IL 505 I, Automatic Extension Payment for Individuals Filing Form IL 1040 2021

What is the IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040

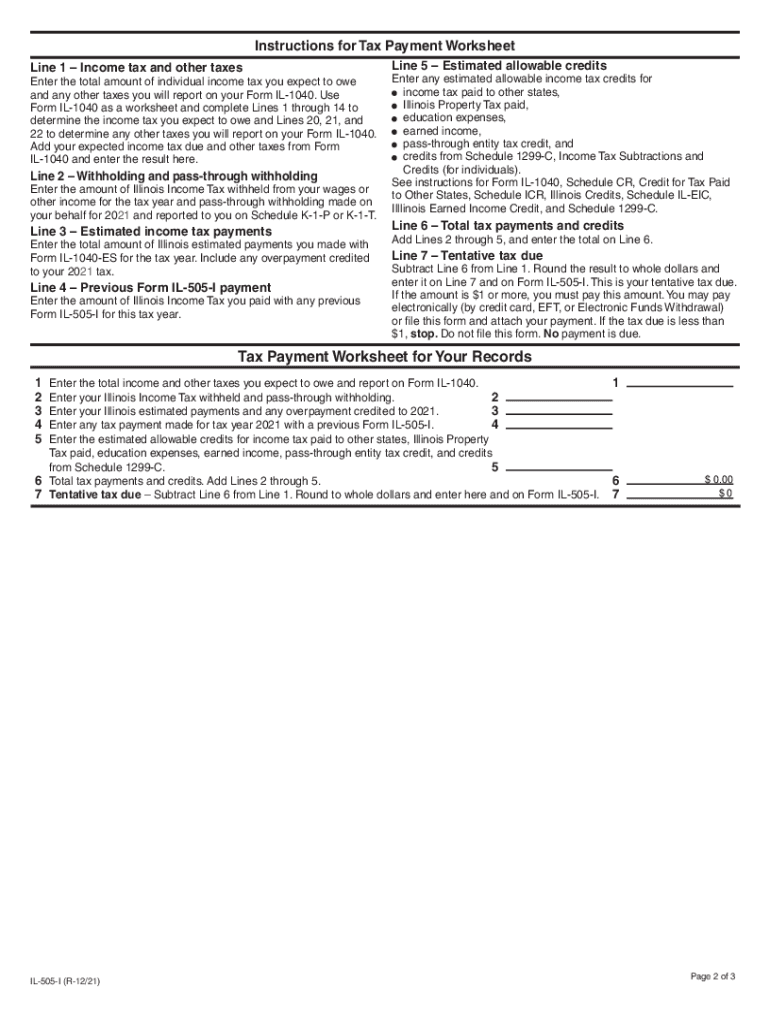

The IL 505 I is a form used by individuals in Illinois to request an automatic extension for filing their state income tax return, specifically Form IL 1040. This form allows taxpayers to extend their filing deadline without incurring late penalties, provided that the extension request is submitted correctly and on time. The extension typically grants an additional six months to file the return, but it is important to note that this does not extend the payment deadline for any taxes owed. Taxpayers must estimate their tax liability and submit a payment with the IL 505 I to avoid penalties and interest.

Steps to complete the IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040

Completing the IL 505 I involves several straightforward steps to ensure proper submission:

- Gather necessary financial documents, including income statements and previous tax returns.

- Estimate your total tax liability for the year to determine the payment amount.

- Fill out the IL 505 I form with your personal information, including your name, address, and Social Security number.

- Indicate the estimated payment amount based on your tax liability.

- Submit the completed form along with your payment by the original due date of your tax return.

Legal use of the IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040

The IL 505 I is legally recognized as a valid method for obtaining an extension on filing your Illinois state tax return. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Compliance with the guidelines set forth by the Illinois Department of Revenue is crucial. Additionally, the payment made with the IL 505 I serves as an acknowledgment of your tax obligation, helping to avoid penalties for late payment.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the IL 505 I is essential for compliance. The IL 505 I must be filed by the original due date of the IL 1040, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware that while the extension allows more time to file, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Eligibility Criteria

To be eligible to use the IL 505 I, taxpayers must be individuals filing Form IL 1040. This includes residents of Illinois and non-residents who earn income in the state. The form is applicable to various taxpayer scenarios, including self-employed individuals, retirees, and students. However, it is important to note that the IL 505 I is not intended for businesses or corporations, which have different requirements for extensions.

Form Submission Methods (Online / Mail / In-Person)

The IL 505 I can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file the IL 505 I electronically through the Illinois Department of Revenue's website, which offers a streamlined process for submitting forms and payments.

- Mail: The form can be printed, completed, and mailed to the appropriate address provided by the Illinois Department of Revenue.

- In-Person: Taxpayers may also choose to deliver the form and payment in person at designated state revenue offices.

Quick guide on how to complete 2021 il 505 i automatic extension payment for individuals filing form il 1040

Complete IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040 effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040 with ease

- Find IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes but seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and eSign IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 il 505 i automatic extension payment for individuals filing form il 1040

Create this form in 5 minutes!

How to create an eSignature for the 2021 il 505 i automatic extension payment for individuals filing form il 1040

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is il 505 i and how does it work with airSlate SignNow?

il 505 i is a feature of airSlate SignNow that allows users to sign and manage documents electronically. This essential tool streamlines the signing process, ensuring that users can complete transactions quickly and securely, benefiting from reduced paper usage.

-

What are the pricing options for airSlate SignNow regarding il 505 i?

airSlate SignNow offers several pricing plans to accommodate various business needs when using il 505 i. You can choose from monthly or annual subscriptions, with pricing tiers that depend on the number of users and features included in the package.

-

Can I integrate il 505 i with other software tools?

Yes, airSlate SignNow's il 505 i can be easily integrated with numerous software applications, enhancing your workflow. Integration with platforms like Salesforce, Google Drive, and Dropbox allows for a seamless document management experience.

-

What are the main benefits of using il 505 i with airSlate SignNow?

Utilizing il 505 i with airSlate SignNow provides several advantages, including improved efficiency, enhanced security, and reduced turnaround times for document signing. It enables businesses to stay organized while ensuring compliance with digital signing regulations.

-

Is il 505 i user-friendly for non-tech-savvy individuals?

Absolutely! airSlate SignNow's il 505 i is designed with user-friendliness in mind, making it accessible for all users, regardless of technical skill. The intuitive interface helps users navigate the signing process without needing extensive training.

-

How does il 505 i enhance the document signing experience?

il 505 i enhances the document signing experience by providing a simple and efficient way to sign digital documents in a secure environment. This feature eliminates the need for printing and scanning, enabling quicker transactions and faster workflows.

-

What features does airSlate SignNow offer within the il 505 i functionality?

The il 505 i functionality within airSlate SignNow includes features such as customizable templates, multi-party signing, and real-time tracking of document status. These features streamline the signing process, making it easier for businesses to get documents signed.

Get more for IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040

- Limited power of attorney for stock transactions and corporate powers minnesota form

- Mn poa 497312884 form

- Minnesota small business startup package minnesota form

- Minnesota property management package minnesota form

- Mn parenting time form

- Application commutation clemency form

- Annual minutes corporation 497312889 form

- Mn bylaws form

Find out other IL 505 I, Automatic Extension Payment For Individuals Filing Form IL 1040

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free