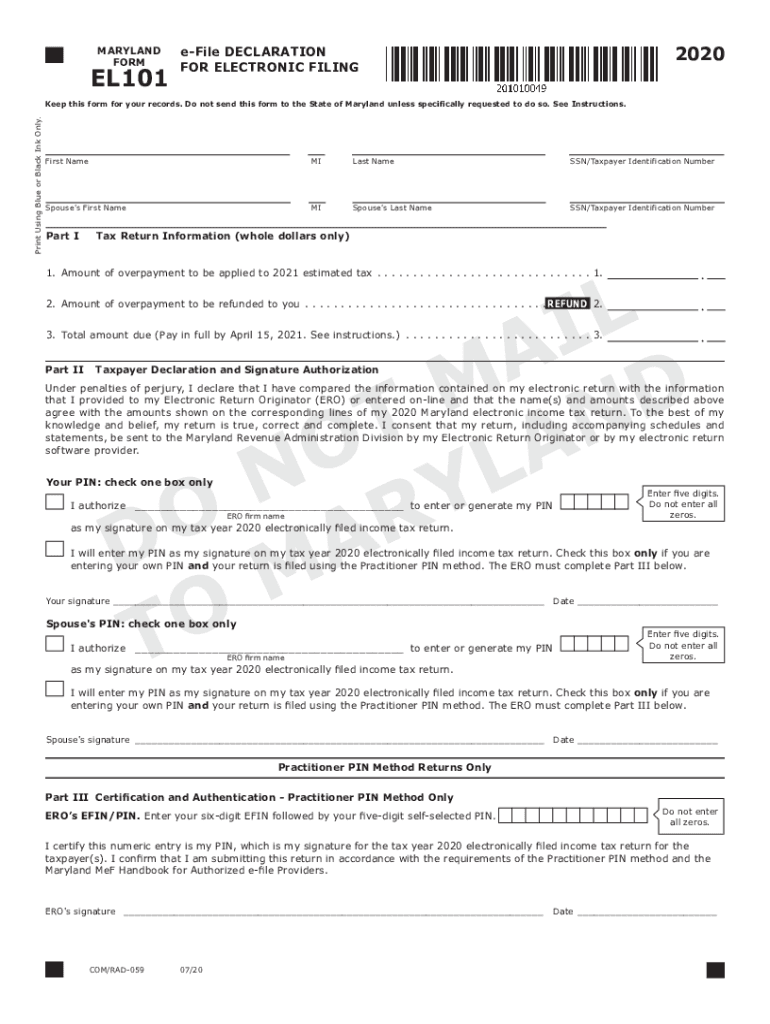

The Maryland Form EL101 is an essential document used by taxpayers to declare their income tax obligations to the state of Maryland. This form serves as a declaration of estimated tax liability for individuals and businesses, ensuring that the state receives accurate information regarding expected income and tax payments. By submitting this form, taxpayers can avoid underpayment penalties and ensure compliance with state tax laws.

How to use the Maryland Form EL101 Maryland Income Tax Declaration For

Using the Maryland Form EL101 involves several key steps. First, gather all necessary financial information, including income sources, deductions, and credits. Next, accurately fill out the form, ensuring that all sections are completed correctly. After completing the form, review it for any errors before submission. The form can be filed electronically or mailed to the appropriate state tax authority, depending on your preference.

Steps to complete the Maryland Form EL101 Maryland Income Tax Declaration For

Completing the Maryland Form EL101 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, such as W-2s, 1099s, and other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Calculate your estimated tax liability based on your income and applicable deductions.

- Sign and date the form to certify that the information provided is accurate.

Key elements of the Maryland Form EL101 Maryland Income Tax Declaration For

The Maryland Form EL101 includes several important elements that taxpayers must understand. Key components include:

- Personal Information: This section requires basic identification details.

- Income Reporting: Taxpayers must report all sources of income accurately.

- Estimated Tax Calculation: This section helps determine the amount of tax owed based on income.

