Schedule ICR Illinois Credits Schedule ICR Illinois Credits 2021

Understanding the Schedule ICR for Illinois Credits

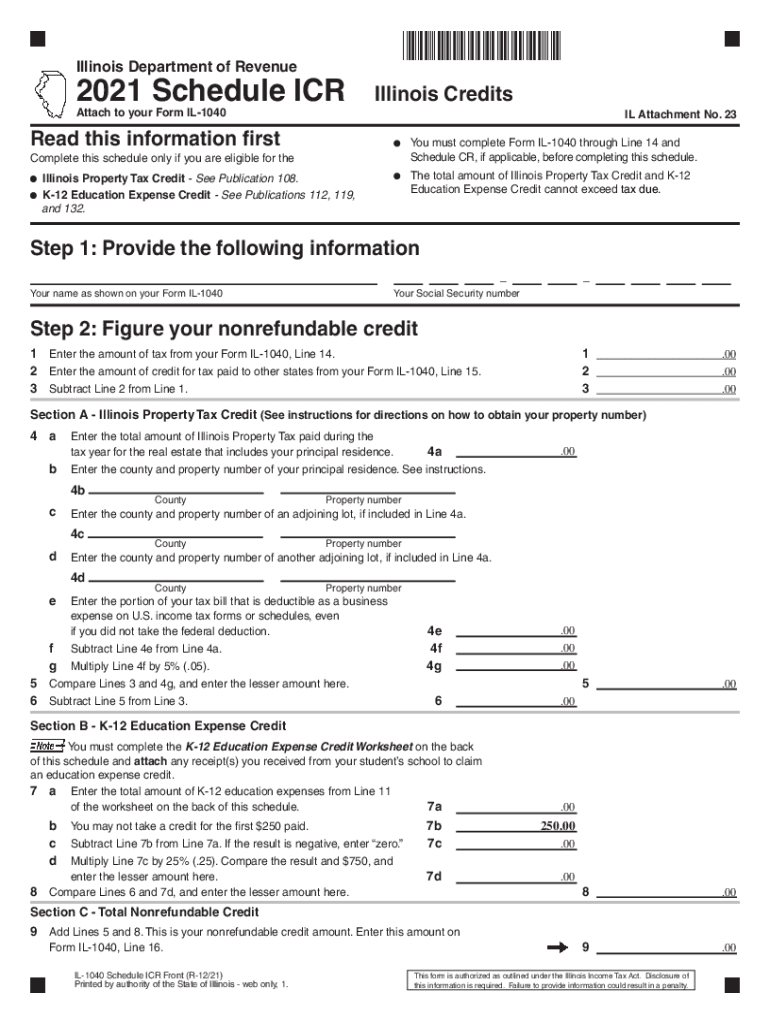

The Schedule ICR is a crucial form for Illinois taxpayers seeking to claim credits against their state income tax. This form is specifically designed to help individuals and businesses calculate the Illinois credits they are eligible for, which can significantly reduce their overall tax liability. It is essential to understand the types of credits available, such as the earned income tax credit and the property tax credit, as these can provide substantial financial relief.

Steps to Complete the Schedule ICR

Completing the Schedule ICR requires careful attention to detail. Begin by gathering all necessary documentation, including your income statements and any relevant tax forms. Follow these steps to ensure accurate completion:

- Fill out your personal information, including your Social Security number and address.

- List all sources of income and calculate your total income for the year.

- Identify the credits you are eligible for and gather supporting documentation.

- Complete the credit calculation section, ensuring all figures are accurate.

- Review the entire form for any errors before submission.

Eligibility Criteria for the Schedule ICR

To qualify for the credits on the Schedule ICR, taxpayers must meet specific eligibility criteria. These typically include:

- Residency in Illinois for the tax year.

- Filing status, which may affect the types of credits available.

- Income limits that determine eligibility for certain credits, such as the earned income tax credit.

