Form EL101B Income Tax Declaration for Businesses 2021

What is the Form EL101B Income Tax Declaration For Businesses

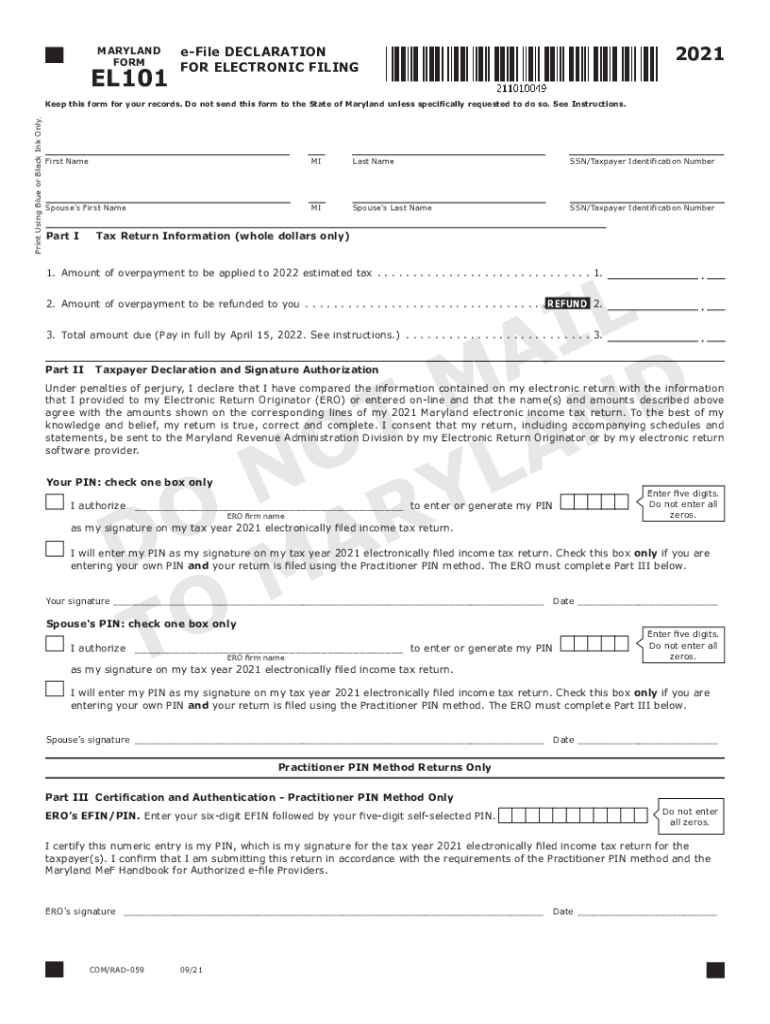

The Maryland Form EL101B is an income tax declaration specifically designed for businesses operating within the state. This form is essential for reporting income and calculating tax obligations for various business entities, including corporations, partnerships, and limited liability companies (LLCs). The EL101B serves as a formal declaration of income earned during the tax year and is a critical component of the overall tax filing process in Maryland.

How to use the Form EL101B Income Tax Declaration For Businesses

Using the Maryland Form EL101B involves several key steps that ensure accurate reporting of your business income. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise details regarding your business's income, deductions, and credits. It is important to review the completed form for accuracy before submission. Lastly, ensure that the form is filed by the designated deadline to avoid penalties.

Steps to complete the Form EL101B Income Tax Declaration For Businesses

Completing the Maryland Form EL101B requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including profit and loss statements.

- Begin filling out the form by entering your business information, such as name, address, and federal employer identification number (EIN).

- Report your total income from all sources, ensuring that you include all applicable revenue streams.

- List any deductions or credits that your business qualifies for, which can reduce your overall tax liability.

- Double-check all entries for accuracy and completeness.

- Submit the form by the required deadline, either electronically or by mail.

