CO DoR UITR 3 Form 2022-2026

What is the CO DoR UITR 3 Form

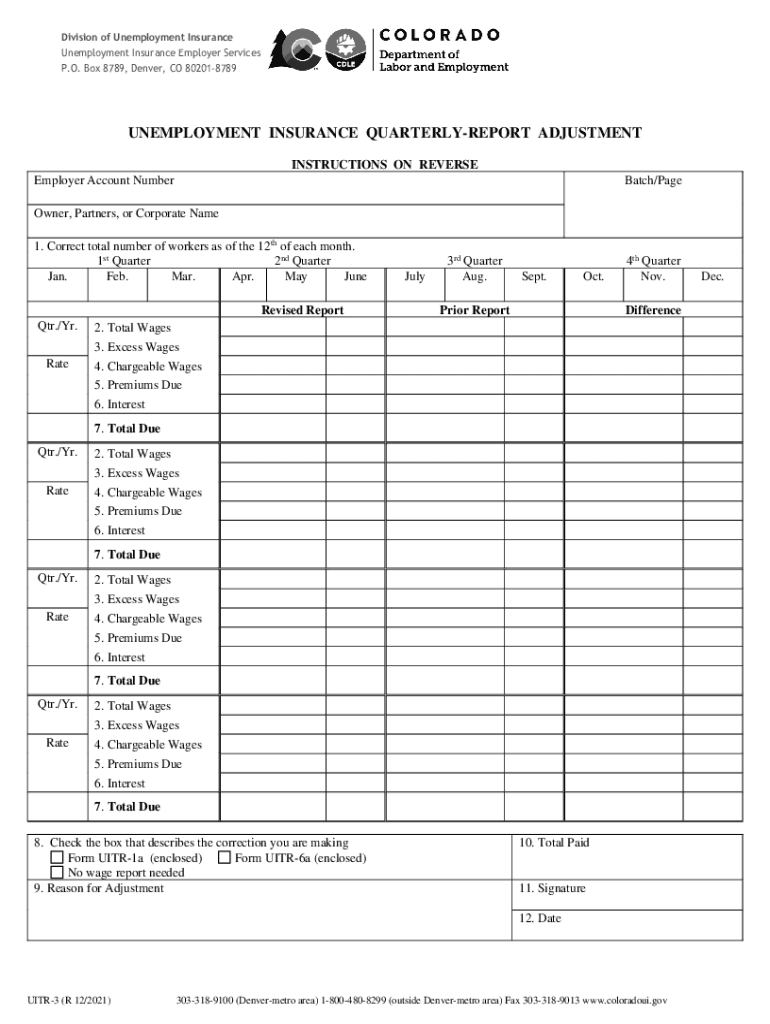

The CO DoR UITR 3 Form is a specific document used in the state of Colorado for reporting unemployment insurance tax. This form is essential for employers to accurately report wages paid to employees and calculate the unemployment insurance contributions owed to the state. The UITR 3 form is part of the broader suite of unemployment tax reporting requirements and is crucial for maintaining compliance with state regulations. Understanding this form is vital for businesses to ensure they are fulfilling their tax obligations correctly.

How to use the CO DoR UITR 3 Form

Using the CO DoR UITR 3 Form involves several key steps. First, employers must gather all necessary payroll information, including employee wages and hours worked. This data is crucial for accurate reporting. Next, employers should fill out the form with the appropriate details, ensuring that all entries are correct and complete. Once the form is filled out, it can be submitted electronically or via mail, depending on the employer's preference. It is important to keep a copy of the completed form for record-keeping purposes.

Steps to complete the CO DoR UITR 3 Form

Completing the CO DoR UITR 3 Form requires careful attention to detail. Follow these steps:

- Gather payroll records for the reporting period, including total wages and employee information.

- Access the UITR 3 Form, which can be downloaded from the Colorado Department of Labor and Employment website.

- Fill in the required fields, including employer information, total wages, and contributions.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or print and mail it to the appropriate address.

Legal use of the CO DoR UITR 3 Form

The CO DoR UITR 3 Form must be used in accordance with Colorado state law. Employers are required to file this form to remain compliant with unemployment insurance tax regulations. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines or increased tax rates. It is essential for employers to understand their legal obligations regarding the UITR 3 Form to avoid potential legal issues.

Key elements of the CO DoR UITR 3 Form

The CO DoR UITR 3 Form contains several key elements that are important for accurate reporting. These include:

- Employer Information: Details about the business, including name, address, and identification number.

- Employee Wages: Total wages paid to employees during the reporting period.

- Tax Calculations: Computation of the unemployment insurance tax owed based on reported wages.

- Signature: Certification by the employer that the information provided is accurate and complete.

Form Submission Methods

Employers have multiple options for submitting the CO DoR UITR 3 Form. The form can be submitted electronically through the Colorado Department of Labor and Employment's online portal, which is the preferred method for many businesses due to its efficiency. Alternatively, employers can print the completed form and mail it to the designated address. In-person submission is also an option, though less common. Choosing the right submission method can streamline the reporting process.

Quick guide on how to complete co dor uitr 3 form

Complete CO DoR UITR 3 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a great eco-friendly substitute to conventional printed and signed documentation, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Manage CO DoR UITR 3 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to edit and eSign CO DoR UITR 3 Form effortlessly

- Obtain CO DoR UITR 3 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, cumbersome form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign CO DoR UITR 3 Form while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct co dor uitr 3 form

Create this form in 5 minutes!

How to create an eSignature for the co dor uitr 3 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Uitr 3 and how does it relate to airSlate SignNow?

Uitr 3 is a powerful solution offered by airSlate SignNow that enables users to streamline their document signing processes. By leveraging Uitr 3, businesses can send and eSign documents effortlessly, improving workflow efficiency and saving valuable time.

-

What pricing plans are available for Uitr 3 in airSlate SignNow?

airSlate SignNow provides flexible pricing plans for Uitr 3, designed to accommodate businesses of all sizes. Depending on your needs, you can choose from individual, team, or enterprise plans, ensuring that you get the best value for your investment in eSigning solutions.

-

What are the key features of Uitr 3?

Uitr 3 offers a variety of features that enhance the document signing experience. Key features include customizable templates, advanced security options, real-time tracking, and integration capabilities with other apps, allowing businesses to create a seamless workflow.

-

How can Uitr 3 benefit my business?

By using Uitr 3 from airSlate SignNow, your business can greatly improve efficiency in document management. The platform's ease of use and comprehensive features help reduce turnaround times for contracts and agreements, ultimately leading to increased productivity and customer satisfaction.

-

Can Uitr 3 be integrated with other software solutions?

Yes, Uitr 3 can easily integrate with various software solutions, enhancing its functionality. Whether you’re using CRM, document management, or productivity tools, airSlate SignNow's Uitr 3 ensures a smooth connection to streamline your workflows.

-

Is Uitr 3 secure for sending sensitive documents?

Absolutely! Uitr 3 employs robust security measures to ensure that all documents are protected during transmission and storage. Advanced encryption protocols and compliance with regulatory standards help safeguard sensitive information, providing peace of mind for businesses.

-

How does Uitr 3 improve the signing experience for my clients?

Uitr 3 is designed with user experience in mind, offering clients a simple and intuitive signing process. With features like mobile accessibility and automated notifications, clients can sign documents quickly and conveniently, enhancing their overall experience.

Get more for CO DoR UITR 3 Form

- Fillable il 4506 request for copy of tax return illinois fill io form

- Form 40a ty 2022

- 2022 il 1120 instructions illinois department of revenue form

- Connecticut registration and title application ctgov form

- Il dor il 1040 2020 2023 fill out tax template online form

- Form tr 1 tax return parker

- Illinois form il 1040 individual income tax return

- 2022 il 505 i automatic extension payment for individuals filing form il 1040

Find out other CO DoR UITR 3 Form

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed