Quarterly Report Adjustment UITR 3 2021

What is the Quarterly Report Adjustment UITR 3

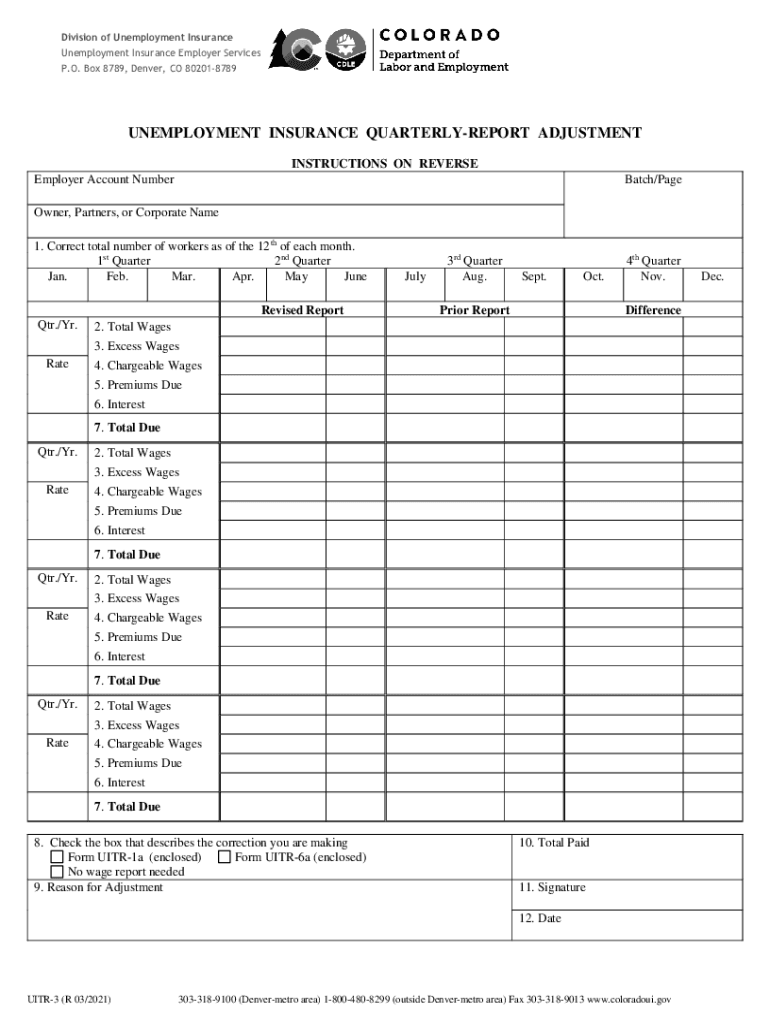

The Quarterly Report Adjustment UITR 3 is a specific form used by businesses in Colorado to report adjustments to their quarterly tax filings. This form is essential for ensuring that any changes in reported income, deductions, or credits are accurately reflected in the state’s tax records. The UITR 3 helps maintain compliance with state tax regulations and allows businesses to correct any discrepancies that may arise during the reporting period.

Steps to complete the Quarterly Report Adjustment UITR 3

Completing the Quarterly Report Adjustment UITR 3 involves several key steps:

- Gather all relevant financial documents, including previous quarterly reports and any supporting documentation for the adjustments.

- Clearly identify the specific adjustments being made, such as changes in income or deductions.

- Fill out the UITR 3 form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed UITR 3 form through the appropriate channels, whether online or by mail.

Legal use of the Quarterly Report Adjustment UITR 3

The UITR 3 is legally recognized as a valid document for reporting adjustments to tax filings in Colorado. To ensure its legal standing, businesses must adhere to the guidelines set forth by the Colorado Department of Revenue. This includes timely submission and accurate reporting of all adjustments. Failure to comply with these regulations can lead to penalties or legal repercussions.

Required Documents

When preparing to submit the Quarterly Report Adjustment UITR 3, businesses should have the following documents ready:

- Previous quarterly tax reports

- Supporting documentation for any adjustments, such as receipts or invoices

- Any correspondence with the Colorado Department of Revenue related to prior filings

Form Submission Methods

The UITR 3 can be submitted through various methods to accommodate different preferences:

- Online submission via the Colorado Department of Revenue's e-filing system

- Mailing a hard copy of the form to the designated address

- In-person submission at local tax offices, if applicable

Penalties for Non-Compliance

Failing to submit the Quarterly Report Adjustment UITR 3 or inaccuracies in the form can result in penalties. These may include:

- Fines imposed by the Colorado Department of Revenue

- Interest on any unpaid taxes due to late reporting

- Increased scrutiny or audits in future reporting periods

Quick guide on how to complete quarterly report adjustment uitr 3 561179107

Complete Quarterly Report Adjustment UITR 3 effortlessly on any gadget

Web-based document management has gained traction among organizations and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the required form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without complications. Manage Quarterly Report Adjustment UITR 3 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Quarterly Report Adjustment UITR 3 with ease

- Find Quarterly Report Adjustment UITR 3 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes no time and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and eSign Quarterly Report Adjustment UITR 3 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarterly report adjustment uitr 3 561179107

Create this form in 5 minutes!

How to create an eSignature for the quarterly report adjustment uitr 3 561179107

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Colorado Uitr and how can it benefit my business?

Colorado Uitr is an innovative electronic signing solution that streamlines document management for businesses. With Colorado Uitr, you can easily send, sign, and store documents electronically, which enhances efficiency and reduces turnaround time. This solution is designed to help businesses in Colorado operate more effectively while minimizing stress.

-

How much does Colorado Uitr cost?

Colorado Uitr offers several pricing plans to cater to different business needs. Whether you're a small startup or an established organization, you can find a plan that fits your budget without compromising on features. Check our pricing page for the most accurate and up-to-date information tailored for Colorado users.

-

What features does Colorado Uitr offer?

Colorado Uitr provides a range of powerful features such as document templates, real-time tracking, and advanced security protocols. Users can also benefit from customizable workflows and automated reminders, ensuring a seamless signing process. These features make Colorado Uitr a comprehensive solution for efficient document management.

-

Is Colorado Uitr compliant with local regulations?

Yes, Colorado Uitr meets all regulatory standards required for electronic signatures in Colorado. It ensures compliance with the ESIGN Act and UETA, allowing you to utilize eSignatures legally and securely. Your documents signed through Colorado Uitr will hold up in court, providing peace of mind for businesses.

-

Can Colorado Uitr integrate with other software I use?

Absolutely! Colorado Uitr is designed to seamlessly integrate with various business applications such as CRM platforms, cloud storage, and project management tools. This integration helps streamline your workflows and ensures that you can manage your documents effectively without having to switch platforms.

-

Is it easy to get started with Colorado Uitr?

Yes, getting started with Colorado Uitr is incredibly easy. Simply sign up for an account, and you'll have access to our user-friendly interface that makes sending and signing documents a breeze. Our onboarding resources and support team are available to assist you every step of the way.

-

What industries can benefit from Colorado Uitr?

Colorado Uitr is versatile and can be beneficial across various industries including real estate, healthcare, legal, and education. Regardless of your field, the efficiency and compliance that Colorado Uitr offers can enhance your document signing processes. Businesses throughout Colorado are already reaping the benefits.

Get more for Quarterly Report Adjustment UITR 3

- Site work contract for contractor missouri form

- Siding contract for contractor missouri form

- Refrigeration contract for contractor missouri form

- Missouri drainage form

- Foundation contract for contractor missouri form

- Plumbing contract for contractor missouri form

- Brick mason contract for contractor missouri form

- Missouri contractor form

Find out other Quarterly Report Adjustment UITR 3

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document