- Signature Line: A signature is required to validate the form.

Legal use of the Maryland Form EL101 Maryland Income Tax Declaration For

The Maryland Form EL101 is legally binding once signed and submitted to the state tax authority. It complies with Maryland tax laws and regulations, ensuring that taxpayers meet their legal obligations. Failure to file this form accurately can result in penalties, including interest on unpaid taxes and additional fines.

Filing Deadlines / Important Dates

Timely filing of the Maryland Form EL101 is crucial to avoid penalties. Typically, the deadline for submitting this form aligns with the state income tax filing deadline, which is usually April 15. However, taxpayers should check for any specific updates or changes to deadlines each tax year to ensure compliance.

Quick guide on how to complete maryland form el101 maryland income tax declaration for

Effortlessly Prepare Maryland Form EL101 Maryland Income Tax Declaration For on Any Device

The management of digital documents has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Maryland Form EL101 Maryland Income Tax Declaration For on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Maryland Form EL101 Maryland Income Tax Declaration For with Ease

- Locate Maryland Form EL101 Maryland Income Tax Declaration For and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and electronically sign Maryland Form EL101 Maryland Income Tax Declaration For and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form el101 maryland income tax declaration for

Create this form in 5 minutes!

How to create an eSignature for the maryland form el101 maryland income tax declaration for

The best way to make an e-signature for your PDF document online

The best way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Maryland Form EL101 Maryland Income Tax Declaration For?

The Maryland Form EL101 Maryland Income Tax Declaration For is a specific filing form used by residents of Maryland to declare expected income tax liabilities. This form is essential for ensuring compliance with state tax laws and allows taxpayers to report their income effectively.

-

How can airSlate SignNow help me with the Maryland Form EL101 Maryland Income Tax Declaration For?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and eSigning the Maryland Form EL101 Maryland Income Tax Declaration For. With our tool, you can fill out the form digitally and securely send it to the necessary parties, streamlining your tax declaration process.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form EL101 Maryland Income Tax Declaration For?

Yes, airSlate SignNow operates on a subscription model, providing various plans tailored to different business needs. Investing in our service for handling the Maryland Form EL101 Maryland Income Tax Declaration For can save you time and enhance productivity with its straightforward electronic signing features.

-

What features does airSlate SignNow offer for managing the Maryland Form EL101 Maryland Income Tax Declaration For?

airSlate SignNow provides essential features such as document templates, secure eSigning, automated reminders, and storage solutions. These features ensure that your Maryland Form EL101 Maryland Income Tax Declaration For is completed efficiently and stored securely for future reference.

-

Can I integrate airSlate SignNow with other applications when working on the Maryland Form EL101 Maryland Income Tax Declaration For?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage and CRM systems. This integration makes it easier to manage and access your Maryland Form EL101 Maryland Income Tax Declaration For alongside other important business documents.

-

What are the benefits of using airSlate SignNow for the Maryland Form EL101 Maryland Income Tax Declaration For?

Using airSlate SignNow for the Maryland Form EL101 Maryland Income Tax Declaration For provides numerous benefits, including increased efficiency, reduced paperwork, and secure electronic storage. The ease of eSigning and sharing documents enhances collaboration and ensures timely submission of your tax forms.

-

Is it secure to use airSlate SignNow for the Maryland Form EL101 Maryland Income Tax Declaration For?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Maryland Form EL101 Maryland Income Tax Declaration For is handled with the utmost care. Our platform uses encryption and follows industry standards to protect your sensitive tax information during the signing process.

Get more for Maryland Form EL101 Maryland Income Tax Declaration For

- Financial statements only in connection with prenuptial premarital agreement maine form

- Revocation of premarital or prenuptial agreement maine form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children maine form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497310713 form

- Maine business form

- Pre incorporation agreement form

- Maine directors form

- Corporate records maintenance package for existing corporations maine form

Find out other Maryland Form EL101 Maryland Income Tax Declaration For

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer