Get the H Ez Form Revenue Wi pdfFiller 2021

Understanding the Wisconsin Homestead Credit

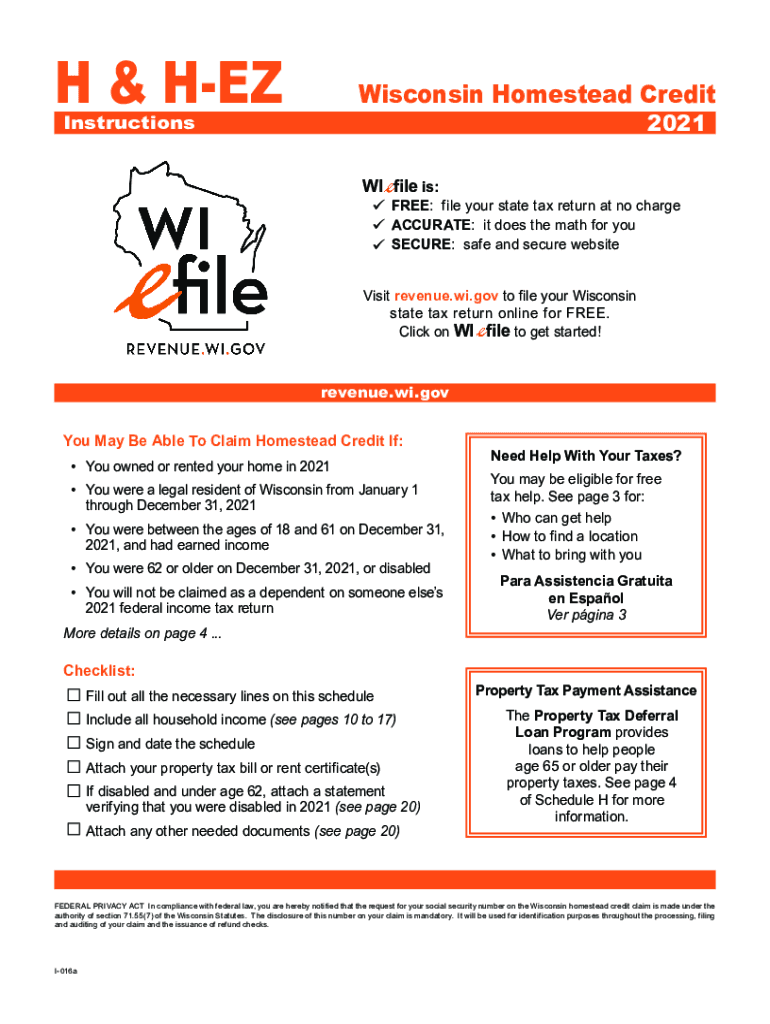

The Wisconsin Homestead Credit is designed to assist homeowners and renters with property taxes. This credit is available to individuals who meet specific eligibility criteria, including income limits and residency requirements. The program aims to provide financial relief for low-income residents, ensuring that housing remains affordable. To qualify, applicants must occupy their property as their principal residence and meet the income threshold set by the state.

Steps to Complete the Wisconsin Homestead Form

Completing the Wisconsin Homestead form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including proof of income, property tax bills, and any other relevant financial information. Fill out the form carefully, paying attention to each section, particularly those related to income and residency. After completing the form, review it for any errors or omissions before submission. It is essential to submit the form by the deadline to ensure eligibility for the credit.

Required Documents for the Wisconsin Homestead Credit

To successfully apply for the Wisconsin Homestead Credit, certain documents are required. These typically include:

- Proof of income, such as W-2 forms or tax returns

- Property tax bills for the home or rental unit

- Identification documents to verify residency

- Any additional documentation that supports the claim

Having these documents ready will streamline the application process and help avoid delays.

Eligibility Criteria for the Wisconsin Homestead Credit

Eligibility for the Wisconsin Homestead Credit is based on several factors. Applicants must be residents of Wisconsin and occupy the property as their primary residence. Income limits apply, which vary based on household size and other factors. Additionally, applicants must not have owned the property for less than one year before applying. Understanding these criteria is crucial for determining eligibility and ensuring that the application is filled out correctly.

Filing Deadlines for the Wisconsin Homestead Credit

Timely filing is essential to receive the Wisconsin Homestead Credit. The application must be submitted by the deadline set by the Wisconsin Department of Revenue. Typically, the deadline for filing is within a specific timeframe after the end of the tax year. It is important to stay informed about these dates to avoid missing out on potential benefits.

Form Submission Methods for the Wisconsin Homestead Credit

Applicants can submit the Wisconsin Homestead Credit form through various methods. The most common submission methods include:

- Online submission via the Wisconsin Department of Revenue website

- Mailing the completed form to the appropriate state office

- In-person submission at designated local offices

Choosing the right submission method can enhance the efficiency of the application process.

Quick guide on how to complete get the free h ez form 2012 revenue wi pdffiller

Complete Get The H Ez Form Revenue Wi PdfFiller seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Get The H Ez Form Revenue Wi PdfFiller on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Get The H Ez Form Revenue Wi PdfFiller effortlessly

- Find Get The H Ez Form Revenue Wi PdfFiller and then click Get Form to initiate the process.

- Make use of the tools we supply to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that intention.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Edit and electronically sign Get The H Ez Form Revenue Wi PdfFiller and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free h ez form 2012 revenue wi pdffiller

Create this form in 5 minutes!

How to create an eSignature for the get the free h ez form 2012 revenue wi pdffiller

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What are Wisconsin homestead s and how do they work?

Wisconsin homestead s are specific tax benefits available to homeowners in Wisconsin, aimed at providing financial relief. They allow eligible homeowners to claim a property tax credit based on their income and property taxes paid, enabling signNow savings. Understanding how Wisconsin homestead s function can ultimately help residents leverage this benefit efficiently.

-

How can airSlate SignNow help with Wisconsin homestead s applications?

airSlate SignNow simplifies the process of applying for Wisconsin homestead s by allowing users to fill out, eSign, and send applications securely. Our platform ensures that your documents are managed efficiently and comply with all necessary regulations. This improves the chances of timely processing of your Wisconsin homestead s applications.

-

What are the pricing options for airSlate SignNow tailored for Wisconsin homestead s?

AirSlate SignNow offers flexible pricing plans suitable for businesses looking to streamline their Wisconsin homestead s applications. Pricing varies based on features needed, such as eSignature capabilities and document storage. We ensure a cost-effective solution that aligns with your needs.

-

Are there specific features of airSlate SignNow that benefit users with Wisconsin homestead s?

Yes, airSlate SignNow provides features specifically beneficial for Wisconsin homestead s, including customizable templates and automated workflows. These tools allow users to manage their applications seamlessly and keep track of document statuses efficiently. Additionally, audit trails ensure compliance with legal requirements.

-

Can I integrate airSlate SignNow with other tools for managing Wisconsin homestead s?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications that can further assist in managing Wisconsin homestead s. Popular integrations include CRM systems, cloud storage solutions, and accounting software, making it easier to keep all records organized and accessible.

-

What are the benefits of using airSlate SignNow for Wisconsin homestead s documentation?

Using airSlate SignNow for Wisconsin homestead s documentation streamlines the application process and enhances efficiency. Our platform ensures secure eSigning and quick document turnaround. By simplifying paperwork, users can focus on other important tasks while ensuring compliance and accuracy.

-

Is airSlate SignNow suitable for individuals filing for Wisconsin homestead s?

Yes, airSlate SignNow is ideal for individuals filing for Wisconsin homestead s as it offers an accessible, user-friendly interface. Whether you're a first-time applicant or a seasoned filer, our platform guides you through each step of the application process. This makes it easier to manage and submit your documents accurately.

Get more for Get The H Ez Form Revenue Wi PdfFiller

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to 497313165

- Mo illegal form

- Missouri violation form

- Letter tenant about sample 497313168 form

- Missouri letter tenant landlord form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase missouri form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant missouri form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase missouri form

Find out other Get The H Ez Form Revenue Wi PdfFiller

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document