It is important to review the latest guidelines from the Illinois Department of Revenue to ensure compliance with all requirements.

Filing Deadlines and Important Dates

Timely submission of the Schedule ICR is essential to avoid penalties and ensure you receive any credits owed. The typical filing deadline for Illinois state income tax returns, including the Schedule ICR, is April 15. However, extensions may be available, so it is advisable to check for any updates or changes to deadlines each tax year.

Form Submission Methods

The Schedule ICR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online filing through the Illinois Department of Revenue's e-filing system.

- Mailing a paper copy of the form to the appropriate address.

- In-person submission at designated tax offices, if applicable.

Choosing the right method can streamline the process and ensure your form is processed efficiently.

Legal Use of the Schedule ICR

Understanding the legal implications of the Schedule ICR is vital for compliance. The form must be filled out accurately and truthfully, as any discrepancies can lead to audits or penalties. It is essential to keep all supporting documents for at least three years in case of verification by the Illinois Department of Revenue.

Quick guide on how to complete 2021 schedule icr illinois credits 2021 schedule icr illinois credits

Complete Schedule ICR Illinois Credits Schedule ICR Illinois Credits effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Schedule ICR Illinois Credits Schedule ICR Illinois Credits on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Schedule ICR Illinois Credits Schedule ICR Illinois Credits with ease

- Locate Schedule ICR Illinois Credits Schedule ICR Illinois Credits and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow caters to all your document management needs with just a few clicks from your preferred device. Edit and eSign Schedule ICR Illinois Credits Schedule ICR Illinois Credits and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule icr illinois credits 2021 schedule icr illinois credits

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule icr illinois credits 2021 schedule icr illinois credits

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What features does airSlate SignNow offer for 2021 Illinois users?

For 2021 Illinois users, airSlate SignNow provides a range of features including customizable templates, document routing, and advanced security measures. These tools are designed to streamline the eSignature process, making it easier for businesses to manage their documentation efficiently.

-

Is airSlate SignNow a cost-effective solution for businesses in 2021 Illinois?

Yes, airSlate SignNow is recognized as a cost-effective solution for businesses in 2021 Illinois. With various pricing plans tailored to fit different needs, companies can choose an option that aligns with their budget while still benefiting from high-quality eSigning capabilities.

-

How can airSlate SignNow integrate with my existing tools in 2021 Illinois?

AirSlate SignNow seamlessly integrates with popular applications such as Google Drive, Salesforce, and Microsoft Office. This feature is especially beneficial for businesses in 2021 Illinois, as it allows for a smooth transition and improved workflow management.

-

What are the security features of airSlate SignNow for users in 2021 Illinois?

In 2021 Illinois, airSlate SignNow prioritizes user security by offering features such as two-factor authentication, encrypted documents, and secure cloud storage. These measures ensure that sensitive information remains protected throughout the signing process.

-

Can I use airSlate SignNow for remote work in 2021 Illinois?

Absolutely! AirSlate SignNow is designed for remote work, allowing businesses in 2021 Illinois to send and sign documents electronically from anywhere. This flexibility boosts productivity and ensures that operations continue smoothly, even outside of the traditional office setting.

-

What customer support options are available for 2021 Illinois users?

For users in 2021 Illinois, airSlate SignNow provides excellent customer support, including live chat, email assistance, and an extensive knowledge base. This comprehensive support ensures that businesses can quickly resolve any issues and maximize the use of the platform.

-

How does airSlate SignNow improve document workflow for businesses in 2021 Illinois?

AirSlate SignNow enhances document workflow for businesses in 2021 Illinois by automating the signing process and allowing multiple signers to seamlessly review and eSign documents. This saves time and reduces bottlenecks in business operations.

Get more for Schedule ICR Illinois Credits Schedule ICR Illinois Credits

Find out other Schedule ICR Illinois Credits Schedule ICR Illinois Credits

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now