Schedules for Form 1065 Internal Revenue Service 2021

What is the Schedules For Form 1065 Internal Revenue Service

The Schedules for Form 1065 are essential documents required by the Internal Revenue Service (IRS) for partnerships to report their income, deductions, gains, and losses. These schedules provide detailed information about the partnership's financial activities and are used to calculate the partners' shares of income or loss. The primary schedule, Schedule K, summarizes the partnership's income, deductions, and credits, while Schedule K-1 is issued to each partner, detailing their individual share of the partnership's earnings and losses.

Steps to complete the Schedules For Form 1065 Internal Revenue Service

Completing the Schedules for Form 1065 involves several key steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, expense reports, and prior year tax returns.

- Fill Out Schedule K: Report the partnership's total income, deductions, and credits on Schedule K. Ensure accuracy to reflect the partnership's financial position.

- Prepare Schedule K-1: For each partner, complete a Schedule K-1 that outlines their individual share of the partnership's income, deductions, and credits.

- Review and Verify: Double-check all entries for accuracy and completeness. Ensure that all necessary documents are attached.

- File the Form: Submit the completed Form 1065 along with all schedules and K-1s to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for Form 1065 and its schedules. Typically, the deadline for filing is the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. If additional time is needed, partnerships can file for an extension, which provides an additional six months to submit the form, but any taxes owed must still be paid by the original deadline to avoid penalties.

Legal use of the Schedules For Form 1065 Internal Revenue Service

The Schedules for Form 1065 serve a critical legal function in the tax reporting process for partnerships. They ensure compliance with IRS regulations and provide transparency in the partnership's financial dealings. Accurate completion of these schedules is necessary to avoid legal penalties and ensure that partners receive the correct tax treatment for their share of the partnership's income. Additionally, the information reported can be subject to audit by the IRS, making accuracy paramount.

Required Documents

To complete the Schedules for Form 1065, several documents are typically required:

- Financial Statements: Income statements and balance sheets that reflect the partnership's financial activities.

- Previous Tax Returns: Prior year Form 1065 and related schedules for reference and consistency.

- Partner Information: Details about each partner, including their ownership percentage and tax identification numbers.

- Supporting Documentation: Receipts and records for deductions claimed, such as business expenses and credits.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedules for Form 1065, which include instructions on how to report various types of income, deductions, and credits. These guidelines emphasize the importance of accuracy and compliance with tax laws. Partnerships should familiarize themselves with these guidelines to ensure that they meet all requirements and avoid common pitfalls that could lead to audits or penalties. The IRS website offers resources and detailed instructions to assist in the preparation of these forms.

Quick guide on how to complete schedules for form 1065 internal revenue service

Complete Schedules For Form 1065 Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage Schedules For Form 1065 Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Schedules For Form 1065 Internal Revenue Service with ease

- Obtain Schedules For Form 1065 Internal Revenue Service and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Revise and eSign Schedules For Form 1065 Internal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedules for form 1065 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the schedules for form 1065 internal revenue service