Legal use of the Form EL101B Income Tax Declaration For Businesses

The Maryland Form EL101B is legally binding when filled out and submitted in accordance with state tax laws. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Maryland Comptroller's office. This includes providing accurate information and submitting the form by the established deadlines. Additionally, utilizing a secure electronic signature solution can further enhance the legal standing of the submitted document.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form EL101B are crucial for compliance. Typically, the form must be submitted by April 15 of each year for calendar-year businesses. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for businesses to stay informed of any changes to deadlines and to mark their calendars accordingly to avoid late penalties.

Required Documents

To complete the Maryland Form EL101B, several documents are necessary. These typically include:

- Income statements detailing revenue for the tax year.

- Expense reports that outline deductible business expenses.

- Previous tax returns, if applicable, to provide context for current filings.

- Any supporting documentation for credits or deductions claimed.

Quick guide on how to complete form el101b income tax declaration for businesses

Complete Form EL101B Income Tax Declaration For Businesses effortlessly on any gadget

Web-based document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Form EL101B Income Tax Declaration For Businesses on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest method to modify and eSign Form EL101B Income Tax Declaration For Businesses without exertion

- Obtain Form EL101B Income Tax Declaration For Businesses and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that aim.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form hunting, or inaccuracies that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form EL101B Income Tax Declaration For Businesses and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form el101b income tax declaration for businesses

Create this form in 5 minutes!

How to create an eSignature for the form el101b income tax declaration for businesses

The best way to generate an e-signature for a PDF in the online mode

The best way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is the Maryland form EL101B?

The Maryland form EL101B is a vital document used for various legal and compliance purposes in Maryland. It is primarily utilized for business registrations and changes within the state. Understanding its requirements is crucial for ensuring compliance.

-

How can airSlate SignNow help with the Maryland form EL101B?

airSlate SignNow streamlines the process of completing and submitting the Maryland form EL101B. Our platform allows users to easily fill out, sign, and send the document electronically, ensuring a seamless experience. It eliminates the hassle of printing and mailing, saving time and resources.

-

Is airSlate SignNow a cost-effective solution for managing the Maryland form EL101B?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective choice for managing the Maryland form EL101B. Our pricing plans cater to various business sizes and needs, ensuring you get the features you require without overspending. We provide excellent value for an electronic signing solution.

-

What features does airSlate SignNow offer for the Maryland form EL101B?

airSlate SignNow provides a range of features for managing the Maryland form EL101B, including customizable templates, secure electronic signatures, and automated reminders. Our platform is user-friendly and helps minimize errors, ensuring your documents are correctly completed and submitted.

-

Can I integrate airSlate SignNow with other applications for the Maryland form EL101B?

Absolutely! airSlate SignNow supports integration with numerous applications, enhancing your workflow when handling the Maryland form EL101B. You can connect it with tools like Google Drive, Salesforce, and more, making document management smoother and more efficient.

-

What are the benefits of using airSlate SignNow for the Maryland form EL101B?

Using airSlate SignNow for the Maryland form EL101B offers a variety of benefits, including faster processing times, improved document accuracy, and enhanced security. Our platform allows for real-time collaboration, making it easier for teams to work together on submissions and track their status seamlessly.

-

Is airSlate SignNow secure for signing the Maryland form EL101B?

Yes! airSlate SignNow employs industry-leading security measures to protect your documents, including the Maryland form EL101B. We utilize encrypted data transmission and storage, ensuring that your sensitive information remains safe throughout the signing process.

Get more for Form EL101B Income Tax Declaration For Businesses

- Sample transmittal letter 497310448 form

- Js 44 civil cover sheet federal district court maryland form

- Maryland disclosure form

- Lead based paint disclosure for rental transaction maryland form

- Notice of lease for recording maryland form

- Sample cover letter for filing of llc articles or certificate with secretary of state maryland form

- Maryland residential lease form

- Maryland tenant form

Find out other Form EL101B Income Tax Declaration For Businesses

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors