December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting Form

Understanding the Wisconsin WT-4 Employee Withholding Exemption Certificate

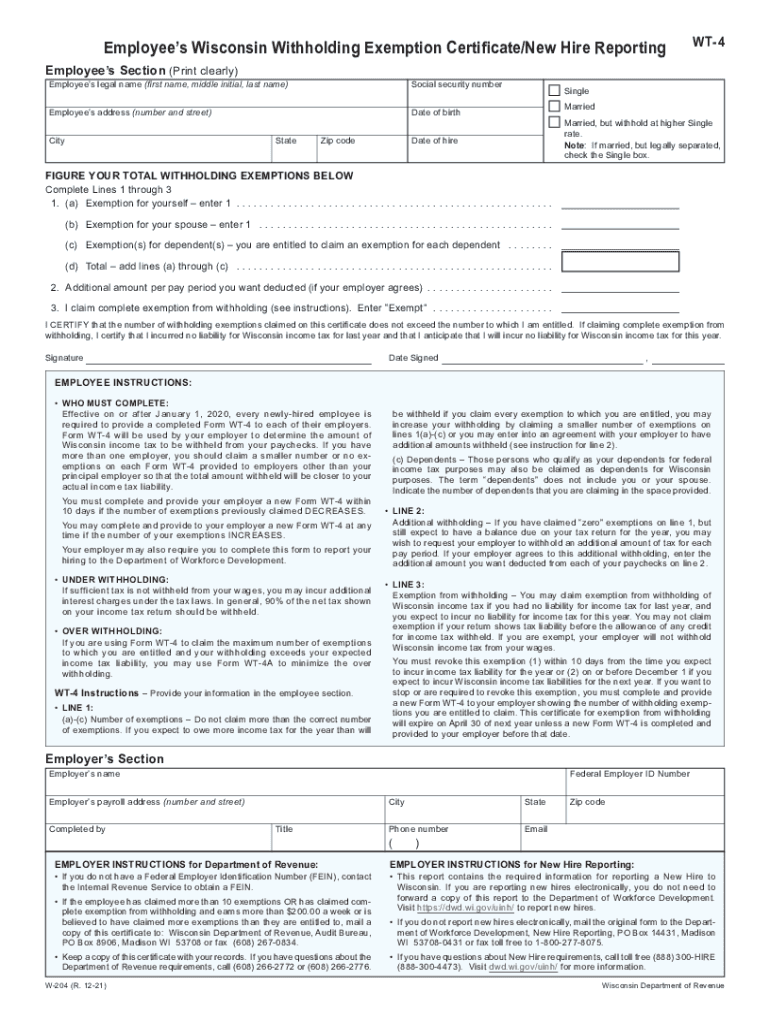

The Wisconsin WT-4 form, also known as the Employee's Wisconsin Withholding Exemption Certificate, is a crucial document for employees in Wisconsin. It allows individuals to claim exemptions from state income tax withholding based on specific criteria. This form is particularly important for new hires who may not have had state income tax withheld in the past or who qualify for exemption due to low income or other factors. Understanding the purpose and requirements of the WT-4 is essential for both employers and employees to ensure compliance with state tax laws.

Steps to Complete the Wisconsin WT-4 Form

Completing the Wisconsin WT-4 form involves several straightforward steps. First, employees should provide their personal information, including their name, address, and Social Security number. Next, they must indicate their eligibility for exemption by checking the appropriate boxes. Employees should also be aware of the specific criteria that qualify them for exemption, such as income thresholds or dependency status. Finally, the form must be signed and dated to validate the information provided. Ensuring accuracy in these details is vital to avoid issues with tax withholding.

Legal Use of the Wisconsin WT-4 Form

The Wisconsin WT-4 form is legally binding when completed and submitted correctly. It is essential for employees to understand that providing false information on this form can lead to penalties, including fines or back taxes owed. Employers are responsible for maintaining accurate records of the WT-4 forms submitted by their employees, as this documentation is necessary for compliance with state tax regulations. The legal framework surrounding the use of the WT-4 ensures that both employees and employers adhere to proper withholding practices.

Filing Deadlines and Important Dates for the WT-4

Employees must be aware of specific deadlines related to the submission of the Wisconsin WT-4 form. Typically, new hires should complete and submit the WT-4 on or before their first paycheck to ensure proper withholding from the start of their employment. Additionally, if an employee's tax situation changes, they should submit a new WT-4 as soon as possible to update their withholding status. Keeping track of these deadlines helps prevent any complications with state tax obligations.

Examples of Using the Wisconsin WT-4 Form

There are various scenarios in which an employee might use the Wisconsin WT-4 form. For instance, a new employee who anticipates earning below the taxable income threshold may complete the WT-4 to avoid state income tax withholding. Alternatively, an employee who has recently experienced a significant change in their financial situation, such as a reduction in income or an increase in dependents, may submit a new WT-4 to adjust their withholding accordingly. Understanding these examples can help employees make informed decisions about their tax withholding status.

Eligibility Criteria for the Wisconsin WT-4 Form

To qualify for exemption on the Wisconsin WT-4 form, employees must meet specific eligibility criteria. Generally, individuals who expect to owe no state income tax for the current year and had no tax liability in the previous year may claim exemption. Additionally, certain income thresholds apply, which vary based on filing status and dependents. It is important for employees to review these criteria carefully to ensure they meet the requirements before submitting the form.

Quick guide on how to complete december 2021 w 204 wt 4 employees wisconsin withholding exemption certificatenew hire reporting

Effortlessly Prepare December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any hold-ups. Manage December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting with Ease

- Find December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting and click on Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or mislaid documents, tiresome searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from whichever device you choose. Modify and eSign December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the december 2021 w 204 wt 4 employees wisconsin withholding exemption certificatenew hire reporting

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is Wisconsin WT4 and how does it work with airSlate SignNow?

Wisconsin WT4 is a tax form required for employees in Wisconsin to claim state withholding exemptions. With airSlate SignNow, you can easily send, sign, and manage your Wisconsin WT4 forms electronically. This streamlined process helps ensure that your documents are secure and compliant with state regulations.

-

How can I use airSlate SignNow to complete my Wisconsin WT4 form?

Using airSlate SignNow, you can upload your Wisconsin WT4 form, fill it out digitally, and send it for e-signature. The intuitive interface allows you to add necessary information quickly and securely. Once signed, the completed document can be downloaded or shared directly with your employer or tax advisor.

-

What are the pricing options for airSlate SignNow in relation to Wisconsin WT4 usage?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes, providing a cost-effective solution for managing documents like the Wisconsin WT4. You can choose a plan that fits your organization's needs and budget, ensuring you have all the necessary features for document management and e-signatures.

-

What features does airSlate SignNow offer for handling Wisconsin WT4 forms?

airSlate SignNow includes features like document templates, automated workflows, and secure e-signatures specifically designed for forms like the Wisconsin WT4. These tools enhance productivity by simplifying the process of preparing, sending, and signing tax forms and other important documents.

-

Can I integrate airSlate SignNow with other applications for managing Wisconsin WT4 documents?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and more, which can enhance your ability to manage Wisconsin WT4 forms. These integrations allow for seamless document storage and retrieval, making it easier to keep track of your tax documentation.

-

Is airSlate SignNow compliant with state regulations for Wisconsin WT4?

Absolutely, airSlate SignNow is designed to comply with all state regulations, including those specific to Wisconsin WT4 forms. The platform uses robust security measures to ensure that your digital signatures and documents are legally binding and compliant with applicable laws.

-

What are the benefits of using airSlate SignNow for Wisconsin WT4?

Using airSlate SignNow to manage your Wisconsin WT4 forms offers numerous benefits, including improved efficiency and reduced paper usage. The platform's user-friendly interface and instant access to forms mean you can complete your tax documents faster while ensuring security and accuracy in the process.

Get more for December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting

- Letter from tenant to landlord about landlord using unlawful self help to gain possession missouri form

- Letter from tenant to landlord about illegal entry by landlord missouri form

- Letter from landlord to tenant about time of intent to enter premises missouri form

- Mo tenant notice 497313152 form

- Letter from tenant to landlord about sexual harassment missouri form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children missouri form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure missouri form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497313156 form

Find out other December W 204 WT 4 Employee's Wisconsin Withholding Exemption CertificateNew Hire Reporting

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free