IL 505 I Automatic Extension Payment for Individuals Filing Form IL 1040 2023-2026

What is the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

The IL 505 I Automatic Extension Payment is a form used by individuals in Illinois who need to file an extension for their state income tax return, specifically for Form IL 1040. This extension allows taxpayers additional time to submit their tax returns without incurring penalties, provided that the payment is made by the due date. The form is essential for those who may not be able to complete their tax filings by the regular deadline, ensuring compliance with Illinois tax regulations.

How to use the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

To utilize the IL 505 I form, individuals must first determine if they need an extension on their state income tax return. If so, they should complete the form, indicating the amount of tax owed. It is important to submit this payment by the original due date of the tax return to avoid penalties. The payment can be made electronically through the Illinois Department of Revenue's website or by mailing a check along with the completed form.

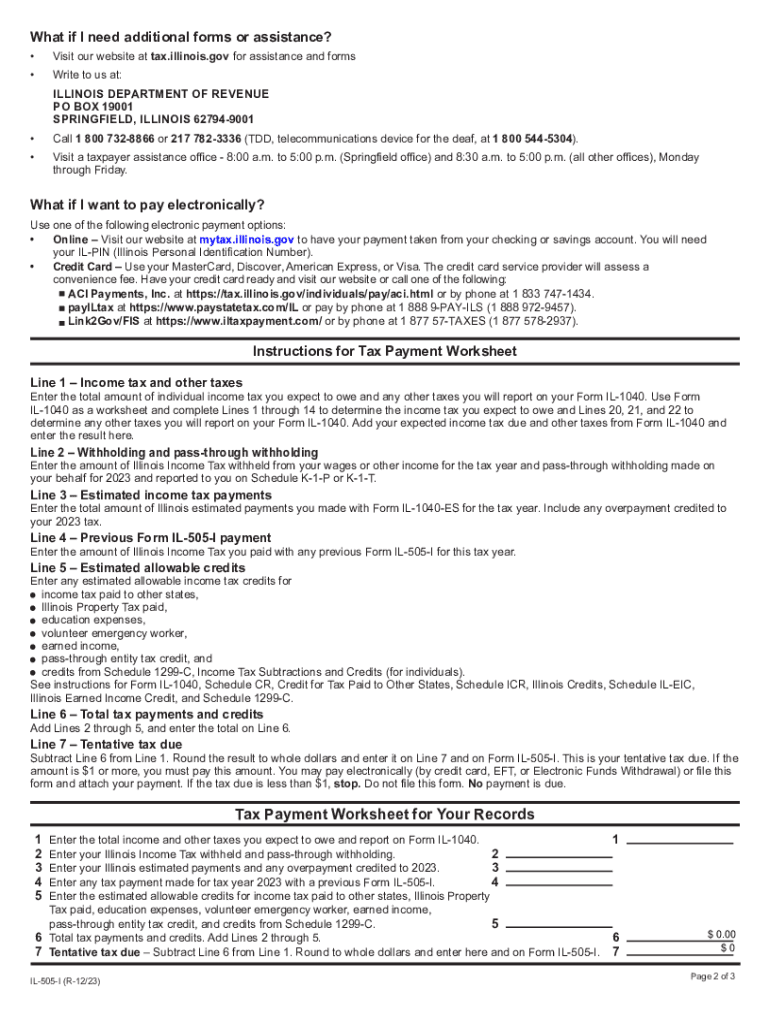

Steps to complete the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

Completing the IL 505 I form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate the total tax liability for the year.

- Fill out the IL 505 I form, ensuring all required information is accurate.

- Submit the form along with the payment by the due date, either online or via mail.

Eligibility Criteria for the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

Eligibility for the IL 505 I form is generally available to all individual taxpayers in Illinois who are filing Form IL 1040. However, it is crucial to note that the extension is only applicable if the taxpayer has made an estimated payment of the tax owed. Individuals who are not required to file a return or who are exempt from income tax are not eligible to use this form.

Filing Deadlines / Important Dates for the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

The deadline for submitting the IL 505 I form coincides with the original due date for the Illinois income tax return, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to be aware of these dates to ensure timely submission and avoid penalties.

Form Submission Methods for the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

Taxpayers have multiple options for submitting the IL 505 I form. The form can be filed online through the Illinois Department of Revenue’s e-payment system, which is a convenient and efficient method. Alternatively, individuals may choose to mail the completed form along with a check or money order to the appropriate address specified by the Illinois Department of Revenue. In-person submissions may also be possible at designated state offices.

Quick guide on how to complete il 505 i automatic extension payment for individuals filing form il 1040

Handle IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, adjust, and eSign your documents swiftly without hurdles. Manage IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to adjust and eSign IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 seamlessly

- Find IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Select your preferred method to share your form, by email, SMS, or invite link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your desired device. Modify and eSign IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 and ensure clear communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 505 i automatic extension payment for individuals filing form il 1040

Create this form in 5 minutes!

How to create an eSignature for the il 505 i automatic extension payment for individuals filing form il 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Illinois extension and how does it work with airSlate SignNow?

The 2023 Illinois extension allows users to streamline document signing and management processes within the state. airSlate SignNow integrates seamlessly with this extension to provide an efficient platform for sending and eSigning documents electronically. This not only saves time but also enhances compliance and tracking capabilities for Illinois-based businesses.

-

How much does airSlate SignNow cost for the 2023 Illinois extension?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those using the 2023 Illinois extension. Pricing typically starts at a competitive monthly rate, making it a cost-effective option for companies looking to improve their document workflows. For specific pricing details, visit our website or contact our sales team.

-

What features does the 2023 Illinois extension provide?

The 2023 Illinois extension offers features like customizable templates, in-person signing, and advanced security protocols. These features work hand in hand with airSlate SignNow to ensure that users can manage their documents effectively and securely. Businesses can also leverage additional functionalities like automated reminders and document tracking.

-

Can airSlate SignNow integrate with other software for 2023 Illinois extension users?

Yes, airSlate SignNow is designed to integrate easily with various software applications, enhancing the efficiency of the 2023 Illinois extension. This allows users to sync documents and streamline their workflows across platforms like CRM systems, accounting software, and more. Check our integration options to see which applications can help you maximize your use of the 2023 Illinois extension.

-

What are the benefits of using airSlate SignNow with the 2023 Illinois extension?

Using airSlate SignNow with the 2023 Illinois extension provides numerous benefits, such as improved efficiency in document processing and enhanced compliance with state regulations. Users also enjoy a user-friendly interface that simplifies the signing process, which can signNowly reduce turnaround times. Overall, this combination helps businesses save time and resources.

-

Is airSlate SignNow legally compliant for documents in Illinois?

Absolutely, airSlate SignNow is compliant with Illinois eSignature laws, including those applicable to the 2023 Illinois extension. This compliance assures users that their electronically signed documents are legally binding and can be used in legal proceedings. By choosing airSlate SignNow, businesses can feel confident in their document security and legality.

-

How can I get support for airSlate SignNow when using the 2023 Illinois extension?

Customers using the 2023 Illinois extension can access a variety of support options through airSlate SignNow. This includes online resources like FAQs, live chat, and a dedicated customer service team that can help resolve any issues. Additionally, users can sign up for webinars and training sessions to maximize their understanding of the platform.

Get more for IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

- Fillable online v18 v19 ampampamp v20 students fax email print form

- Alliant direct form

- Disclosure ampampamp agreement for savings and transaction accounts form

- News3visa dispute form secu credit union secumd

- Method to obtain a distribution please contact fidelity to determine if you may request a distribution by telephone or by a form

- Vystar credit union membership application vystarcu form

- Aflac payment authorization agreement form

- Down payment bgift letterb date to bmo bank of bb the biggar team thebiggarteam form

Find out other IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer