Homestead Refund Kansas Department of Revenue 2020

Understanding the Wisconsin Homestead Tax

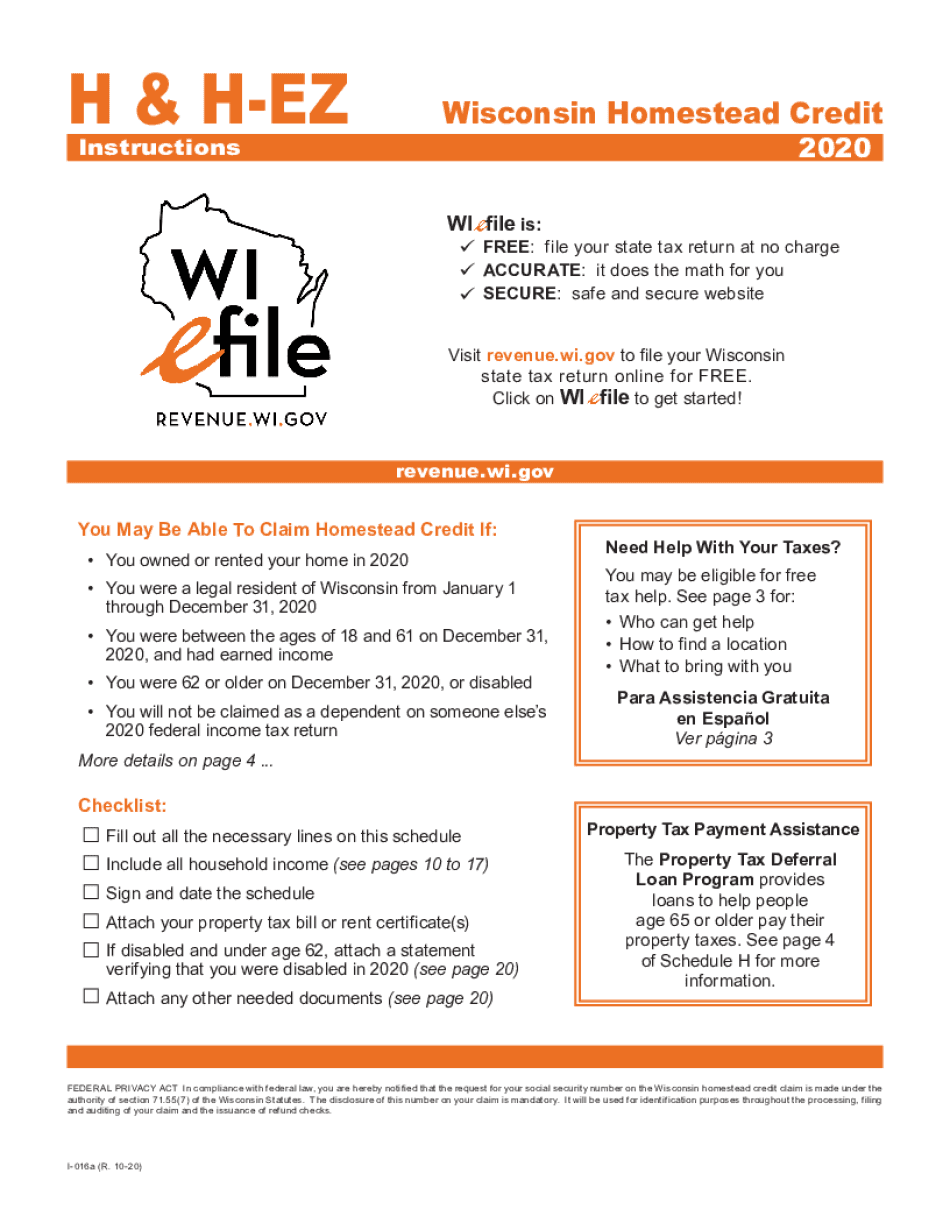

The Wisconsin homestead tax is designed to provide financial relief to eligible homeowners and renters. This tax credit helps reduce property taxes for individuals who meet specific income and residency criteria. The program aims to support low-income residents, ensuring they can afford to maintain their homes. Understanding the eligibility requirements and benefits of this tax can help residents make informed decisions regarding their housing expenses.

Eligibility Criteria for the Wisconsin Homestead Tax

To qualify for the Wisconsin homestead tax credit, applicants must meet several criteria:

- Applicants must be a resident of Wisconsin.

- They must have owned or rented their primary residence for at least part of the year.

- Income limits apply, which may vary annually. Generally, applicants must have a household income below a certain threshold.

- Individuals must be at least eighteen years old or be a dependent of a qualifying individual.

It is essential for applicants to review the latest income limits and eligibility requirements to ensure compliance with the program guidelines.

Steps to Complete the Wisconsin Homestead Tax Form

Filling out the Wisconsin homestead tax form involves several straightforward steps:

- Gather necessary documentation, including proof of income, residency, and property ownership or rental agreements.

- Obtain the correct form, typically the 2020 Wisconsin Homestead Credit Claim (Form H), which can be downloaded online.

- Complete the form by providing personal information, income details, and any applicable deductions.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form either online or via mail to the appropriate tax authority.

Taking these steps carefully can help ensure a smooth application process and maximize potential tax benefits.

Required Documents for the Wisconsin Homestead Tax

When applying for the Wisconsin homestead tax credit, several documents are necessary to support your claim:

- Proof of residency, such as a utility bill or lease agreement.

- Income statements, including W-2 forms, 1099 forms, or other relevant tax documents.

- Documentation of property ownership or rental agreements.

- Any additional forms required by the Wisconsin Department of Revenue.

Having these documents ready can expedite the application process and ensure compliance with program requirements.

Form Submission Methods for the Wisconsin Homestead Tax

Applicants can submit their Wisconsin homestead tax credit forms through various methods:

- Online Submission: Many residents prefer to complete and submit their forms electronically through the Wisconsin Department of Revenue's online portal.

- Mail Submission: Forms can also be printed and mailed to the appropriate tax office. Ensure to send the form well before the deadline to avoid delays.

- In-Person Submission: Residents may choose to submit their forms in person at designated local tax offices for assistance.

Choosing the right submission method can depend on personal preference and access to technology.

Filing Deadlines for the Wisconsin Homestead Tax

Staying aware of filing deadlines is crucial for applicants seeking the Wisconsin homestead tax credit. Generally, the deadline for submitting the homestead tax credit form is the last day of the tax year, which is typically April 15. However, specific deadlines may vary based on changes in tax laws or extensions granted by the state. It is advisable to check the Wisconsin Department of Revenue's official communications for the most current information.

Quick guide on how to complete homestead refund kansas department of revenue

Accomplish Homestead Refund Kansas Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without obstacles. Manage Homestead Refund Kansas Department Of Revenue on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and electronically sign Homestead Refund Kansas Department Of Revenue without difficulty

- Find Homestead Refund Kansas Department Of Revenue and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Homestead Refund Kansas Department Of Revenue and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homestead refund kansas department of revenue

Create this form in 5 minutes!

How to create an eSignature for the homestead refund kansas department of revenue

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Wisconsin homestead tax exemption?

The Wisconsin homestead tax exemption is a program designed to provide property tax relief to eligible homeowners. This exemption allows qualifying homeowners to reduce their property taxes based on their income, which can be beneficial in managing housing costs. It's important to understand the specific eligibility requirements to take full advantage of the Wisconsin homestead tax.

-

How can I apply for the Wisconsin homestead tax exemption?

To apply for the Wisconsin homestead tax exemption, you need to complete the appropriate forms provided by the Wisconsin Department of Revenue. Generally, the application must be submitted by a specific deadline to ensure you receive the tax relief for that year. Be sure to include all necessary documentation to prove your eligibility for the Wisconsin homestead tax benefit.

-

What are the income limits for the Wisconsin homestead tax exemption?

Income limits for the Wisconsin homestead tax exemption can vary year by year, so it is essential to check the latest information from the Wisconsin Department of Revenue. As of recent guidelines, applicants typically need to have a household income below a certain threshold to qualify. Understanding these limits is crucial for homeowners who wish to take advantage of the Wisconsin homestead tax.

-

Are there any special provisions for senior citizens regarding the Wisconsin homestead tax?

Yes, Wisconsin offers specific provisions for senior citizens regarding the homestead tax exemption. Seniors aged 65 and older may benefit from additional tax relief options, which can help lower their property tax bills even further. This consideration is part of Wisconsin's effort to support its older residents in managing housing costs through the homestead tax.

-

What benefits does the Wisconsin homestead tax exemption provide?

The Wisconsin homestead tax exemption decreases the amount of property tax you owe, which can lead to signNow savings each year. This exemption helps support lower-income homeowners by making their living costs more manageable, ultimately benefiting the overall community. Utilizing the Wisconsin homestead tax can be a vital tool for financial stability among residents.

-

Can I use airSlate SignNow to manage my Wisconsin homestead tax documents?

Absolutely! airSlate SignNow provides an easy-to-use platform for sending and eSigning any documents needed for your Wisconsin homestead tax application. By utilizing this solution, you can streamline your document management process and ensure everything is handled efficiently and securely, saving you time during tax season.

-

Is there a cost associated with applying for the Wisconsin homestead tax exemption?

No, there is typically no cost to apply for the Wisconsin homestead tax exemption itself. However, homeowners should be aware that standard fees may apply if they require professional assistance in preparing their application. Taking advantage of the Wisconsin homestead tax can save you money, but it’s essential to understand any potential costs related to the application process.

Get more for Homestead Refund Kansas Department Of Revenue

- Wa executors form

- Washington application form

- Quitclaim deed limited liability company to individual washington form

- Wa bargain form

- Discovery interrogatories from plaintiff to defendant with production requests washington form

- Certification of mailing washington form

- Discovery interrogatories from defendant to plaintiff with production requests washington form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant washington form

Find out other Homestead Refund Kansas Department Of Revenue

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement