Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota Form

What is the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

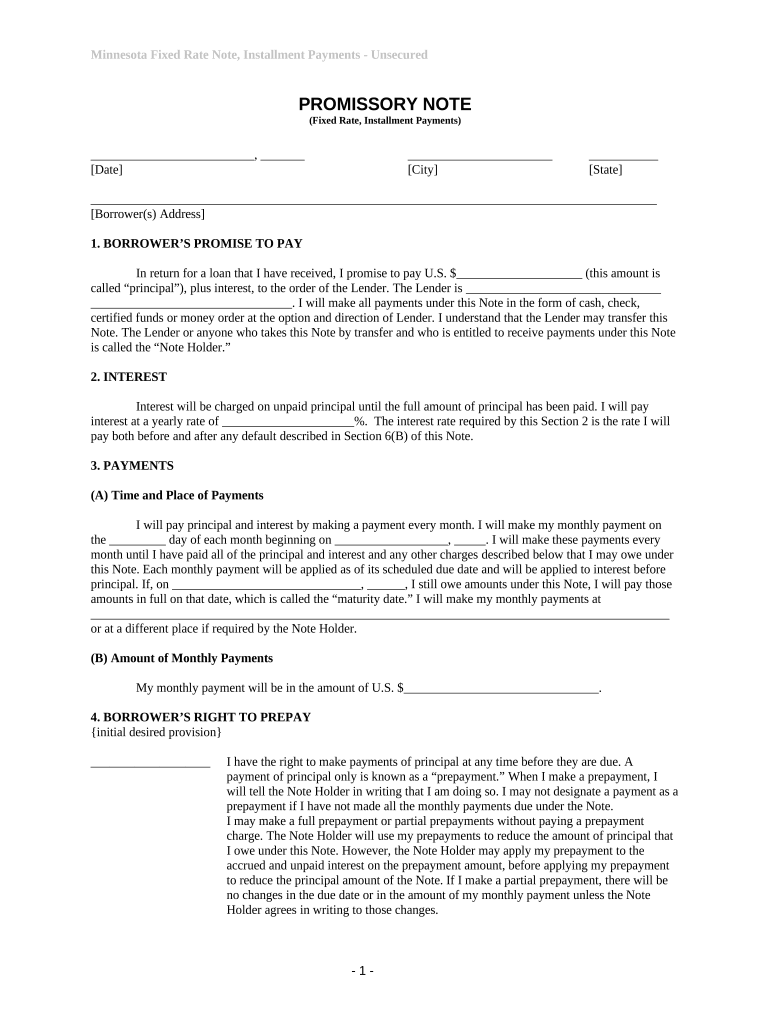

The Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota is a legal document used to outline the terms of a loan agreement between a lender and a borrower. This type of promissory note specifies the amount borrowed, the interest rate, the repayment schedule, and any penalties for late payments. Unlike secured notes, this document does not require collateral, making it crucial for both parties to understand their rights and obligations clearly. It serves as a binding contract that can be enforced in a court of law if necessary.

Key Elements of the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

Several key elements must be included in the Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota to ensure its validity:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate that will apply to the outstanding balance.

- Payment Schedule: Details on how and when payments are to be made, including frequency and due dates.

- Late Fees: Information on any fees incurred for late payments.

- Signatures: Both the borrower and lender must sign the document to make it legally binding.

Steps to Complete the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

Completing the Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota involves several straightforward steps:

- Gather Information: Collect all necessary details, including the principal amount, interest rate, and payment schedule.

- Draft the Document: Use a template or create your own document, ensuring all key elements are included.

- Review the Terms: Both parties should carefully review the terms to ensure mutual understanding and agreement.

- Sign the Document: Both the borrower and lender must sign the note, either in person or electronically.

- Distribute Copies: Provide copies of the signed document to all parties involved for their records.

Legal Use of the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

The legal use of the Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota is essential for establishing a clear agreement between the lender and borrower. This document can be used in various situations, including personal loans, business financing, or informal lending among friends or family. It provides legal protection by clearly outlining the expectations and responsibilities of each party. In case of disputes, having a signed promissory note can serve as evidence in court, ensuring that the terms are upheld.

How to Obtain the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

Obtaining the Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota can be done through several methods:

- Online Templates: Many legal websites offer downloadable templates that can be customized to meet specific needs.

- Legal Professionals: Consulting with an attorney can provide tailored guidance and ensure compliance with Minnesota laws.

- Financial Institutions: Some banks or credit unions may provide their own versions of promissory notes for their customers.

State-Specific Rules for the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

When using the Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate Minnesota, it is important to be aware of state-specific rules that may apply. Minnesota law requires that the document be clear and unambiguous to be enforceable. Additionally, any interest rates charged must comply with state usury laws to avoid legal issues. It is advisable to familiarize oneself with these regulations to ensure that the note is valid and enforceable.

Quick guide on how to complete minnesota unsecured installment payment promissory note for fixed rate minnesota

Prepare Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Process Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The simplest way to modify and eSign Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota with ease

- Obtain Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Formulate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to secure your modifications.

- Select your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and eSign Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota and ensure exceptional communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota?

A Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota is a legal document that details a borrower's promise to repay a loan in fixed installments without the need for collateral. It establishes clear terms regarding payment schedules and interest rates, ensuring transparency for both parties. This document is essential for personal loans, facilitating trust and accountability.

-

How can airSlate SignNow help with creating a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota?

With airSlate SignNow, creating a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota is straightforward and efficient. Our platform provides customizable templates and user-friendly tools that allow users to generate, edit, and finalize their promissory notes in minutes. This saves time and ensures accuracy in documentation.

-

What are the key features of the Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota available through airSlate SignNow?

Key features of our Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota include customizable templates, eSignature capabilities, and secure cloud storage. These features ensure that your document is legally binding, easily accessible, and tailored to suit your specific loan terms. Additionally, our platform supports all necessary compliance measures, protecting both lender and borrower.

-

Is there a cost associated with using airSlate SignNow for a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs regarding a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota. We provide a range of subscription options, allowing users to choose the plan that best fits their requirements. Our solution is designed to be cost-effective while offering extensive functionality.

-

What benefits can I expect by using airSlate SignNow for my Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota?

The primary benefits of using airSlate SignNow for your Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota include enhanced efficiency, reduced paperwork, and increased scalability. Our digital solution streamlines the signing process, allowing for quick turnaround times and improved customer satisfaction. Furthermore, our platform supports collaboration across teams and stakeholders.

-

Can airSlate SignNow integrate with other tools for managing a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms, making it easier to manage your Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota. These integrations can streamline your workflow by connecting with CRM, project management, and accounting solutions. This ensures a smooth transition of data across your business processes.

-

How is the legality of a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota ensured?

The legality of a Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota created through airSlate SignNow is strengthened by our compliance with state regulations and digital signature laws. Each document generated conforms to legal standards, making it enforceable in court. Additionally, securing eSignatures ensures that all parties are legally bound to the agreement.

Get more for Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

- Isbe 73 03d form

- Ucla extension number form

- Conditional final waiver form

- Hh application rough huhot mongolian grill form

- South carolina fillable quarterly withholding form wh 1606 for

- Inside out worksheet answers form

- Data correction form candidates use only

- Payment arrangement car payment agreement template form

Find out other Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate Minnesota

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now