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

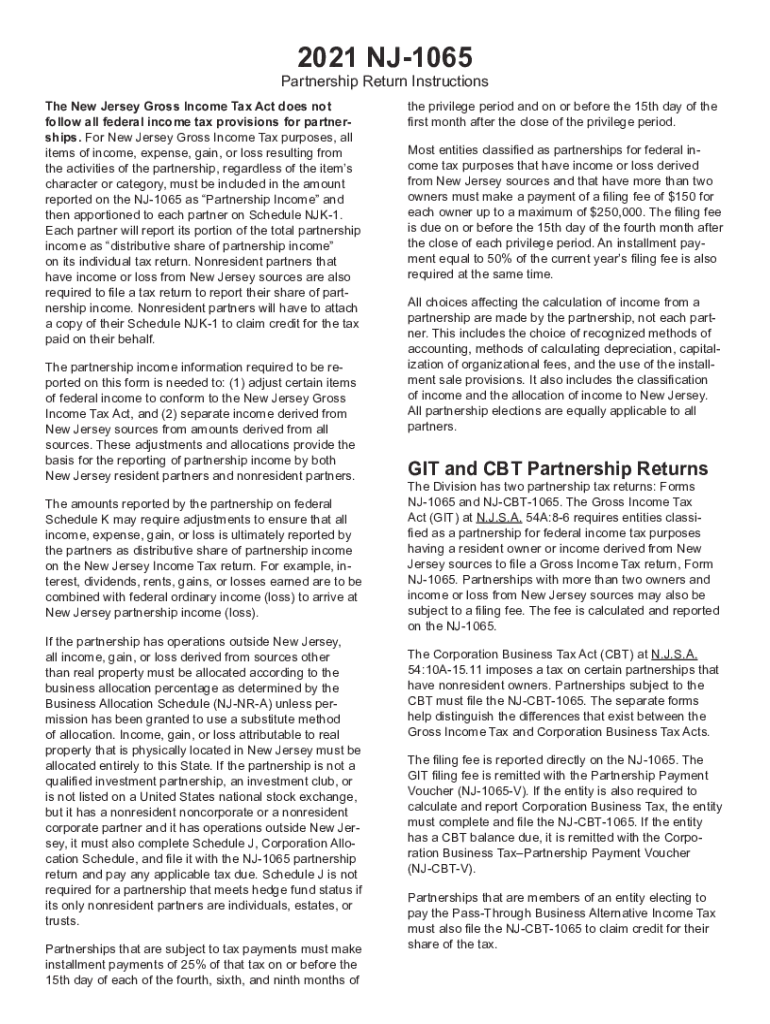

What are the nj 1065 instructions for filing taxes in New Jersey?

The nj 1065 instructions detail the steps businesses must follow to accurately file their partnership taxes in New Jersey. Ensure you include all necessary financial information, and review the guidelines closely to avoid penalties. It's recommended to consult with a tax professional familiar with nj 1065 instructions to ensure compliance.

-

How does airSlate SignNow support filing nj 1065 instructions?

airSlate SignNow simplifies the process of preparing and signing documents required for your nj 1065 instructions. With our platform, you can easily create, edit, and eSign necessary tax documents securely. Integrating SignNow's solutions into your workflow can help streamline the preparation for filing.

-

Is airSlate SignNow cost-effective for handling nj 1065 instructions?

Yes, airSlate SignNow offers a range of pricing plans suited for businesses of all sizes, making it a cost-effective choice for managing nj 1065 instructions. By reducing the time and hassle of document handling, our solution helps save money while ensuring compliance. Explore our pricing options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for nj 1065 instructions?

Using airSlate SignNow for your nj 1065 instructions provides multiple benefits, including enhanced efficiency, easy document access, and secure eSignatures. Our solution allows you to manage tax-related documents from any device, ensuring you stay compliant without the administrative burden. Experience a smooth tax filing process with our user-friendly platform.

-

Can I integrate airSlate SignNow with other tools to assist with nj 1065 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your workflow while preparing for your nj 1065 instructions. Whether you use CRM systems, cloud storage, or accounting software, our integrations can help centralize your documentation process.

-

What features does airSlate SignNow offer for managing nj 1065 instructions?

airSlate SignNow offers versatile features such as custom templates, secure eSignatures, and collaboration tools that cater specifically to managing nj 1065 instructions. These tools help simplify document workflows and ensure that all partners can easily contribute to and sign off on necessary tax forms.

-

How can airSlate SignNow enhance collaboration on nj 1065 instructions?

With airSlate SignNow, collaboration on nj 1065 instructions is made easy through real-time document sharing and commenting features. Teams can work together seamlessly, ensuring that all information is accurate and complete before filing. This enhances communication and reduces errors during the filing process.

Get more for Schedules For Form 1065 Internal Revenue Service

- Missouri owner form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497313219 form

- Mo breach form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497313221 form

- Missouri notice written form

- Missouri property owner form

- Mo contractor form

- 10 day notice to pay rent or lease terminated missouri form

Find out other Schedules For Form 1065 Internal Revenue Service

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe